Hedge funds dive into volatile energy markets

Hedge funds have significantly increased their presence in energy markets this year, traders say, as macro managers with money to put to work have increasingly looked to take advantage of wild commodity price swings to turn a profit.

Volatility returned to oil markets last month following an escalation of tensions in the Middle East. Prices jumped after Iran launched missiles against Israel, only to fall again when Israel avoided Iranian oil facilities when it struck back.

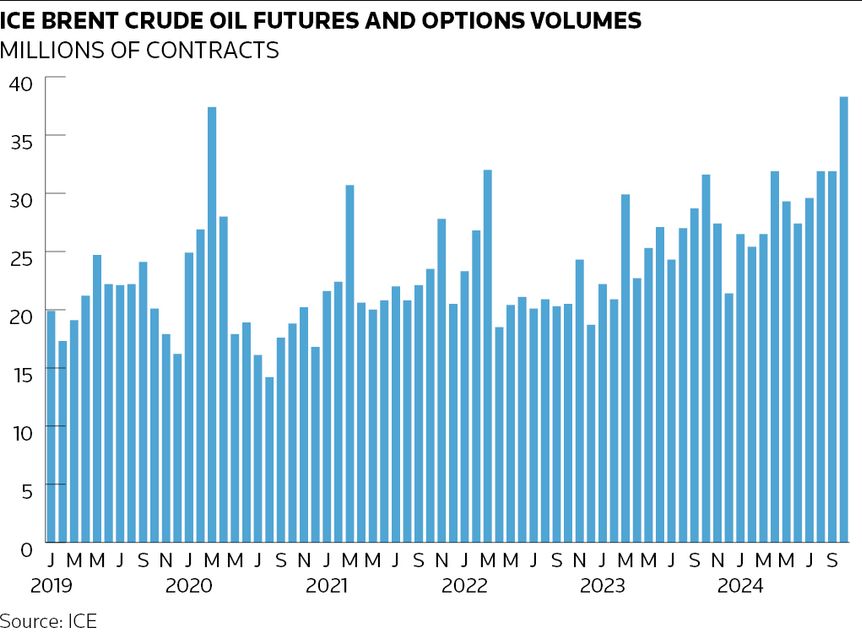

Intercontinental Exchange reported record oil futures and options trading volumes in October, while rival platform CME Group registered its busiest day ever in crude options on October 18 and said its average daily volumes in these contracts reached a fresh high for the third month in a row. Traders say hedge funds have been particularly active over this period.

“The kind of volume that we’ve seen from the hedge funds this year is some of the biggest I’ve seen,” said George Cultraro, head of commodities trading at Bank of America. “Volumes have been very high and widespread and span across names that the market trades with frequently, as well as quite a few newcomers to this space.”

Commodity markets have proven to be a fertile hunting ground for hedge funds in recent years thanks to some extreme market moves. Prices of US oil futures briefly turned negative at the start of the pandemic in 2020 amid concerns over the global economy, and energy prices jumped after Russia invaded Ukraine in 2022.

Commodity-focused hedge funds notched an annualised average return of 14.6% in the five years to the end of September, according to data provider Preqin, up from 6.7% in the five years to the end of 2019. In one prominent example, Ken Griffin’s alternative investment firm Citadel reportedly raked in about US$8bn trading commodities in 2022 alone.

Moderating returns

Preqin data show that average commodity fund returns have moderated since then, but that hasn’t dampened interest from more players investing in this space. Fund giant Millennium Management, for instance, has reportedly been building its commodities business with last year's hire of Anthony Dewell, a former Goldman Sachs star oil trader, to spearhead its efforts.

“Investing in commodities for multi-strat funds and banks goes in and out of fashion. I think we’re moving back into fashion,” said Brett Friedman, managing partner at advisory firm Winhall Risk Analytics.

“Crude oil is one of the biggest commodity markets in the world. It’s very established, it’s incredibly liquid ... and that’s why a lot of hedge funds get involved," Friedman said. "The tails are big in crude, so you can make a lot of money.”

Famed oil trader Pierre Andurand recently told investors that his fund, Andurand Capital Management, was renewing positions in crude oil amid the escalating tensions in the Middle East, Bloomberg reported, having dumped oil bets earlier this year in favour of other commodities. Away from specialist firms, commodity traders report increased interest from macro funds that are looking to diversify their returns.

Hedge funds have been active in Brent and WTI crude oil, although many tend to favour WTI. So-called non-commercial participants – an umbrella term for managed money, which includes hedge funds – accounted for 21% of total open interest in Nymex WTI crude futures in early August, compared with 15% of ICE Brent crude contracts, according to a recent blog on ICE’s website.

Managing risks

Options tend to be particularly popular with hedge funds. Cultraro said hedge funds' increased presence has tested the market’s ability to manage liquidity because their trades tend to be concentrated on specific strikes and months.

“These are mainly focused around geopolitical events,” he said. “It puts the market into some interesting volatility positions and in pockets of low liquidity. The key is how the market manages those risks and challenges in terms of where they put hedges and the ability to source liquidity.”

WTI at-the-money implied volatility hit an 18-month high of 50% an October 11, according to data provider OptionMetrics, amid ongoing uncertainty over how Israel would respond to Iran’s attack. That came as WTI skew – a measure of market stress showing the difference between at-the-money and out-of-the-money options – sank below 9%, its most distressed level since the aftermath of Russia’s invasion of Ukraine.

Friedman noted that WTI skew, unlike implied volatility, is yet to settle back to its long-term average, potentially implying some degree of unease persists in the market.

"With ongoing geopolitical and supply/demand uncertainty in crude oil markets, we are seeing a sharp increase in options trading," said Peter Keavey, global head of energy and environmental products at CME Group, which owns Nymex. Keavey said short-term options are the platform's fastest-growing energy product and the contracts now have an expiry every day of the week, providing investors with greater flexibility and precision to manage exposures.