US IPOs stall amid volatility as focus turns to 2025

The US IPO market has been stunted, but not entirely closed, following a steep selloff in stocks amid signs of a slowing economy that raised expectations the US Federal Reserve may be forced to cut interest rates sharply, as opposed to a gradual easing, though major deals are not expected to come until 2025.

For stocks, the triple-whammy came in comments by Fed chair Jerome Powell over rising unemployment, confirmation that jobless numbers in the US are rising and an unexpected rate hike by Japan’s central bank that imperilled a carry trade of low-cost money into US stocks.

Volatility hit a post-pandemic high of 65.7 last week and comes on top of a recent rotation out of large-cap growth equity into more defensive cyclical companies.

“The market volatility we have seen over the past week has not changed much around the prospective IPO calendar post-Labor Day,” said Eddie Molloy, global head of ECM at Morgan Stanley. “We are going to continue to have deal activity in the fall, but it’s not going to be a mad rush.”

The wobble is far from ideal as the calendar is frontloaded ahead of the US presidential election in November.

Lineage, a cold storage and logistics REIT, KKR-backed enterprise software developer OneStream and Select Medical workers’ compensation spin-off Concentra went public in July, removing three of the highest profile companies from the backlog.

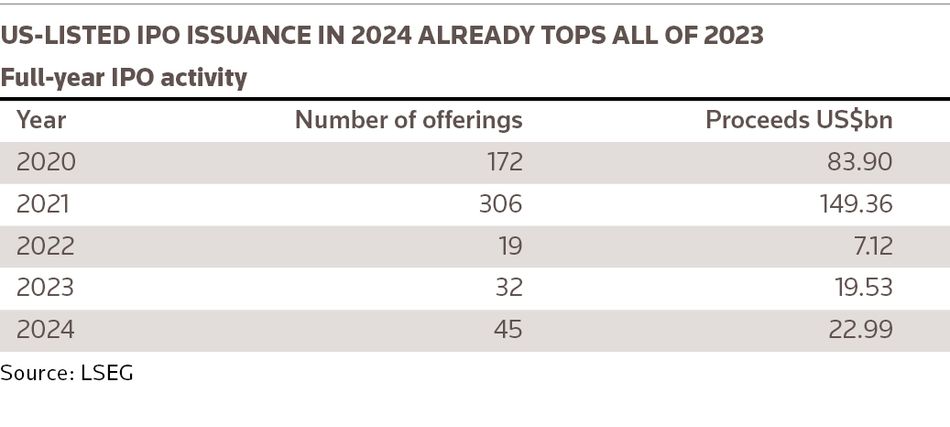

This year, 45 US companies have raised a combined US$23bn from IPOs, already topping the US$19.5bn raised by 32 companies in all of 2023, according to LSEG data.

Unlike last year, which saw late-year pricings from UK chip designer Arm Holdings (US$5.2bn), German sandal maker Birkenstock (US$1.5bn), and Instacart (US$660m), fewer high-profile names look poised to go public later this year.

Backlog bare

Grupo Aeromexico, a once-bankrupt Mexican airline operator, had hoped to go public through a US listing but has been grounded by the selloff in Mexican stocks, bankers involved in that process told IFR, following the surprise election in June of Claudia Sheinbaum as president.

Historically, August has been a slow month for US IPO issuance – in 2022 and 2023, there were no IPOs – not just due to holidays but because companies using unaudited second-quarter financial results to market IPOs, including the July trio above, must close their deals by August 12, after which time they are obliged to use audited results.

This year has the added complexity of a presidential election and sudden turn towards vice-president Kamala Harris as the Democratic nominee that had muddled the outcome from a previously expected victory by former president Donald Trump.

“Historically, there has been an uptick in IPO volume after the US presidential election,” said Keerthika Melissa Subramanian, a partner at law firm Winston & Strawn. “In this presidential cycle, there is also greater uncertainty over when the Fed is going to cut rates and what the cadence of cuts will be.

“You are going to see companies file confidentially but wait until they get clarity on the election and Fed rate cuts before deciding to go public.”

In the US, companies universally file IPO documents confidentially with the SEC and publicly file once fully vetted, allowing them to launch marketing 15 days later.

The publicly visible US IPO pipeline is almost non-existent. Aside from Aeromexico, which publicly filed in May, Vista Equity Partners-backed trucking logistics software company Solera, which filed on June 28, is among the few companies that technically could go public in August.

There is little to be gained by publicly filing now, but there is reputational harm of filing and the transaction failing.

“There has definitely been some tapping the brakes this week as issuers don’t want to get caught exposed with the increased volatility,” said Seth Rubin, head of ECM at Stifel. “But the fundamentals and the medium-term outlook have not changed.”

IPO logistics

That is not to say the cupboard is entirely bare.

Morgan Stanley’s Molloy pointed to mature tech, healthcare, industrial, insurance and aviation services as areas of potential issuance after the Labor Day holiday on September 2.

Winston & Strawn’s Subramanian adds semiconductor companies feeding into AI, transport and logistics, and biotechnology as other possibilities.

AI chip developer Cerebras Systems tipped its hand at the end of July by announcing it had confidentially filed to go public. The company is being touted as an alternative to the capacity-constrained Nvidia, which, despite a selloff, still sports a US$2.4trn market cap.

The success of Lineage's US$4.44bn offering, the largest by a US REIT, comes amid increased investor focus on the value of logistics and supply chain management. The REIT achieved a premium valuation and its shares have traded up 13.2%, in part by marketing technology and construction expertise in supply chain management.

FedEx is considering strategic alternatives for its less-than-truckload last-mile delivery unit, FedEx Freight, leading to speculation it may spin off the business. Canadian trucking company TFI International has also talked about splitting off its LTL unit.

The spin-offs, which may or may not include an IPO, play into the broader theme of delivery of goods into the home with the proliferation of ecommerce following the pandemic.

2025 normal

There has been a lot of discussion around when the US IPO market will return to "normal”, and what that will look like. The boom fuelled by low interest rates in 2020–2021 was abnormal and the market is still recovering.

“It has been our view for a bit that 2025 is when the IPO market likely gets back to fully normalised,” said Morgan Stanley’s Molloy. “That is still the case.”

Leveraged companies, such as KKR's in-home healthcare provider BrightSpring Health, have struggled to find an audience because of higher interest rates.

Software and traditional technology have been underrepresented as valuations are yet to fully recover from post-pandemic highs. Ready access to private capital has allowed companies in these sectors to hold off on IPOs until they are ready.

Stripe, the financial payments provider, fetched a US$70bn valuation on an US$861m investment by Sequoia Capital in July that was used to cash out the VC’s limited partners, Axios reported.

Swedish buy now, pay later provider Klarna is exploring a private sale of secondary shares to allow employees to sell and firm up its valuation ahead of an IPO in early 2025.