Dutch pension reform set to upend euro swaps market

A major overhaul of the €1.8trn Dutch pension fund industry is set to reverberate across the euro interest rate swaps market, as demand from these prominent users of long-term derivatives declines sharply in the coming years.

The Dutch government laid out plans last year to revamp Europe’s largest pension system by 2028 by moving all employees on defined benefit schemes, in which members are guaranteed a certain level of income upon retirement relative to how long they've worked, to a defined contribution system, which forces members to take greater responsibility for building their pension pots.

Traders say those changes will upend long-held dynamics in euro swaps markets, where Dutch pension funds have loomed large for years by buying ultra-long-dated hedges to dampen the impact of interest rate moves on their defined benefit schemes.

The shift to the new arrangements is expected to trigger a significant repricing of risk across the euro swaps market, which is used in trillions of euros of bond sales and hedging transactions every year, as demand switches towards shorter-dated derivatives.

"Dutch pension funds have long been one of the key players in long-term euro interest rate swaps, so this transition is obviously going to impact the euro swaps market in a pretty big way," said Frederic Goulipian, head of euro swaps trading at Natixis. "I’d estimate that Dutch pension funds contribute to more than half of the recurring long-end trades taking place within the euro interest rate swap market today.”

Dutch pension funds are among the biggest users of long-dated euro swaps because of how defined benefit schemes, which ING says cover 87% of Dutch pension scheme members, are designed and managed.

Future payouts to pensioners in these schemes are fixed, which makes them extremely sensitive to moves in interest rates. The robustness of these pension schemes, meanwhile, is monitored by calculating "coverage ratios" – the difference between the sum of those future payouts and the capital held by a pension fund.

Those features encourage pension funds to hedge moves in long-dated interest rates that could affect the value of payouts a scheme makes to its members over the coming decades. Many funds hedge those moves by entering long-dated swaps, typically between 30 and 50 years in length.

"Dutch pension funds are probably the biggest player at the long end of the euro swaps curve and are certainly the single biggest industry receiving at the long end of the euro swaps curve," said Steven Montgomery, rates strategist for Europe at BNP Paribas.

Sizeable shift

Those long-dated hedges won't be necessary under the revamped Dutch pension system as future payouts to pensioners will no longer be fixed. Bond giant Pimco estimates hedging activity on behalf of all Dutch pension funds will fall by about €400m in PV01 terms – a measure of interest rate risk that shows how much the value of a position changes for every basis point move in rates. That's equivalent to €200bn of 30-year swap hedges – or the total amount of interest rate risk from last year's record net supply of European government bonds.

Defined contribution schemes will still have some need for euro swaps, though – albeit in smaller quantities and shorter maturities. That is because they will still need to hedge interest rate risk for members nearing retirement who typically want greater certainty over their pension payouts.

While about €400m in DV01 (a similar measure of fixed-income market risk) could be unwound for hedges greater than 25 years, an additional €200m–€300m in DV01 may be put in place for hedges shorter than 25 years due to the transition, Montgomery estimated.

Analysts said that will have a material impact on the euro swaps market, which is the main reference point used in pricing the €560bn of euro debt that corporates and financial institutions have issued this year. Euro swaps are a popular tool for corporates and financial institutions to manage their interest rate risk too, with about US$17trn of notional trading in the first half of the year, according to ISDA and DTCC.

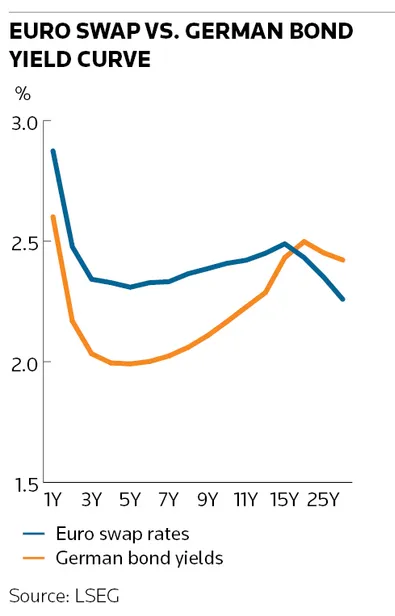

Declining demand for ultra-long-dated euro swaps should allow those rates to rise, while greater demand for 10 to 20-year swaps should cause those rates to fall, resulting in a significantly steeper euro swaps curve. Montgomery estimated 30-year swaps could trade about 30bp higher than 10-year swaps, compared with about 13bp lower now.

“Given the size of the Dutch pension fund industry, growing demand for 10 to 20 years will have a curve-steepening effect,” said a senior investment consultant at a large advisory firm. “That will result in the interest rate swaps curve more closely matching the shape of the German government bond curve.”

Pre-transition hedging spike

Despite the projected decline in overall hedging, traders expect pension funds to become more active in the run-up to the introduction of the new defined contribution system as they look to subdue volatility within their portfolios and ensure a smooth transition.

Falling interest rates coupled with an equity market selloff is one adverse scenario asset managers will be wary of. Some funds have already turned to interest rate options to navigate this pre-transition period.

"We’ve already seen some pension funds looking at swaptions to conduct that short-term hedging pre-transition," said Rik Klerkx, chief investment officer for liability-driven investment at advisory and investment management firm Cardano. “For smaller pension funds, it’ll be easy to just unwind some swaps close to transition date whereas the larger funds will need to position themselves ahead of time, which is where the use of swaptions will come in."

Some are concerned that a sudden rush to hedge new schemes – and unwind old positions – could lead to volatility in the market in the coming years. "There could be lots of volatility around transition dates," said the senior investment consultant.

Others are betting on a more passive approach from pension funds, allowing their current hedges to roll off, which should cause less disruption. "The majority of funds will have limited room to readjust their positions in advance," said Goulipian. "Therefore, over the next four years, we’ll see a gradual shift to shorter maturities rather than a 'big bang' event."