Taiwan ECM hits heights on AI boom

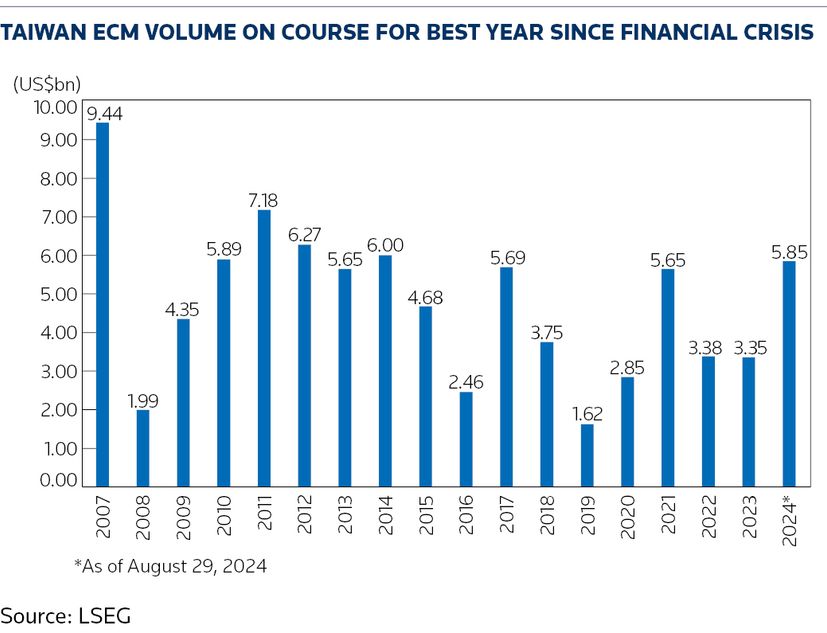

Taiwan’s equity capital market is on course to achieve the highest annual issuance volume in 17 years, with at least four deals totalling US$2.3bn planned for the fourth quarter.

Contract notebook computer maker Quanta Computer is expected to bring a convertible bond of up to US$1bn to the market after receiving regulatory approval on September 9. Hon Hai Precision Industry, better known as Foxconn, has picked Citigroup, Goldman Sachs, HSBC and UBS to arrange the sale of a CB of up to US$700m.

Solar cell maker Sino-American Silicon Products and integrated circuits maker VIA Technologies plan global depositary receipt issues of around US$300m each.

The deals are set to take Taiwan’s 2024 ECM volume, which stood at US$5.85bn as of Thursday, to around US$8.15bn, the highest since 2007 when issuance totalled US$9.44bn, according to data from LSEG.

The fundraising boom in Taiwan is fuelled by surging global demand for artificial intelligence-related technologies.

The strong run-up in the share price of US AI chip giant Nvidia since late last year has drawn a lot of attention to the Taiwanese market.

Not only does Nvidia’s founder and CEO Jensen Huang have Taiwanese ties (he was born in Taiwan but moved to the US as a child), but Taiwan Semiconductor Manufacturing Co, the world's largest contract chipmaker and a major Nvidia supplier, is listed on the island. Shares in TSMC are up 59% this year, mirroring a 154% surge in Nvidia’s shares.

Other Taiwanese companies in the global technology supply chain also benefit. Hon Hai, which expects revenue to surpass NT$7trn (US$219bn) next year thanks to a surge in demand for AI-enabled servers, saw its shares jump 77% this year. Hon Hai expects to ship its first batch of AI servers powered by Nvidia's latest high-tech chip before the end of the year.

High-flying shares

The high-flying shares, together with funding needs, have driven issuers to the market.

“Capacity expansion and capital expenditure needs have driven semiconductors and hardware companies to tap the market for funds,” said Brian Chau, co-head of equity-linked in Asia at UBS.

Cloud IT infrastructure provider Wiwynn in July raised US$1.44bn from an offering of GDRs and a CB to fund the procurement of raw materials in foreign currencies. The company is investing heavily in the production of AI-based servers, which are expected to be its next growth engine.

Some issuers that were previously concerned about the potential dilution brought by fundraising are also now turning to equity sales.

“Taiwanese companies have been very careful about raising equity given the dilution. Most of them used debt to finance their capital needs as debt has been pretty cheap,” said Jennifer Pu, managing director, Greater China ECM, at Citigroup.

“Strong share price performance is one of the key reasons that they decided to raise equity this year and there are some other reasons such as overseas acquisitions,” she said.

Quanta Computer, Hon Hai and VIA Technologies are all raising funds to purchase raw materials overseas, in a move to secure inventory upfront amid fierce competition in the AI sector.

New investors

With more transactions and a broader base of issuers, Taiwan's deals have attracted new investors from other regions.

“The investor mix has changed a lot this year especially towards semiconductors and AI-related companies. The investor mix, as well as the investor base, that are looking at Taiwan has expanded from Asia into Europe and the US,” said Pu.

“Some sovereign wealth funds, as well as international long-only investors, are trying to build up more positions in some high-quality companies,” she said.

UBS’s Chau believes fundraising in Taiwan will continue next year as AI capex is huge. “We may see repeat issuers or new issuers coming to the market,” he said.