FX futures gain traction amid greater automation

Foreign exchange futures volumes are on the rise this year as greater automation transforms a set of products that have historically struggled to gain traction, allowing them to imitate trading practices that are popular in the wider US$7.5trn-per-day currency market.

Average daily notional FX futures volumes reached US$113bn across 1.3 million contracts in June at CME Group, the world's largest marketplace for these contracts, a 15% increase on last year.

That comes amid increasing electronification of block and "exchange for related position” trades – types of futures transactions that are favoured by traders in the highly automated over-the-counter market where most FX activity takes place.

“We’re definitely seeing an increase in the use of FX futures this year in particular … [as] there’s now a lot more automation within the futures market around block and EFRP trades,” said Deirdre O’Sullivan, in the global futures and options execution and portfolio solutions team at JP Morgan.

“Executing these trades was more manual in the past, which maybe created a bit of an invisible barrier to more clients getting involved in the FX futures market, whereas now clients can more easily fit them into their broader FX product suite,” she said.

Futures never really took off in FX markets in the same way that they did in the other asset classes like equities and interest rates, where listed derivatives have become a common way to manage risk. Notional outstanding for FX futures reached US$362bn in April, according to the Bank for International Settlements, a drop in the ocean compared with the US$38.9trn for interest rate futures. That means only a tiny fraction of FX trading occurs on futures exchanges, with most counterparties preferring to face each other directly in the OTC market.

Stricter OTC derivatives regulations have nevertheless increased the appeal of listed FX products in recent years, while exchanges have also been striving to make FX futures trade more like OTC derivatives in an effort to attract more volumes.

Increasing automation to make it easier to carry out block and EFRP trades has been one important step. That is significant because these transactions – unlike traditional futures – are negotiated privately between counterparties and typically allow larger transfers of risk more akin to the OTC market.

In another important development, exchange operators like CME have made it possible to trade blocks and EFRPs on non-standard dates. FX futures have traditionally lacked such flexibility, which has been a deterrent for many institutional investors.

Rising liquidity

It also helps that more banks have begun providing liquidity for these futures contracts over the past few years. That’s enabled block and EFRP trades to become a much more scalable and accessible product, according to Richard Condon, head of FX, commodity and EM institutional sales in North America at BNP Paribas.

The French bank fielded perhaps a dozen client questions about blocks and EFRP trading in 2020, Condon said. Requests to discuss this topic have expanded exponentially since then with BNPP now hosting multiple calls per week with some of the "largest household names" across the market.

"Clients are actively trying to figure out how best to incorporate these products into their workflow and, although actively trading them can take some time, the growing interest in having these conversations indicates that something is evolving here rather rapidly," he said.

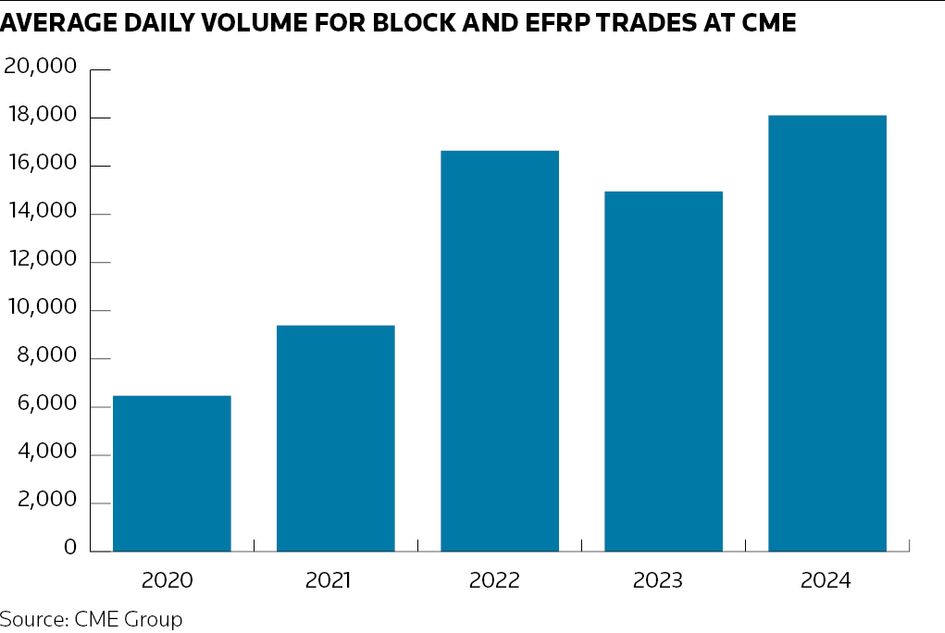

There are 25 liquidity providers supporting block and EFRP trading at CME Group. Average daily volumes in 2024 for blocks and EFRPs are 20% higher than last year at 18,109 contracts.

“A growing trend among end-users is demand for block trades and [EFRPs],” said Paul Houston, head of FX at CME. “We're certainly seeing more buyside participants looking to utilise that method of execution.”

The fact that more OTC venues – such as 360T – are offering futures contracts within their multi-dealer platforms is also helping to boost electronification in the futures market. That is because it enables investors to transact directly with their preferred liquidity providers, further aligning the listed FX market with the OTC market, according to Tobias Rank, head of FX product sales at Eurex, which lists FX futures on its exchange.

“This enables market participants to trade FX futures in a highly automated, electronic and bilateral fashion – in the same way they trade OTC FX,” Rank wrote on Eurex's website in April.

O’Sullivan at JP Morgan said she has seen “elevated” futures trading around large macro events this year – including the Mexican and UK elections. Mexican peso futures reached an average daily notional of US$3.6bn last month, a 77% increase from June 2023, according to CME.

“[That’s] quite a new development for the FX futures market,” said O’Sullivan. “Previously, the barrier to more clients trading FX futures was the fact that the EFRP/block [trading] process was highly manual. The innovation around automating liquidity provision and workflow makes futures a very easy product to trade, full stop – especially when wanting to express a view around macro events.”