Dutch pension fund hedging activity set to peak this year

Interest rate hedging activity among Dutch pension funds is set to peak in 2025, analysts say, ahead of a major overhaul of the roughly €1.5trn industry that is set to cause demand from these prominent users of long-term derivatives to decline sharply.

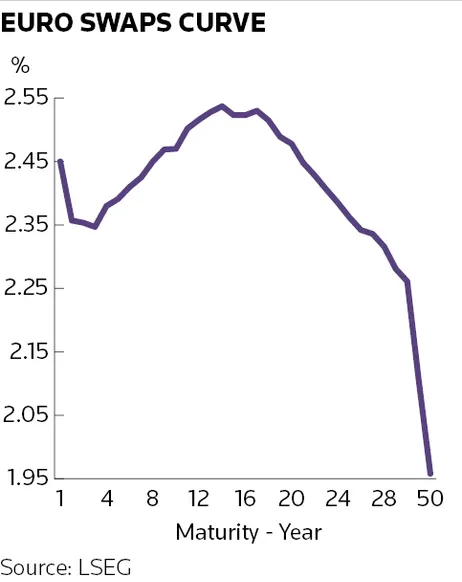

Subject to a potential referendum, the Dutch government is aiming to revamp Europe’s largest pension system by 2028 by shifting all employees away from receiving a guaranteed payout on retirement, an approach that has encouraged Dutch pension funds to engage in a high level of ultra-long dated interest rate hedging. The new regime will instead favour a lower level of shorter-dated hedging, upending long-held dynamics in the €142trn euro swap market.

Despite this anticipated decline in activity, Dutch pension funds are expected to become more active hedgers this year as they look to subdue interest-rate volatility in their portfolios ahead of the transition.

"2025 is likely [to] see the peak in interest rate hedging by Dutch pension funds as they prepare for the transition to the new regime,” Adam Kurpiel, head of rates strategy at Societe Generale, wrote in a recent report.

Dutch pension funds have featured as one of the largest players at the long-end of the euro swap curve because of their need to hedge future payouts to members. Employees will be encouraged to take greater responsibility for building their pension pots under the new system, a change that should lower hedging requirements of Dutch pension funds by the equivalent of €200bn of 30-year swap hedges – or the total amount of interest rate risk from 2023's net supply of European government bonds.

Any hedging activity under the new regime will instead favour tenors of closer to 10 to 20 years, triggering a significant repricing of risk across the euro swaps market. Recent data from the Dutch National Bank suggest most pension funds plan to adopt the system over the course of 2026.

However, analysts believe pension fund hedging will increase this year in the run-up to transition as funds look to strengthen their finances. Pension fund robustness is typically monitored by calculating a fund’s coverage ratio, the difference between the sum of future pension payouts and capital held.

Market impact

Some pension funds started using euro swaps to increase their coverage ratios in the second half of last year, Bank of America analysts said in a recent note. PMT – the €72bn pension fund for Dutch metal industry employees – increased its ratio by a “significant” 14bp in 2024, SG strategists said.

In adjusting these ratios, funds “will need to balance on the one hand the risk of pension cuts if rates rally to the point where [coverage] ratios decline below the [minimum] required on transition day and, on the other hand, risks of excessive repricing when long-end [hedges] are unwound”, said Sphia Salim, rates strategist at Bank of America.

Rabobank analysts said the euro swaps market will start to feel a “noticeable market impact” at the end of the third quarter given the significant amount of long-dated risk that is expected to be unwound by Dutch pension funds. However, that’s only if recent challenges to the transition fail to garner support.

Two parties in the Netherlands' coalition government recently suggested extending the transition deadline for pension funds and adding a referendum for pension fund members to vote on whether to transition to the new system.

“Currently, the vast majority of the Dutch pension funds are preparing to transition so this referendum could have major ramifications for these plans and/or the timelines of these plans,” Bas van Zanden, senior analyst at Rabobank, wrote in a recent note.