Ares circles US$2.1bn for real estate-focused M&A

Ares Management part-funded its US$3.7bn purchase of alternative asset manager GLP Capital Partners' international business with a mandatory convertible above its all-time high share price and an investment-grade bond that catered to booming investor interest in private credit.

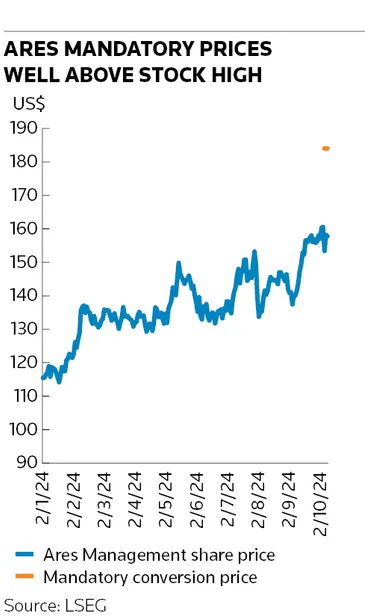

Morgan Stanley and Citigroup, providers of a bridge loan, priced the US$1.35bn three-year mandatory convertible preferred on Tuesday at a 6.75% dividend and 20% conversion premium, the midpoint of 6.5%–7% and 17.5%–22.5% talk, after a day of marketing alongside the M&A announcement.

“Mandatory issuance has been relatively quiet,” said a banker involved. “They tend to be done in the context of acquisitions and there haven’t been a lot of acquisitions in recent years.

“The investor base for a mandatory is different from a regular-way convertible bond. In addition to hedge funds, the mandatory appeals to yield-oriented investors.”

The mandatory's 6.75% dividend is a 435bp pickup over the 2.4% yield on the underlying shares, though investors are giving up most of the upside to a share price of US$184.03, the 20% premium. That puts the breakeven period at four years, outside the three-year tenor and suggesting that on a breakeven basis investors would have been better off buying the stock.

Ares issued its mandatory a day after its shares hit an all-time high US$161.56.

Because investors are obligated to convert and the preferred allows for deferring dividends, Ares’ mandatory gets 100% equity credit. S&P and Fitch rate the mandatory at BBB–.

Having secured the equity funding, Ares on Wednesday raised US$750m from the sale of a 30-year senior unsecured note priced at a 5.60% coupon, 130bp over Treasuries and 25bp inside initial price talk. Morgan Stanley and Citigroup were also leads for the BBB+/A– rated bond transaction.

The credit-focused alternative asset manager is using the combined proceeds to fund the US$1.8bn upfront cash needed to buy GCP International. It is also issuing US$1.9bn of stock and could pay another US$1.5bn under earn-out provisions through 2027, though the latter can mostly be paid in stock.

Ares expects the acquisition to close in the first half of 2025 and be modestly accretive to earnings in the first year, with “meaningfully higher” accretion in future.

The purchase marks a significant expansion of Ares’ real estate business globally.

“Data centre demand from both hyperscale and enterprise customers continues to accelerate with capital expenditures expected to materially exceed US$1trn over the next three years,” Ares said in the M&A announcement on Tuesday.

Private credit boom

Ares, which has US$447bn of assets under management, last month closed the US$3.3bn Ares US Real Estate Opportunity Fund IV, giving it US$5.5bn to target investments across the US and Europe. GCP International adds US$44bn of AUM, of which US$20bn is focused on Japanese real estate.

Blackstone closed a record US$30.4bn for its Blackstone Real Estate X fund in April 2023 and Apollo Global Management in September closed a US$25bn private credit programme in partnership with Citigroup. Blackstone and Apollo have also both sold long-dated bonds at the parent level to support fund launches, according to a fixed-income portfolio manager, but nonetheless such bond issuance from alternative asset managers remains rare.

There is precedent for private equity using mandatories to capture the benefit of high stock prices. In August last year, Apollo raised US$1.25bn to capitalise its Athene insurance subsidiary while KKR raised US$750m in 2020 to fund its purchase of life insurer Global Atlantic Financial.

The mandatory has also been used by traditional corporations this year. Hewlett Packard Enterprise issued a US$1.5bn mandatory in September to help fund its US$14bn acquisition of Juniper Networks, following mandatories earlier this year from Albemarle (US$2bn) to support its credit ratings and utility NextEra Energy (US$2bn) as a ratings-friendly way to fund capital expenditure.