Political upheaval spurs French credit derivatives trading

Investors scrambling to shield themselves against the fallout from France’s political turmoil have driven a surge in derivatives volumes linked to French government debt.

A record amount of French bond futures contracts changed hands on Monday after France’s far-right and far-left parties submitted no-confidence motions against prime minister Michel Barnier, according to LSEG data. Traders also reported a significant uptick in activity from clients using credit default swaps to protect themselves against a selloff in French debt.

“We’ve seen some really large French sovereign and [French] banks' CDS hedging activity, first with the elections earlier in the year and now this week around the vote of no confidence,” said Vikram Prasad, global head of credit trading at Citigroup.

The flurry of hedging came as the spread between 10-year French bonds and equivalent German debt hit its highest level since the depths of the eurozone crisis more than a decade ago amid fears of an imminent government collapse.

French bonds have retraced some of those losses since Barnier’s government fell late on Wednesday, suggesting investors widely expected the motion to pass to oust the prime minister. However, French 10-year spreads remain wide by historical standards at 75bp, about 30bp above levels seen earlier this year before French president Emmanuel Macron in June called for snap parliamentary elections.

France’s far-right and far-left parties increased their seats in those elections, depriving Macron’s centrist alliance of a majority and prompting him to ask Barnier to form a minority government. Barnier came unstuck only a few months later after attempting to force a deficit-reducing budget through parliament.

Many investors believe French debt could remain under pressure in the months ahead given the fragile political backdrop and considerable uncertainty over the country’s fiscal plans. Orla Garvey, senior fixed-income portfolio manager at Federated Hermes, said she expects French spreads to widen further if there is some kind of caretaker government following the no-confidence vote.

“Then you have to think about the knock-on [effect] for spreads broadly in the eurozone,” she said.

"This is quite a France-specific story in my mind, so I don’t see this as [having] huge contagion, [although] I think you could have a broad widening in spreads," Garvey said.

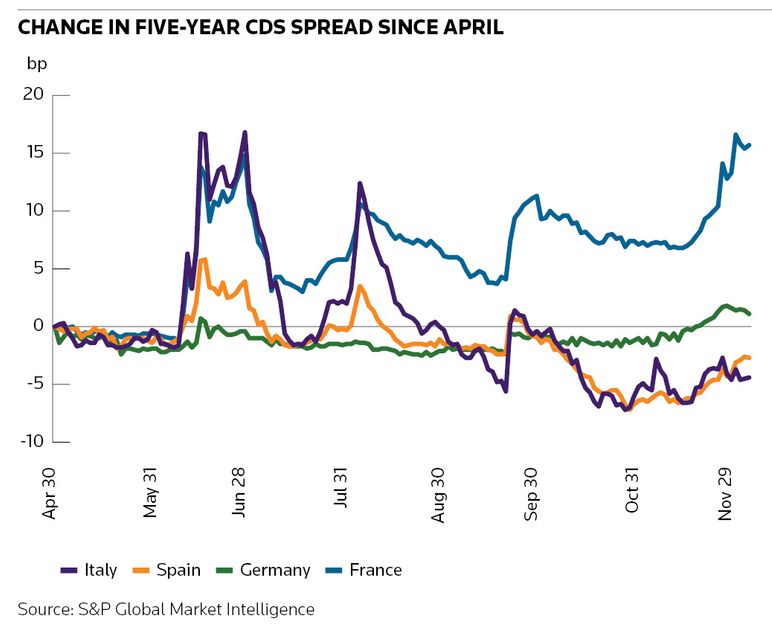

So far, at least, there haven’t been any signs of stress spilling over into neighbouring markets – something that became a feature of the eurozone sovereign debt crisis more than 10 years ago. Five-year French CDS spreads are about 14bp wider than 37bp in early June before Macron called the snap parliamentary elections, according to S&P Global Market Intelligence. Italian and Spanish CDS spreads, by contrast, have tightened slightly over that time.

CDS quirks

Traders say French sovereign CDS volumes were also high in June when Macron called the parliamentary election. That included some investors taking advantage of a little-known quirk in CDS markets where two different types of contract exist: one that is meant to offer protection against France leaving the euro – and an older version that has no such provisions.

Trading the difference between the two contracts became popular during the 2017 elections when far-right politician Marine Le Pen, who then wanted France to quit the euro, went head to head with Macron for the presidency. Le Pen lost that election and no longer supports France dropping the single currency, but some traders have still identified opportunities in this space.

“When the French elections came along there was a renewed interest in the idea of what optionality you can get via trading different CDS contracts,” said a senior trader at another major bank.

“No one is saying that there is going to be a currency redenomination in France. [But] the cheapness of that optionality meant that it was suitable for anyone looking to hedge a lot of French risk in an efficient way.”

The spread between the two French CDS contracts is now 21bp, according to S&P Global Market Intelligence, up from 12bp before Macron called the elections.

In currency markets, meanwhile, traders say France's political woes have encouraged some investors to ramp up bets against the euro. That comes amid widespread pressure on the single currency since Donald Trump’s win in the US presidential elections in early November, which raised the prospect of a trade war between the US and the EU.

“Macro clients [have been] very active in rates, but they also express a lot by FX as well,” said a senior FX trader at a major bank. “A lot of people are buying downside euro-dollar options, because vols are not that expensive and downside euro is attractive for many reasons.”