Ding-dong, Avon falling: bigger-than-expected CDS payout after bankruptcy

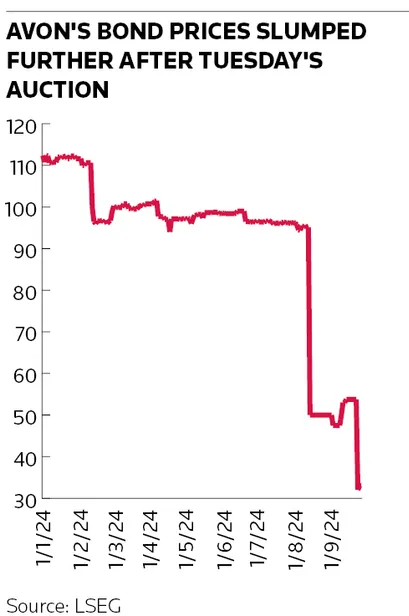

Avon’s bonds slumped last week after payouts on credit derivatives linked to the bankrupt beauty brand were far larger than traders had anticipated.

The price of Avon's 2043 bonds had plunged to 33% of face value on Thursday, down from 54% on Monday, according to LSEG data, in the wake of an auction to establish payouts on the roughly US$900m of credit default swaps referencing the company's debt. The decline capped a remarkable run of losses for holders of Avon's bonds, which had traded near par just days before the company filed for bankruptcy protection on August 12.

“The whole thing obviously took the market by surprise,” said a credit market analyst at a large dealer. “Both bond and CDS investors weren’t really expecting the outcome of the auction that we saw.”

CDS auctions are designed to establish a market price for defaulted bonds and determine how much money CDS sellers should pay CDS buyers (CDS buyers who settle in cash receive the difference between the cash price for the bonds established at the auction and par). Anyone can participate in the process, meaning auctions often represent a good opportunity for investors to buy or sell the defaulted securities.

The result of the Avon CDS auction on Tuesday implied that the company's bonds were worth just 34% of face value, despite bond dealers having quoted them at a much higher price only hours before. That meant CDS holders received a payout of 66 cents for every dollar of protection they bought.

Auction controversy

The run-up to the Avon CDS auction had its share of controversy due to the tiny amount of bonds – just one security with US$22m of principal – that had been identified to settle US$888m of Avon CDS that Depository Trust & Clearing Corp said was outstanding as of September 20. There have previously been concerns that constraining the amount of debt in CDS auctions could produce unusual results.

Barclays had argued that more debt should be included in the auction in the form of a US$405m promissory note that Avon had with an affiliate of its Brazilian parent Natura. That motion failed to gain support, though, and the Credit Derivatives Determinations Committee – the industry body that rules on matters in the US$8.7trn CDS market – stuck with its initial decision that only the US$22m Avon bond could be used. Barclays declined to comment.

Some believe the lack of bonds made the auction process far more uncertain. "People really had a hard time guessing what the proper price should be," said one derivatives lawyer.

"Many would have guessed a lower number for the likely recovery for [Avon] bondholders than what most of the participating bidders came out with. That [final price] was really driven by the fact that … the only deliverable obligation admissible is one that has very little liquidity ... with US$22m outstanding," the lawyer said.

No harm done

In the end, the small amount of Avon bonds didn't do any harm to CDS protection buyers. CDS auctions comprise two rounds. First, bond dealers provide quotes to give an initial indication of the value of a company's debt. Then, in the second round, physical CDS settlement requests are filled (where the protection buyer delivers the relevant bonds in return for an appropriate cash payment) by dealers placing limit orders.

The final price at which these physical requests are filled becomes the CDS payout for those settling their contracts with cash. This dynamic means that an imbalance between buyers and sellers of the bonds in the second round can affect the final CDS payout.

Bond dealers on average indicated the Avon bonds were worth about 63% of their face value in the first round – higher than where LSEG data show them being quoted in the wider market at the time. However, the second round of the auction produced a much lower final settlement price of 34 cents on the dollar amid flagging demand to fill the US$13m of net demand to sell Avon’s bonds via physical settlement.

“The big question [coming into this auction] was whether [CDS] sellers would demand physical settlement, knowing that they would essentially be getting bonds that weren’t worth very much,” the credit analyst said. “What ended up happening was that no one wanted to end up with these Avon bonds.”