With 2024 almost over, bank heads of credit and equities trading will be happy about their year. That is until they hear that Jane Street is crushing them – again.

On December 2, Bloomberg reported that Jane Street generated US$5.8bn in third-quarter net trading revenue and US$4.3bn in adjusted Ebitda. That is a record and more than double the year-earlier levels. Jane Street revenues for the first half of 2024 of US$8.4bn were also more than double the year earlier.

Given the strong activity around the US election, it would not be a surprise to see full-year revenues of around US$20bn, which would be a material leg up from the US$10bn–$11bn that Jane Street has produced in the past few years.

Rising equity markets, tight credit spreads and high levels of corporate bond issuance have meant that credit and equities trading have outperformed macro (rates and FX) trading in 2024. Data provider Coalition Greenwich estimates mid-teen-percentage year-on-year revenue increases for credit and equities trading and a low double-digit-percentage contraction for macro trading.

We have seen an “equitisation” of credit markets, with electronic trading volumes in US corporate bonds having tripled over the last five years. Investment banks have been investing heavily to future-proof their credit trading businesses with algorithms, portfolio trading and ETFs, as highlighted in IFR’s recent interview with Bank of America’s head of credit trading Brian Carosielli.

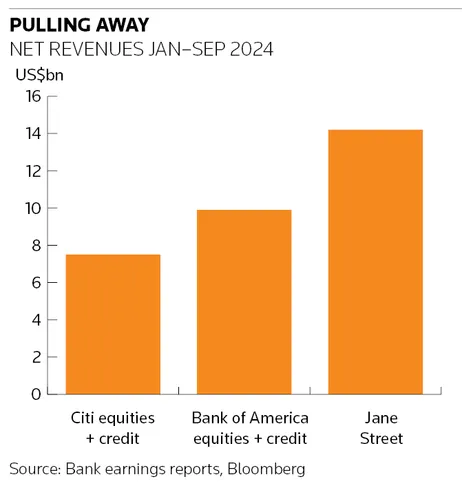

But here’s the thing. Even the market leaders are struggling to keep up with Jane Street. In the first nine months of 2024, BofA’s equities and credit revenues were up in the mid-teen percentages (it’s difficult to be precise because the bank doesn’t give a specific breakdown), while those at Citigroup, which had a weak prior-year comparable, are up just over 20%. And yet across equities and all non-macro trading businesses, BofA and Citi made significantly less revenues than Jane Street. These number also include securitised trading and financing – areas in which Jane Street does not play.

Jane Street’s dominant position in ETFs is widely known but much of its revenues now come from elsewhere.

It has become a major player in the equity market, particularly in the US. That includes taking on the likes of Citadel Securities in the cash equities wholesale market where it executes order flow from retail brokers and also strong growth in equity options where it has also expanded recently into the wholesale market for retail order flow. Many weaker investment banks are now even white-labelling and distributing Jane Street’s prices and execution. “In North American equities, its market share (excluding ETFs) surged from 4% in 2021 to greater than 10% last year,” S&P said in a ratings note.

Jane Street’s large capital base of more than US$24bn has underpinned its ability to expand aggressively in trading individual corporate bonds having started trading bonds with institutional clients in 2018. With around half US and European corporate bonds traded electronically – largely through a few major platforms – Jane Street has been able to compete head on with banks that traditionally had a distribution advantage.

So far in 2024, in terms of ranking by traded volume on MarketAxess, Jane Street is second in European credit, sixth across all investment-grade bonds and third in high-yield.

Crypto has been another major area of revenues for Jane Street and the emergence of ETFs recently has been beneficial. The huge move in bitcoin prices around the US election bodes well for Jane Street’s fourth-quarter trading performance.

Jane Street is also increasingly global. Profitability of its individual business lines or desks is a closely guarded secret but a court filing in the case of Jane Street Group LLC versus Millennium Management LLC alleges that Indian options trading strategies used by two former Jane Street traders who have since joined Millennium generated US$1bn of profit for Jane Street last year.

Jane Street is well known for its risk management, including buying out-of-the-money options to give downside protection but S&P said the compensation model at Jane Street also provides a measure of safety. “We view the compensation framework as probably less conducive to excessive risk-taking than at some of its peers. This is because individual traders and quants are compensated based on a variety of factors, including their contributions to research, their understanding of market dynamics and their cooperation with other teams,” the rating agency said. Those details on comp are particularly interesting given all the media coverage around the huge salaries available for junior staff at Jane Street.

There was a time when Wall Street trading desks were the ultimate prize for maths geniuses from top universities but given its scale and breadth Jane Street is now top dog. In recent days, Indian newspapers have been full of stories of Jane Street offering US$500,000 as a starting salary to a final-year computer science student from IIT Madras. That says it all.

Rupak Ghose is a former financials research analyst