Summertime and the livin' ain't easy: Europe suffers equity deal drought

Americans love to make fun of how long Europeans spend on holiday in summer. But when it comes to the European ECM and M&A market, it feels like bankers might as well have stayed at the beach.

Summer got off to the ECM equivalent of an airline cancelling your flight to somewhere sunny just as you arrive at the airport: Permira being forced to abandon the IPO of Golden Goose in June and the months that followed haven’t been much better.

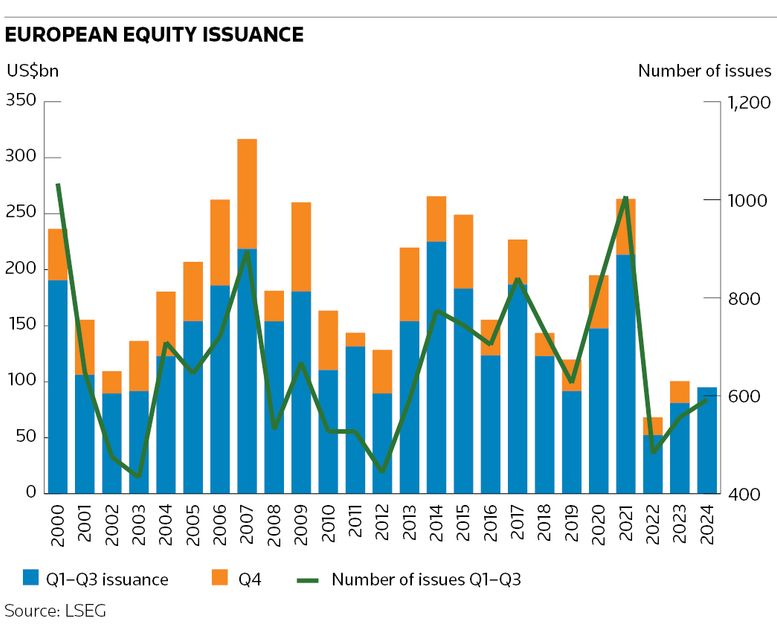

The crucial month of September was very quiet for European equity bankers, ending a terrible third quarter in which just US$500m of IPOs got done in Europe, according to LSEG data – a tenth of Q3 2023, which itself was hardly a good year. Any optimism that came in early October from Springer Nature's IPO stumbling out of the gate was dashed this week when Europastry pulled its IPO at the last minute – the frozen croissant company’s second failed flotation attempt this year.

Follow-on equity sales in the third quarter were also disappointing, with only US$10.5bn raised in Europe compared with the US where at US$18bn September was one of the best months in years for follow-ons. And it was a similar story for convertible bonds.

This was a considerable about-turn from the first half when European IPO activity had been decent, if not stellar, even if the year-on-year comparable was a very quiet first half in 2023. The number of first-half IPOs in Europe rose by 18 to 60 and the amount of equity capital increased five-fold to US$15.5bn, underpinned by several large floats like those of Puig Brands, Galderma and CVC Capital Partners. There was also a decent mix of PE and non-PE-backed listings.

The first half also saw US$54.9bn raised from follow-ons in European equity markets, a 30% year-on-year increase that included a few larger offerings from the likes of National Grid and Haleon.

Elsewhere too

It wasn’t just Europe that was in the doldrums when it comes to third-quarter listings. IPO activity has been tepid across most geographies and even the significant rise in the Nasdaq has not prevented a drought in US tech IPOs. The main problem has been the dependence of markets on a few large-cap stocks – particularly the Magnificent 7 US tech names – and any tech stocks exposed to the AI theme. Valuations in private markets being above those available in IPOs haven't helped either.

The only market to really see strong momentum in IPO activity in recent months is India, which as we have noted previously is a smaller opportunity for Western banks, not just because of the size of the market but also competition from local banks and much lower fee levels.

Similar story

Is it the same story of relative gloom in European M&A? Essentially, yes. Advisory fees booked from completed M&A in Europe over the nine-month period are flat year on year – an improvement on the 9% drop in the first half although behind a 12% increase for the Americas.

But given the time lag between announcement and completion of M&A, announced deals are perhaps a better indication of the health of M&A markets.

LSEG data show that the value of announced M&A in Europe in the first nine months of 2024 rose by 31% year on year, but it slowed both sequentially and year on year in the third quarter. This was also against a very quiet period a year earlier. As a result, 2024 is likely to end up as the second-worst year for announced European M&A in the last decade.

Bond bonanza

By contrast, 2024 is shaping up to be amazing for European DCM, with debt deals raising 19% more in the first nine months of 2024 than 2023 for the highest tally since 2007.

DCM is, of course, a traditional strength of European banks.

While European investment banks – Barclays, for instance – have highlighted the strategic importance of diversifying their investment banking franchises through expanding their market share in ECM and M&A markets, in the US in particular, in the near term the relative weakness of those business lines in Europe and the strong DCM environment has only increased their dependence on debt dealmakers.

As we look into 2025, the relatively smaller size of the European ECM and M&A markets mean some big-ticket items could make all the difference. The biggest of these is any banking consolidation kicked off by UniCredit's potential takeover of Commerzbank. Other themes include deals involving government entities such as the €20bn-plus IPO of Dutch state-owned electric grid operator TenneT.

Bankers on the equity and M&A side will be hoping desperately that 2024 is a blip rather than a sign of things to come. Otherwise, they won’t be able to afford those fancy summer holidays.

Rupak Ghose is a former financials research analyst