Call spread business booms as convertibles return to favour

A rebound in convertible bond sales this year is creating big business for banks’ derivatives desks, with many companies entering hedging arrangements to accompany their issuance of these complex equity-linked securities.

US convertible bond sales rose by a third to US$33bn in the first half from a year earlier, according to LSEG data, as the combination of high interest rates and strong stock markets increased the appeal of these structures for companies looking to refinance debt.

To replicate fixed-income like economics, convertible issuers are spending some of the money raised to buy derivative structures – known as call spreads and capped calls – that are designed to offset the effects of dilution from an ultra-high share price once their bonds transform into stock.

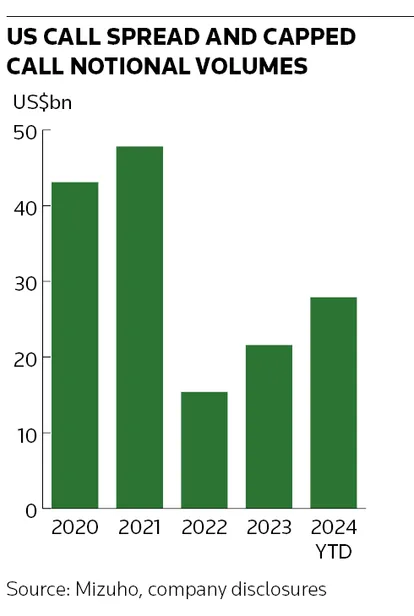

US call spread and capped call volumes have totalled US$27.9bn notional so far this year, Mizuho said, citing company disclosures, with companies ranging from recreational vehicle maker Winnebago Industries to power utility NextEra Energy spending tens of millions of dollars on these hedges. That has already comfortably passed 2023’s full-year total of US$21.6bn.

“The call spread business has been booming,” said Steve Nawrocki, head of equity derivatives for the Americas at BNP Paribas. “It’s been a massive year for the convertible equity-linked market. And, on the back of that, you also have all [these] derivative structures traded around those convertibles.”

Convertible bonds have returned to favour following a lean couple of issuance years. The relentless rise in the S&P 500 has provided a healthier backdrop for equity-linked securities for issuers and investors alike. Interest rates resting at high levels, meanwhile, has encouraged a broader array of companies to consider convertible bonds as a way of reducing borrowing costs.

Coupon payments on convertibles are lower than companies would otherwise have to pay on regular debt. That's because convertibles give investors the opportunity to benefit from a potential rise in the issuer’s stock price in the years ahead through the bonds converting into shares once certain conditions are met. Changes in US accounting treatment for convertible bonds introduced in 2023 has also encouraged issuance.

Broadening out

Once largely the preserve of fast-growing technology firms, this year’s convertible deal roster includes the likes of homebuilder Meritage Homes, miner MP Materials and copy machine maker Xerox Holdings. Equity capital markets advisory firm ICR Capital said 53% of convertible deals had a call spread or capped call this year, up from 38% in 2023.

A typical trade would see the company buying a call option on its shares to offset the effects of dilution if its stock price rises sharply over the life of the bond. These calls are often capped at a level that is usually well above the price at which investors can convert the bonds to stock.

“We have been very active in call spreads. Call spreads trail the convertible market because call spreads are done to hedge converts. The reason why we’re seeing more call spreads is because there are more convertibles this year,” said Mariano Gaut, managing director at Mizuho.

“With the combination of the savings on the coupon and equity prices at these levels, we expect the convertible market – and the call spread business – to be busy in the second half of the year.”

These trades can be an important source of revenue for banks. NextEra spent roughly US$50m to purchase a capped call that was 50% above its share price when its US$900m convertible priced in February – and more than 20% higher than the price at which investors can convert. Winnebago and MP Materials spent US$29m and US$57m, respectively, on capped calls.

Cleaning up

Rather than relying solely on their convertible bond underwriters, companies will often look to widen the field of banks pitching to provide their hedge to sharpen pricing as much as possible. It is commonplace for specialist advisory firms to run an auction process for these hedges, reducing the once-fat margins banks earned on the trades. Advisers say their growing presence in the market has helped broaden the appeal of these structures, which had sometimes received a bad press.

"When call spreads first became popular, there were a number of situations that negatively impacted the reputation of these structures – for example, a number of call spreads were unwound because of M&A, and issuers had to write large cheques to banks," Syed Raj Imteaz, head of convertible and equity derivatives advisory at ICR Capital.

"The introduction of advisers has cleaned things up – issuers now have comfort around what they’re signing up for and also that they’re paying a fair price for their hedge."

Bankers expect call spread activity to remain busy in the months ahead as companies look to refinance debt. There was about US$91bn of notional of call spread and capped call volumes in 2020 and 2021, according to Mizuho, following a surge in convertible bond issuance. Convertibles typically have a maturity of about five years and many of these bonds – along with their accompanying hedges – will need replacing as they come due.

“There is a wave of convert refinancings coming in 2025 and 2026 and many of those had call spreads as well. So the call spread part of the business has been busy and will continue to be busy,” said Gaut.

Additional reporting by Stephen Lacey