Quant credit rebounds after tough period

The relentless rise of electronic trading in corporate bonds is driving a rebound among hedge funds specialising in quantitative credit, helping to draw a line under a chastening period for investors that called into question the role that model-driven strategies play in these markets.

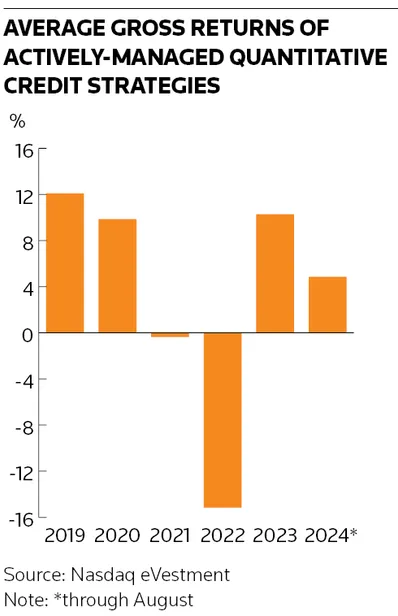

The buzz around systematic credit investing has been building for years amid a structural shift in the way corporate bonds are traded and organised towards a more equity-like model. But these strategies faced a brutal reality check in 2022 when bond volatility jumped as central banks began raising interest rates aggressively.

Surging transaction costs around that time upended many quant credit strategies, which rely on ease of trading to implement investment ideas. Many reported heavy losses in 2022 and assets across the industry dropped 27% that year to US$52bn, according to investment database and software firm, Nasdaq eVestment.

But the continued electronification of credit markets and an improvement in trading conditions since then have led to a revival in quant credit over the past 18 months, with actively managed funds on average recording returns of about 10% in 2023 and 5% through to August this year, according to Nasdaq eVestment.

“We think we’re starting to enter the heyday of systematic credit," said Paul Kamenski, co-head of credit at investment firm Man Numeric. "It was a struggle in the early years translating what looked good on paper into live portfolios. What we’ve seen more recently, with lower transaction costs and increased fill rates, is that we’re able to tap into the opportunity set that systematic credit provides."

Trading evolution

For years, the conventional wisdom held that corporate bond markets were too complex and illiquid to accommodate the kind of quant investors that have been a mainstay in equity markets for decades thanks to the use of technology to identify and profit from inefficiencies in stock price movements.

Those attitudes began to change as credit markets became more electronic. E-trading now accounts for 44% of all US corporate bond trading volumes, according to Coalition Greenwich, up from less than a quarter in 2019.

“The growth of e-trading has been dramatic. This isn’t a case of ‘the market is electronifying’ – this is 'the market is electronic',” said Kevin McPartland, head of market structure and technology research at Coalition Greenwich.

The growing availability of data in credit markets has been another important factor behind the rise of quant investing, McPartland said.

“There’s just so much more to work with nowadays. If you want to do any kind of quant strategy, you need reams and reams of data to pore through to figure out where the opportunities are," he said.

The electronic revolution in credit has boosted volumes significantly across the wider market as it has become easier and cheaper to trade. Median bid-ask spreads in US high-grade bonds have fallen to 0.11 in price terms this year from 0.19 in 2022, according to bond platform MarketAxess. Average ticket sizes, meanwhile, have declined from about US$560,000 four years ago to US$360,000.

“There is heightened interest in quant trading, as the ETF and portfolio trading ecosystem has given rise to the ability to do more in this space," said Sonali Theisen, global head of FICC e-trading and markets strategic investments at Bank of America. "While fixed income is not following the exact same playbook as equities, it is noteworthy that average ticket sizes continue to trend downwards while overall volumes trend upward – likely reflecting more algorithms at work.”

Tough times

That's not to say it has been all plain sailing for the quants. Actively managed funds on average recorded negative returns of 15% in 2022, according to Nasdaq eVestment, as transaction costs more than doubled amid heightened market volatility.

"That was a really painful time that made us look inward and try to figure out what was happening in the marketplace," Kamenski said. That led to Man Numeric identifying a clear divergence in costs between different trading protocols, with the traditional method of trading large blocks of bonds over the phone proving to be the most painful and the largest driver of the increase.

“It really matters how you’re trying to tap into liquidity. We’re seeing some of the lowest transaction cost levels we’ve ever seen in single name electronic trading, but trading larger blocks via voice protocols is becoming much harder and more expensive, oftentimes twice as expensive or more in our experience," Kamenski said.

The concern will be whether another episode of extreme market volatility could send quant strategies reeling again. Kamenski said recent experiences offer encouragement on this point, with electronic markets proving to be "much better behaved" during the regional banking crisis last year compared with algo execution at the start of the pandemic in 2020.

“We feel confident that the overall trajectory is corporate credit becoming more electronic. That’s a really healthy backdrop," he said.