LSEG data illustrate that the dealflow that keeps those in the City (not to mention financial commentators) in work wasn’t as bad in 2024 as it might have appeared, says Rupak Ghose

Gilt yields are rising sharply; 2024 was a terrible year for UK IPOs; UK equity funds have suffered years of outflows; valuations have hit rock bottom. The world is wondering if the City of London has fallen.

But an examination of LSEG deal and fee data for 2024 shows the UK performing in line with – if not better than – peers.

There are good reasons to worry about the health of the City – especially as there can be a lag effect from a sustained period of low valuation multiples. But context matters.

Let’s look at the numbers.

In 2024, UK investment banking fees were up 23% year over year, which is better than the 19% for Europe as a whole and 14% globally. Despite the rampant US stock market, North American investment banking fees were up by a similar percentage, 24%. And this isn’t just a one-year performance. In 2023, UK investment banking revenues were down 5% compared with 3% lower for Europe overall, 11% down for North America and 7% lower globally. Similarly in 2022, UK investment banking revenues were down 41% from an extraordinarily busy 2021 – again within the range of 34% lower for Europe overall, 40% down for North America and 33% lower globally.

Agonising

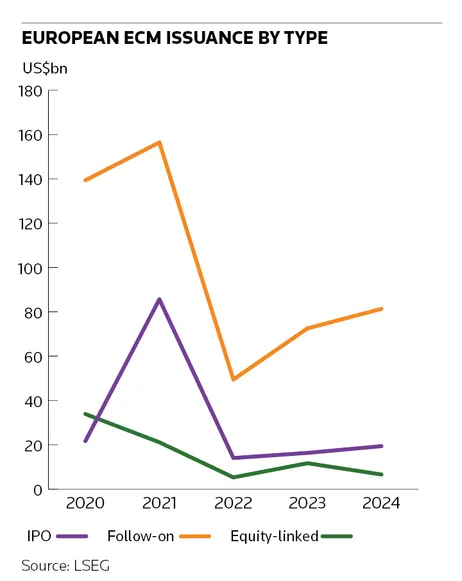

The most obvious contrast between the headlines and data comes in equity capital markets where there has been – quite reasonably – much agonising over the significant downturn of IPO volume. There were only four IPOs of note – though at least one more than in 2023 – with listings hit by the UK market’s low valuations. But that hasn’t stopped the UK being one of the busiest arenas in the world for follow-on offerings.

In fact, UK ECM volume increased by 39% on the year, well ahead of 7% for Europe and globally. Only the US came anywhere near the UK’s ECM volume growth.

Yes, the UK lagged behind continental Europe in IPOs but more than 80% of European ECM volume came from follow-ons and convertible bonds. If UK stock markets are so broken relative to other markets, why were they able to see this kind of activity?

Here’s a telling fact: JP Morgan’s league table share of UK ECM issuance at US$6.7bn is only just behind issuance in France and Italy, both a little over US$7bn.

It’s true there was some lumpiness to this, with more than US$9bn raised in National Grid's rights issue and more than US$6bn from Haleon selldowns. Then again, the same could be said elsewhere – the jumbo Boeing fundraising in the US or a few large IPOs across continental Europe, for example.

Value add

It’s a similar story when it comes to mergers and acquisitions. In fact, in this case the UK’s low valuations have helped. UK-announced M&A volumes in 2024 increased by 51%, well ahead of the 22% increase for the whole of Europe and 10% globally. Of course, very little of this has been homegrown companies getting bigger and was instead driven by the low valuation of the UK market attracting corporate buyers particularly from the US and private equity. At least for UK M&A bankers and lawyers, the good times are likely to continue.

UK DCM volumes also had a stellar year. The 48% increase was ahead of 19% for Europe and 20% globally. Much of this delta is high government bond issuance and M&A-driven refinancing, but underlying corporate bond issuance trends in the UK, including the large financial institutions segment, have been healthy.

Zooming out

Let’s look at the bigger picture. Is the City punching below its weight relative to other financial centres as the IPO slump suggests? Much of the City’s woes are linked to the UK’s consistent economic underperformance versus the US, though it’s hardly alone there. And yet UK investment banking is roughly the same size as US investment banking if you look at the ratio of local investment banking revenues relative to the size of the countries' respective GDPs. London’s UK investment banking also generates more than twice as much as continental European deals once adjusting for the relative size of the economies.

I write this as the UK is suffering its worst week in markets since 2022 when former prime minister Liz Truss announced her mini-budget and it is reasonable to worry about the fragility of UK finances. But the latest LSEG data at least provide some context.

So far, London and UK investment banking hasn’t fallen. “So far” being the operative words.

Rupak Ghose is a former financials research analyst