How US tech stocks came to dominate the structured products market

Investors clamouring for exposure to US technology firms drove structured products volumes to record heights in 2024, underlining how the tech and AI frenzy has permeated the complex ecosystem surrounding US equity markets.

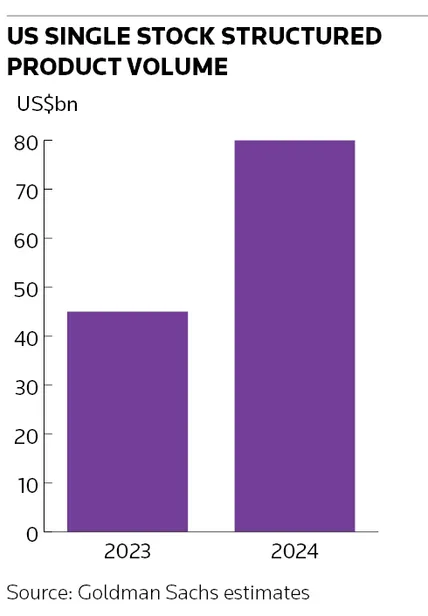

Banks issued around US$160bn of US SEC-registered structured notes last year, according to Goldman Sachs, about a third more than in 2023. Nearly all that growth came from surging demand for single-stock products based on the Magnificent Seven tech firms. Goldman estimates banks traded a record US$80bn of these products, a 77% rise from the previous year, with Nvidia, Tesla, Google's parent Alphabet and Microsoft among the top-traded names.

This rapid expansion inevitably raises questions about the influence these products may exert over US stock markets and the risk they pose to banks – particularly during times of stress such as Monday’s bruising tech selloff. Traders hedging these exotic exposures have frequently produced unexpected moves in other markets like Europe and Asia. Banks have also suffered steep losses from structured products in the past when equities have nosedived.

So far, at least, the unparalleled depth and liquidity of US equity markets have absorbed these flows with barely a ripple. But that doesn't mean that structured products won't cause serious headaches if volumes swell further in the coming years or, more immediately, if the bull market suddenly breaks.

“Structured products impact long-term volatility in all markets. But that wasn’t what happened on Monday; volatility increased because of the uncertainty over tech stocks,” said Steve Nawrocki, head of global equities trading for the Americas at BNP Paribas.

“Unlike in other regions like Asia, there is a depth of market in the US that goes well beyond structured products. The jury is still out on what would happen to structured products books if there’s a really big selloff given how much the market has grown. But certainly the recent moves we’ve seen – August last year and on Monday – haven’t been a problem."

Hard to handle

Structured products have become a staple investment among many retail investors over the past decade or so. In a typical trade, an investor buys a note that returns them their money along with a chunky interest payment provided an equity index or stock reaches a certain level in a year’s time.

Designing and selling these notes is normally very profitable for banks, but it also saddles them with exotic risks that can be fiendishly hard to handle during stressed market environments. Many banks suffered heavy losses in 2020 when markets plunged at the outbreak of the pandemic.

The centre of gravity of these markets has shifted dramatically in recent years as the extraordinary performance of US stocks has turbocharged volumes in this once sleepier region – and drawn interest from investors across the globe.

Goldman said 80% of structured products traded by its Asian clients are linked to US stocks and estimated that market-wide volumes from Asian investors on US single-stock products totalled US$35bn last year. Bankers say Europeans started bulk-buying US-linked products for the first time last year and hoovered up US$10bn in total.

More than 80% of these volumes focus on the Mag 7 stocks, traders say, a dynamic that significantly amplifies the concentration of the famously narrow US stock market. Bankers say this demand for US products has accelerated in recent months following the reelection of Donald Trump and expectations of continued US outperformance.

“There’s been a big growth of activity on US single-stock products coming mainly from Asia and US retail clients since the AI theme emerged in the market,” said Michele Cancelli, global head of structuring in the multi asset group at Citigroup. “Banks have had to issue a lot of products just to replace their inventory as markets have kept going up and products have been called. In this environment, the impact of these products on market dynamics is minimal. The question is what would happen in a bearish scenario.”

Investors got a sneak-peek of what that could look like on Monday when the hype around China’s DeepSeek AI program sent Nvidia shares tumbling 17% and wiped out more than US$1trn of market cap from AI-exposed US companies. The panic proved short-lived, however, and markets rallied as the week wore on.

Mitigating factors

Significant differences between structured product markets give traders some comfort that the US boom isn’t about to end in the kind of catastrophic losses for which structured equity derivatives have become notorious elsewhere.

Chief among these is the sheer size of US equity markets. This heft makes it far easier for banks to source offsetting client flows to hedge positions with retail and institutional investors. Traders say options on Tesla or Nvidia are more liquid than the Euro Stoxx 50 – Europe’s flagship and most liquid equity index.

Shorter-dated US products also makes hedging simpler. That differs from Europe, where banks are often the only ones trading longer-dated derivatives to match their structured products exposures – a dynamic that has led to crowded positions and heavy losses during periods of extreme volatility like in 2020. Bankers also highlight the growing community of hedge funds that has emerged to take structured product risk off their hands this past year.

“The US equity derivatives market is far more diverse and deep: liquidity is a multiple [of] what it is in Europe,” said Gauthier Amiot, global head of exotics trading at UBS. "The structured products market has grown significantly in the US, but it’s still a tiny fraction of the market cap of the Mag 7 or even the daily volume in options trading. You’d need the ... US structured products market to at least double in size to see some serious concentration effects."

These mitigating factors appear to have blunted the impact of structured products, although traders have identified distortions in some less liquid corners of markets. Amiot highlighted periods last year when the impact of banks' exotics desks' re-hedging following market moves was visible on the Russell 2000 Index as well as some semiconductor stocks.

Nevertheless, bankers say the resilience of structured products desks during these benign markets is encouraging more firms to hire exotics traders and build their offerings – a sign that many expect the market to continue expanding.

“Once retail [investors] get involved in structured products, the market only tends to grow, in my experience,” Amiot said. "The theoretical potential for growth in the US is tremendous given the amount of US investible wealth. So while structured products aren't a problem right now, they could become one in the future.”