Deutsche made US$100m amid yen carry trade unwind

Deutsche Bank traders rode the volatility that tore through the financial system in early August to reap hefty profits from swings in currency markets that followed the unwinding of the so-called yen carry trade.

Traders focused on China’s offshore renminbi market generated roughly US$100m in revenues for the bank on the back of sharp moves in the currency and short-term interest rates, according to sources familiar with the matter, helping Deutsche outperform many rivals during this tumultuous period.

A significant portion of those revenues came from positioning in FX forwards, the sources said, a type of derivative contract used to lock in exchange rates on future currency transactions. That allowed Deutsche to capitalise on moves in offshore renminbi markets when volatility jumped and investors had to unwind carry trades, the sources said.

A spokesperson for Deutsche declined to comment. The German bank cited “significantly higher” emerging market revenues when reporting an 11% rise in fixed-income and currency trading revenues in the third quarter from a year earlier.

The yen carry trade unwind marked the most volatile period for financial markets this year. Japan’s Topix equity index plunged 12.2% on August 5 in the wake of the Bank of Japan raising interest rates and disappointing US economic data. Cboe’s VIX Index, which measures S&P 500 options volatility, spiked to above 60 – its highest level since the outbreak of the pandemic in 2020.

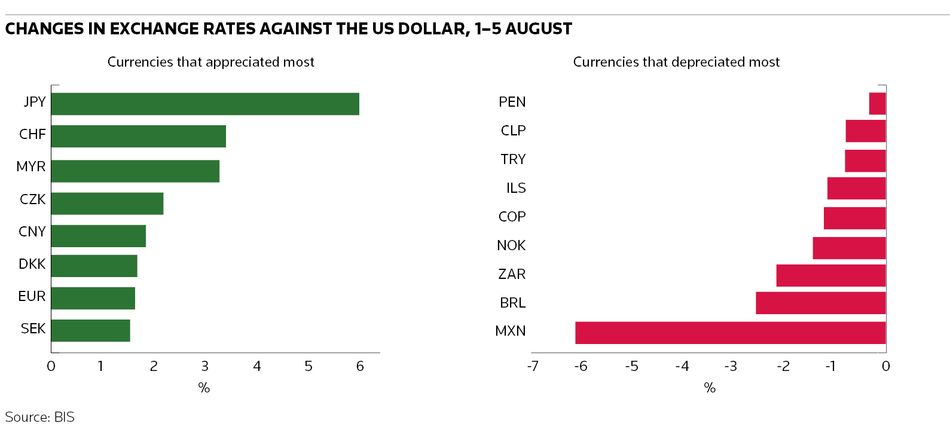

The turmoil forced an unwinding of large FX carry trade positions, in which investors borrow in a low-yielding currency like the yen to fund positions in higher-yielding currencies, like the Mexican peso or Brazilian Real. These carry trades rely on calm markets to generate returns and tend to come unstuck when volatility rises steeply.

“A well-established pattern is that spikes in volatility go hand in hand with deleveraging pressures and the unwinding of currency carry trades,” economists at the Bank for International Settlements wrote in a report on the August 5 episode, noting that leveraged carry trade positions “had grown rapidly before the event”.

The yen surged in early August as investors scrambled to unwind their carry trades while the Mexican peso and Brazilian Real tumbled. The renminbi also gained against the US dollar in a sign of its growing popularity as a funding currency in carry trades.

“Interestingly, the recent episode also involved currencies not typical in carry trade funding, most notably the offshore renminbi (CNH), which also appreciated notably,” the BIS said. “The Malaysian ringgit gained even more, as it was likely traded as a proxy for renminbi bets, but is also fairly illiquid and volatile.”

Deutsche’s FX gains during the carry trade unwind contrasts with losses sustained in early 2023 in the market volatility that followed the collapse of Silicon Valley Bank. In its first-quarter 2023 results, Deutsche said FX trading was “negatively impacted by extreme interest rate volatility”.

The German bank has since shaken up its leadership in FX trading. Former global head Russell LaScala retired in 2023 and has been replaced by Sameen Farooqui and Chris Leonard as co-heads. Farooqui is based in Singapore and also leads emerging markets trading.