Bank of America gains ground in credit trading push

Bank of America is making gains in the fast-changing world of corporate bond trading after pouring significant resources into the business in recent years.

BofA was the largest bank in North America flow credit trading by revenue in the first three quarters of the year, according to data provider Vali Analytics, referring to activities in which banks buy and sell corporate debt, credit default swaps and other related financial instruments on behalf of clients. The bank was the fifth largest by revenue in 2019, and in EMEA flow credit, BofA has jumped to fourth largest by revenue from ninth over the same period.

The credit trading expansion comes amid a broader push by BofA in global markets and coincided with an upheaval in the way corporate bond markets are organised and traded.

Accelerating electronification has increased client volumes but also compressed the margin that dealers make from brokering flows, prompting some to retrench. Those remaining are having to invest heavily in technology to keep pace with competition, including an increasingly assertive group of non-bank trading firms.

“We were tasked with fixing flow credit at a time when those markets were going through epic change,” Brian Carosielli, head of global credit trading at Bank of America, told IFR. “We’ve looked to reset the business and get better across regions in cash, index and CDS. We are now seeing those investments pay off, even in an environment of fee compression.”

Structured prowess

Credit trading has been a traditional strength for BofA, typically accounting for 40%–50% of its fixed-income revenues. But while the bank has long maintained its presence in the less liquid parts of credit markets, such as trading distressed debt or arranging and selling securitised products like collateralised loan obligations, BofA was punching below its weight in trading simpler flow products.

Its decision to bolster its flow operations is part of a wider initiative to improve its standing in sales and trading, which has seen it report an annual rise in markets revenues for 10 consecutive quarters. Markets chief Jim DeMare has overseen a significant increase in financial resources deployed on BofA's trading division, including raising its total assets by more than a third over the past five years to US$924bn.

Growing the flow credit business has involved BofA strengthening its capabilities across a range of instruments including CDS and exchange-traded funds in the US and Europe. It has also meant adapting to a shifting landscape in corporate bond trading that is upending the status quo in ways once thought impossible.

“Doing it the old way doesn’t work anymore. Parts of our business are looking more like equities and so we have to embrace some of the same changes that happened in that market,” said Carosielli.

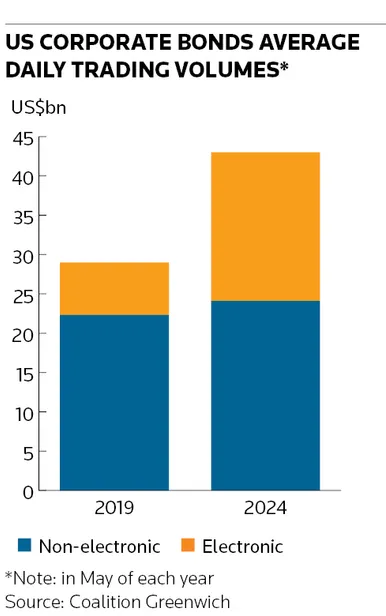

E-trading of corporate bonds has mushroomed in recent years after decades of inertia, precipitating a roughly 50% rise in trading volumes in the wider US market over the past five years, according to data provider Coalition Greenwich.

The growing prevalence of using algorithms to price bonds, along with the emergence of ETFs as an outlet for offloading risk, has revolutionised the way markets operate. Portfolio trading volumes, where investors can buy or sell huge amounts of securities in one go, are set to double this year to more than US$1trn, according to projections from Barclays, underscoring how electronification is turbocharging growth in these markets.

“The ecosystem of portfolio trading, ETFs and the algo has been our obsession for the last four years," said Carosielli. "Clients want more liquidity and larger size, so you have to be able to recycle your risks in an efficient, integrated way.”

Shifting landscape

The speed of the bond market revolution has already shaken up the competitive landscape. Citigroup has made cuts to flow trading as bid-offer spreads have shrunk and industry revenues declined. JP Morgan, another credit trading behemoth, has said it is now investing heavily in electronic trading after falling behind rivals in recent years. Bankers say the tech investment needed to remain relevant in these markets is huge.

“The moat is going to get deeper and there’s going to be a point where some dealers are not going to be able to cross it, because there’s been so much investment in the credit ecosystem from a technology and quant perspective,” said Carosielli. “We’re years away from credit being a mature ecosystem. It’s a constant journey and the bar is going to keep getting higher.”

One of the toughest competitors to emerge for banks in this new world are non-bank market-makers like Jane Street, which commands an impressive presence in the newly important world of ETF trading. That has coincided with a time when rapid growth in private credit funds is starting to encroach on another mainstay banking business – lending to companies.

Those forces are squeezing banks' credit businesses, prompting some to consider how they should interact with firms that often occupy a grey area between client and competitor.

"Electronification and private credit were two things that no one was even talking about five years ago. Now they’re changing many aspects of the credit business," said Carosielli. "At the end of the day, as a major global bank, we have certain strategic advantages because of the scale and structure of the businesses we run."