Hedge funds help create secondary market for deal contingent hedges

A growing number of hedge funds are helping banks recycle the risks stemming from deal contingent trades, a risky type of derivative that banks sell to corporates and private equity firms looking to hedge financial market moves ahead of the completion of major mergers and acquisitions.

At least four hedge funds are active in helping banks offset deal contingent risks, according to industry experts, compared with just one a few years ago. That is helping create a secondary market for the risks stemming from these complex trades and enabling banks to underwrite more – and larger – deal contingent transactions than ever before.

“We are regularly facing a lot larger [deal contingent hedging] opportunities than in the past,” said the global head of foreign exchange structuring at a major dealer. “The fact that banks’ appetite [for deal contingent risk] has increased is linked to the fact that there’s now an ability to distribute that risk in the market to hedge funds, allowing us to take on larger deals through risk recycling.”

Deal contingent options are often touted as the perfect hedge for companies engaging in M&A thanks to their ability to protect would-be acquirers against sharp moves in currencies or financing costs between the time they announce a deal and when it completes. The most valuable feature for buyers – and the riskiest part for the banks selling the derivatives – is that the acquirer can walk away without paying for the hedge if the deal falls through.

The entrance of more hedge funds into these markets comes at an opportune moment, with demand for deal contingent hedges picking up this year. That has come as private equity firms, historically the biggest users of these structures, have started to ramp up dealmaking again following a lean period.

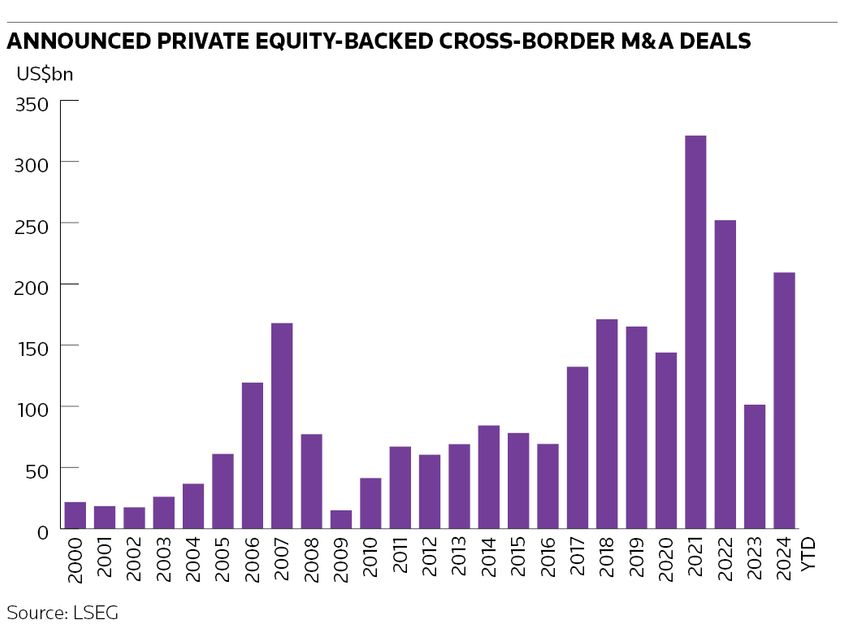

There have been US$209bn of private equity cross-border M&A transactions announced this year, according to LSEG data, more than double the same period in 2023. Average deal sizes have tripled to US$109m, meaning that any accompanying deal contingent hedges have considerably increased in size.

While cross-border M&A is creating demand for contingent FX hedges, the higher interest rate environment has encouraged more firms to use deal contingents to hedge their future borrowing costs.

“Deal contingent hedging has been very prominent for interest rate hedging this year and is much more the norm in both the M&A and project finance space than in previous years,” said the head of corporate sales at a European bank.

Risky business

Selling these derivatives can be a profitable business for banks but it's also fraught with risk. The contingent aspect of these trades can cause serious headaches if the M&A transaction fails and the market moves against the bank that sold the hedge.

Barclays suffered a US$125m hit on a deal contingent trade in late 2021 following Advent International’s abortive takeover of drugmaker Swedish Orphan Biovitrum. About 19% of corporate and private equity cross-border M&A deals that were announced last year were withdrawn.

To account for these risks, banks charge clients a premium that is calculated using the cost of the relevant FX or interest rate derivative. Riskier deals with a higher chance of failing typically carry a heftier price tag.

Hedge funds becoming more active in these markets has created an outlet for banks looking to manage these exposures. As well as helping banks free up capacity to do more deal contingent business, the ability to recycle risks is encouraging banks to underwrite larger hedges.

“If a bank has the appetite to underwrite 100% of the risk of a large deal contingent transaction, then that’s very attractive to clients from a confidentiality perspective, especially preannouncement [of a deal] as they’ll only be dealing with one party versus multiple banks aware of the trade with the potential for negative market impact," said Benoit Duhil de Benaze, managing director, hedging and capital markets, at consultancy Chatham Financial.

"Having the ability to recycle the risk can help a bank to secure the deal – even if that bank then offloads that risk with other banks or hedge funds at a later stage," he said.

Unique opportunity

Taking the other side of deal contingent hedges is one way for hedge funds to diversify their investments – thanks to the unique risks that deal contingents pose – while also opening up new streams of revenue.

Hedge funds are comfortable holding these chunky exposures because they don’t face the same regulatory and risk constraints as banks. It can also be a lucrative business as banks are often willing to pay handsomely to offload deal contingents on public transactions that can involve billions of dollars of risk.

It’s these riskier, public M&A deals that hedge funds are most interested in taking off banks' hands, in part because there's often a higher chance of failure, meaning the hedge will be more expensive. There also tends to be more information around the proposed transaction to scrutinise.

"Public transactions tend to be riskier, and therefore priced higher in terms of deal contingent premium," said de Benaze. "Hedge funds can potentially achieve better economics than in private transactions – which most banks tend to keep on their books rather than recycling."