Lenders in India, the Philippines and Singapore are lining up US dollar bonds to take advantage of extremely tight credit spreads, but pricing mismatches are hampering some deals in a volatile rate environment.

India's Canara Bank, Bank of Baroda, power sector financier REC and non-bank lenders Manappuram Finance and Muthoot Finance are planning benchmark US dollar offerings, according to sources aware of the plans.

State-owned Canara Bank and REC have reached out to banks to appoint arrangers, while Manappuram Finance and Muthoot Finance conducted investor meetings in Asia and Europe in the past few weeks.

"We are working on mandates for financial institutions from the Philippines to India which are looking to raise dollar bonds even while the markets remain volatile," said Amit Singh, head of South and South-East Asia capital markets at Linklaters in Singapore.

The Philippines’ Security Bank and Philippine National Bank are ready to hit the US dollar market, sources said. A Singaporean bank is also planning a US dollar bond, sources said.

The lenders did not reply to emails seeking confirmation of the plans.

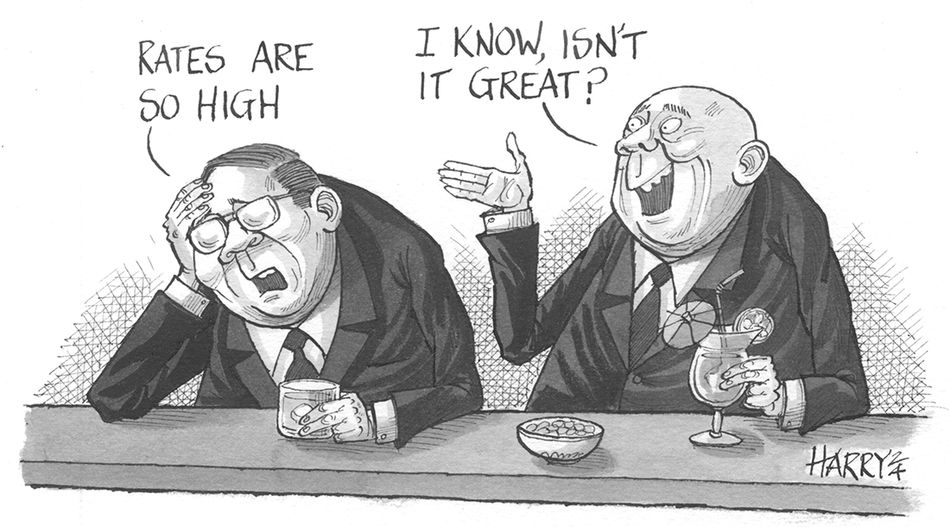

Even though US dollar yields are high, spreads for investment grade Asian issuers are at historically tight levels. That benefits financial issuers, which can use the proceeds to lend at wider spreads. Additionally, financial institutions often issue floating-rate bonds, which will benefit them if rates come down.

"Spread borrowers like banks will consider raising dollar bonds because the credit spreads of BBB rated banks [over US Treasuries] is around 80bp–90bp levels in recent times, below the average range of 120bp–150bp in the last seven to eight years," said Avinash Thakur, head of capital markets financing for Asia Pacific at Barclays in Hong Kong.

During the last financial crisis of 2008, credit spreads had even reached 250bp–300bp for banks, he said.

Rising yields are playing in banks' favour. "If the yields rise, their clients, instead of going to the bond market, come to them for loans. So, they will need to borrow to serve their clients’ needs," Thakur said.

This year has already seen decent US dollar bond supply from financial institutions in Asia Pacific ex-Japan, which accounted for 57.5% of the overall APAC volume of US$69bn with deals worth US$39.7bn, according to LSEG data.

Some lenders are opportunistic in the context of higher-for-longer US interest rates. On Wednesday, the US Federal Reserve kept the target for federal funds unchanged in the range of 5.25%–5.5% and Fed chairman Jerome Powell said that there was “a lack of further progress” towards the inflation target of 2%.

The market now expects at most one rate cut later this year, versus the four to six cuts anticipated earlier in the year.

Some bankers expect more financial institutions from Asia to join the offshore pipeline in the coming weeks if spreads start to widen.

"The inflation is still unabated, and it does not intuitively seem right for the credit spreads to remain where they are,” said Bhavik Pandya, head of South and South-East Asia DCM and co-head of Asia Pacific syndicated and leveraged finance at Bank of America. “The macro indicators are all pointing towards higher rates for longer, and this combined with all the other factors currently at play could adversely impact spreads."

Not easy

However, some issuers may not find it easy to push deals across the line.

For example, Indian gold financing company Muthoot Finance has yet to launch a deal after holding investor calls in Asia, Europe and the US in the week of April 19.

Security Bank was reportedly looking to price as early as last week but decided to hold back in light of recent market volatility, according to sources.

"Muthoot did roadshows a couple of weeks ago, and they were supposed to hit the market last week, but they have not come yet because the pricing is not quite what they wanted," said Mel Siew, portfolio manager at Muzinich & Co, an investment firm in Singapore.

Indian non-bank lenders are opportunistic and will only come to market if they get the price they want. "In the rupee market they can raise funds at 9%–9.5%, but they may not get the size they desire. The hedging cost is 2.8% and 6.75% (estimated) may be the funding cost in the dollar bond market," Siew said, indicating that it could be more expensive for Indian issuers to sell US dollar bonds.

Instead, Muthoot Finance chose to raise bonds in the rupee market for a smaller amount last week. It raised Rs1.9bn from a three-year year bond at 8.95% and Rs5bn from a five-year piece at 9.03% on May 2, according to data from India's National Securities Depository.

NBFCs are "generally more cost conscious compared to other Indian corporates as they operate on thinner margins. They tend to look for tight pricing taking into account the swap costs of converting dollars to rupees," said Singh at Linklaters.