Boeing boosts turnaround hopes with US$24.25bn of equity

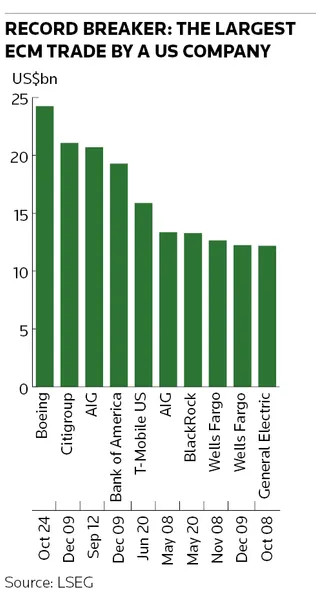

Boeing drew strong investor support for its potentially protracted corporate turnaround by raising US$24.25bn from a record equity and equity-linked offering, the largest primary ECM deal by a US company.

The massive capital call on investors ended years of speculation that had intensified in recent weeks and enables the struggling aircraft maker to slash debt and bolster its liquidity while it seeks to overcome long-running safety and quality concerns and production delays and start to address an estimated seven-year backlog of orders.

The proceeds could also help Boeing fend off the recent threat from credit rating agencies to cut its investment-grade ratings to junk.

“The big takeaway for me is that in the right situation, for the right company, the ability to do a raise in size is there," one senior ECM banker said. “[The banks] haven’t really had to put these tools to the test since Covid-19.”

After a weekend wall-cross followed by one day of marketing, Boeing on Monday sold US$16.1bn of common shares and raised another US$5bn from an equity-linked three-year mandatory convertible security.

Boeing later confirmed the bank syndicate behind the offering had exercised a 15% greenshoe on the share sale for another US$2.4bn of proceeds.

The banks also confirmed they had exercised the 15% greenshoe on the mandatory for another US$750m, taking the total haul from the exercise to US$24.25bn, the biggest primary raise on record by a US company topping Citigroup's US$21.1bn recap in 2009.

The only larger equity offerings globally in the past 15 years are Petrobras' US$69.8bn secondary offering in 2010 of which US$23.2bn was placed in the market, Saudi Aramco's US$29.4bn IPO in 2019 and Alibaba's US$25bn NYSE IPO in 2014.

A syndicate comprising 11 bookrunners led by Goldman Sachs, Bank of America, Citigroup and JP Morgan priced the base offering of 112.5m shares, or about 15% of Boeing, at US$143 each, a 7.7% discount to the close on October 25. The sale was upsized by 25% from 90m shares at launch and, with the shoe, added more than 20% to Boeing's outstanding shares.

The highly anticipated offering closed multiple times covered.

The banks allocated 55% of the shares to the top 10 accounts and 80% to the top 25.

The mandatory convertible priced at a 6% dividend and a 20% conversion premium versus initial price talk of 6%–6.5%, up 17.5%–22.5%, later tightened to 5.75%–6%, up 20%.

The mandatory was six times covered with allocations skewed to mutual funds and outright investors.

The syndicate told investors from the outset the stock sale could be upsized but the mandatory would not, reflecting Boeing's sensitivity to the cost of paying the dividend on the latter as the company has not paid a dividend for four years.

Boeing shares fell 2.8% to US$150.69 while the equity raise was in the market on Monday, fading late in the session despite widespread anticipation of the offerings and the stock already being down 40% this year.

Reflecting the willingness of investors to back Boeing's turnaround, the shares rose to US$152.98 on Tuesday and to US$154.29 on Wednesday, though they fell back to US$149.31 in Thursday's weaker broader market.

As a result, the offering delivered windfall profits of roughly US$800m to those that bought shares in the stock sale.

Another banker close to the deal defended the wide discount, arguing it accounted for the upsize and reflected Boeing's eagerness to ensure a positive aftermarket so the greenshoes could be exercised to collect extra proceeds. Boeing was also keen to reward its long-suffering shareholders, the banker said.

Saturday marketing

Both legs were oversubscribed at launch following a confidential marketing effort led by Goldman Sachs that started on Saturday to give the syndicate greater confidence in the level of demand.

Participation in the wall-cross was confined to mutual funds and other existing investors, and did not include any sovereign wealth funds.

No material non-public information was disclosed to these investors apart from plans for the equity raise.

“A lot of those discussions focused on how much capital they would need to raise to keep their investment-grade credit rating and execute the turnaround of the business,” a third banker said.

As it turned out, the financing was significantly larger than the US$10bn–$15bn analysts had expected, a surprise especially welcomed by bond investors. That said, Boeing earlier this month filed a US$25bn shelf that gave some indication of the upper limit of its appetite for capital.

The equity injection represents a key part of new CEO Kelly Ortberg's plans to turn around the company. Ortberg, in the seat since August, is the former CEO of aerospace firm Rockwell Collins, now called Collins Aerospace and part of defence contractor RTX.

Negative cashflow

On October 11, Boeing announced a 10% reduction in its workforce, a delay in its 777X wide-body jet programme, and said it anticipated steep quarterly losses in its Defense, Space & Security division.

Those were confirmed when Boeing later that month reported negative free cashflow of US$2bn for the third quarter and warned it would continue to burn cash into 2025.

At the end of the last quarter, the company had US$57.7bn of debt and just US$10.5bn of cash, only slightly above the US$10bn minimum it prefers to always have on hand.

The equity raise will enable Boeing to clear US$4.6bn of debt maturing by the end of next year and nearly US$8bn due in 2026.

That could relieve ratings pressure after Moody’s placed Boeing’s ratings under review for downgrade in September, a move echoed in October by S&P and Fitch.

The agencies have Boeing at Baa3/BBB–/BBB–, one notch above junk.

Fitch said in a statement following the equity raise that the proceeds alleviated downgrade risks but Boeing still needs to "regain operational momentum" and bring leverage below four times by the end of 2026.

Still, some think Boeing is not yet out of the woods in terms of downgrade risk.

"They still may fall to high-yield at some point, but it seems like they're doing what they can," one fixed-income portfolio manager said. "And, yes, the equity raise is a huge positive."

Boeing's bonds were still trading wide relative to the investment-grade market, the portfolio manager said.

Notably, Boeing moved ahead with the offering while it remains locked in a month-and-a-half-long dispute with 33,000 striking machinists that is said to be costing US$50m–$100m per day.

Bankers previously said that Boeing would raise less equity if the strike was resolved but some investors said the company should push ahead anyway on the understanding the dispute is nearing a resolution.

In Monday's filings, Boeing cited the strike as a risk factor and said it was unable to predict its duration. That said, Boeing tabled a new deal for workers late on Thursday that may point to a near-term resolution.

No credit

Alongside the raise, Boeing opted to terminate the US$10bn "supplemental" credit line put in place last month amid speculation about the pending equity raise.

On October 14, Boeing secured the credit with BofA, Citi, Goldman and JP Morgan as joint lead arrangers and bookrunners. Citi was administrative agent with BofA, Goldman and JP Morgan as co-syndication agents. The loan included bridge-like pricing that became increasingly expensive over time.

The financing, which was never funded, aimed to shore up Boeing's liquidity as the company worked to stabilise its finances while arranging the equity raise.

“They were doing the equity and they needed the liquidity,” a source close to the financing said.

PJT Partners was Boeing's financial adviser.

Banks feast on nearly US$400m fee take from Boeing raise

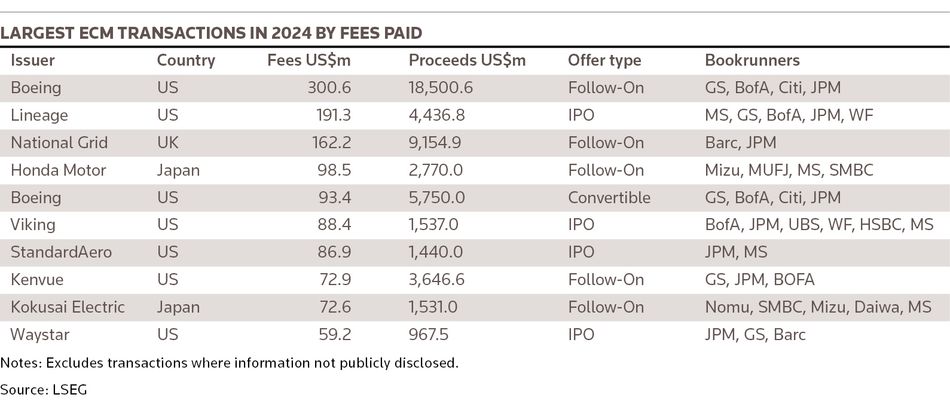

Banks booked almost US$400m of equity underwriting fees from Boeing's jumbo US$24.25bn sale of equity, easily the year's biggest fee event globally for ECM syndicate desks and a significant league table boost to the four banks that led the transaction.

The syndicate of 20 banks shared in a 1.625% gross spread across the US$18.5bn common stock sale and the US$5.75bn mandatory convertible offering (both offerings included fully exercised 15% greenshoes).

That translated to US$300.6m in fees for the stock sale plus US$93.4m for the mandatory, according to SEC filings and IFR calculations.

Those numbers do not include the undisclosed fee to PJT Partners, Boeing's financial adviser.

The transaction was an especially lucrative mandate for the four joint lead bookrunners: Goldman Sachs, Bank of America, Citigroup and JP Morgan.

Those banks each collected 19.5% of the deal economics or nearly 80% of the fees between them, followed by Wells Fargo with 6.5% and six other banks with 2.1% each.

The fee bonanza on Boeing topped the US$191.3m that banks earned from July's US$5.1bn Nasdaq IPO of cold storage warehouse REIT Lineage and the US$162.2m fee on UK power network National Grid's US$9.1bn rights issue in June that was shared by Barclays and JP Morgan.

The transaction leaves JP Morgan and Goldman Sachs, in that order, ahead of peers in US and global ECM league tables for this year.

According to LSEG data, JP Morgan has raised US$60.6bn from 255 offerings for a 12.2% global equity and equity-related market share, ahead of Goldman with US$55.6bn from 244 offerings and Morgan Stanley on US$50.2bn from 218 deals.

Though Morgan Stanley was relegated to a minor role on Boeing's equity raise, it priced a US$2bn selldown of Keurig Dr Pepper shares the same night as Boeing priced its transaction.