Trump trade could turbocharge 2025 IPO pipeline

With Donald Trump heading back to the White House and a likely Republican clean sweep in Congress, IPO bankers will be hoping that the three years of famine are coming to an end and there are four years of feasting ahead of them.

So how will Trump's presidency and, just as importantly, Republican control of the two houses of Congress help the IPO market?

Trump’s rhetoric, like that of most politicians, can be different to actions, but we should assume a general move towards a more business-friendly environment in the US, especially for the banking sector.

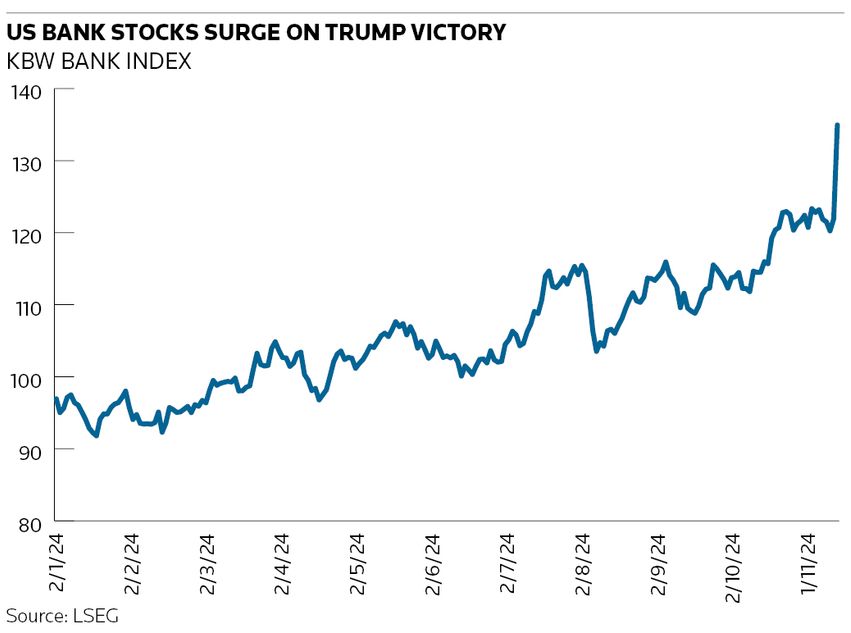

US stock markets have rallied hard since the election news, especially mid-cap and bank stocks, with the Russell 2000 mid-market index up 4% on Wednesday’s open and the KBW Bank Index up 8% – outperforming an also buoyant broader market.

The animal spirits sparked by lower taxes and deregulation is likely to have a sustained impact at least through the first half of Trump's presidency. It could also lead to further watering down of the proposed additional capital requirements for US banks from the Basel III endgame proposals.

One of the areas where the IPO drought has been greatest has been the tech sector, despite the Nasdaq having risen by around 25% in 2024. According to LSEG data, there have been only seven VC-backed tech US IPOs so far in 2024 and not many more in the two preceding years. This compares with 77 such IPOs in 2021 and data from Jay Ritter showing there was an average of 30 VC-backed tech US IPOs in the 2010–2020 period.

Large sections of Silicon Valley – in particular leading venture capitalists – have been scathing of the Biden administration’s policies towards the tech sector, in particular its aggressive antitrust stance.

A huge swing in tech antitrust policy will drive tech M&A activity allowing big-cap tech companies to buy smaller firms. But higher valuations of publicly listed smaller companies will also provide more attractive comparables for privately owned VC-backed tech companies when they go public.

Some of the largest private VC-backed tech decacorns like Stripe and Revolut have recently had large secondary offerings of stock and are likely to be in no rush to IPO. Some of these offerings have been at relatively high valuations meaning that companies need to grow into their new numbers.

In my view, the first out of the gate of the giant VC-backed decacorns in the US will be Databricks. The company has an attractive business model with recurring revenues and exposure to the artificial intelligence theme. It has an attractive financial profile with US$2bn–$3bn of revenues growing at 60% per year. In a 2023 fundraising round it was valued at US$43bn. Databricks bankers will be encouraged by the runaway success of Arm Holdings' IPO as an AI play.

CoreWeave also plays into this red-hot AI theme. It is an emerging cloud provider that has been raising significant amounts of capital to build data centres with the latest GPU chips. It was recently valued at US$23bn.

A tough regulatory approval process resulted in Adobe’s US$20bn acquisition of Figma falling apart recently, making Figma a leading candidate for a 2025 IPO. Other US tech IPOs for 2025 will likely include cloud security provider Netskope, instant messaging platform for video gamers Discord, software for contractors company ServiceTitan, buy now, pay later provider Klarna and neobank Chime.

Indian bromance

Of course, the 2025 IPO pipeline will not all be about Trump, although his bromance with Indian prime minister Narendra Modi may help overall sentiment towards Indian equities. A once-in-a-generation IPO of Reliance Jio could take place in 2025.

The company is India’s number one telecoms and broadband provider with 479 million subscribers. International investors invested US$18bn in recent years to own a 33% stake. The valuation of Reliance Jio is expected to be above US$100bn thanks to the confluence of strong growth, a tech theme, a market leading position in the fast-growing Indian economy and the sprinkled stardust of the Reliance/Ambani brand.

Other smaller IPOs in India in 2025 will include Hero Fincorp, the financial services division of two-wheeler Hero MotoCorp, and EV firms Tata Passenger Electric Mobility and Ather Energy. But Reliance Jio is likely to make or break the Indian IPO market.

Geopolitical headwinds

Both Europe and China are likely to be less active given potential geopolitical headwinds but there are several large listings that could take place in Europe. Trump's election is likely to reinforce the idea that London is Shein’s safest path to the public markets. At a rumoured valuation of US$66bn this would easily be the largest IPO in the UK for a long time.

In continental Europe the largest IPO at a valuation of more than €20bn is likely to be the German transmission business of TenneT, the Dutch state-owned electric grid operator. Private equity will also be a large player in terms of either exits or competing for carveouts of businesses from multinationals. One of the largest likely private equity exits at a valuation of around US$10bn will be German generic drugmaker Stada Arzneimittel.

Carveouts that could either go the private equity or IPO route include two ice cream businesses. Unilever is looking to carve out its frozen food business, which includes brands like Ben & Jerry's and Magnum at a US$20bn valuation. A competitor, Froneri – jointly owned by Nestle and PAI Partners – with brands like Haagen-Dazs, is also in play.

Dealmakers will be frantically getting ready to unleash all of this pent-up demand in early 2025. Trump's presidency may help them get off to a decent start, but there is no guarantee that the sugar high will continue through the whole term.

Rupak Ghose is a former financials research analyst