Private equity uses at-IPO margin loans to boost capital raisings

Private equity firms, under pressure to return cash to investors, are using an old trick to upsize their equity capital raises: borrowing more money.

So-called at-IPO margin loans are growing in popularity this year, as private equity sponsors struggle to extract enough capital from their portfolio companies despite a recent thawing in the IPO market.

Borrowing against their remaining stake in a company at the same time as they list it publicly is one way for private equity funds to monetise a greater slice of their investments without risking a larger IPO that could weigh on the share price.

In one prominent example, banks underwriting CVC Capital Partners' €890m listing of German cosmetics company Douglas in March also provided a €300m margin loan to the private equity giant – a sizeable uplift to one of the largest European IPOs this year. Not all loans are made public, but bankers report a broader rise in at-IPO financing this year and say several deals are in the pipeline.

“It’s definitely a trend. We’re seeing a lot of pre-IPO and at-IPO margin lending as sponsors continue to look to return capital to investors,” said Mariano Gaut, managing director at Mizuho. “The market tone is better and IPOs are beginning to happen, but there’s still uncertainty as to how long those windows will last – and how many windows sponsors will have.”

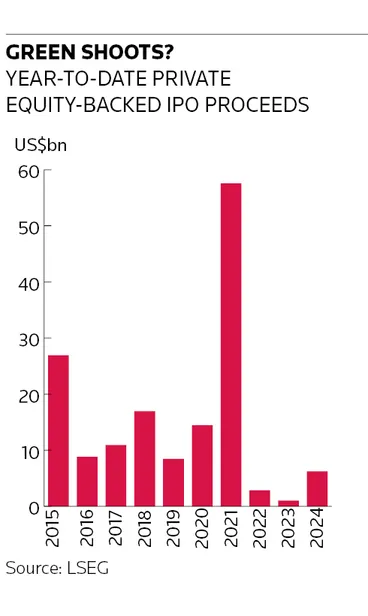

A virtual freeze in the IPO market during 2022 and 2023 proved damaging for private equity sponsors as new stock listings are a crucial route to begin exiting and monetising their investments.

The market has shown signs of life lately with a roughly sixfold rise in proceeds from private equity-backed IPOs in 2024 to US$6.2bn, according to LSEG data. However, that run rate is still far below the average of the past decade. There are also lingering concerns about the reception IPOs can expect, as shown by UK investor Permira’s eleventh-hour withdrawal last month of its listing for Italian shoemaker Golden Goose.

All of this has done little to relieve the pressure that private equity is feeling from investors to return money after a prolonged hiatus. Hence companies turning to financial engineering to weather this tricky period.

Japanese conglomerate SoftBank secured an US$8.5bn pre-IPO margin loan in 2022 to free up capital ahead of its US$5.2bn blockbuster listing of UK chip designer Arm Holdings in September. Private equity sponsors that are finally bringing deals to market are now deploying a variation of this strategy – the at-IPO margin loan – to increase proceeds.

"Over the last year, the IPO markets have been plugged and so there's been pressure to figure out ways to raise innovative financing. And now, even as the IPO market opens up a bit, sponsors still aren't able to get done what they want to get done," said a senior equity derivatives banker at a US firm.

"If they can use financing and derivative tools to generate more proceeds, then it's something that they're certainly willing to do."

Overcollateralisation

The €300m margin loan that accompanied Douglas’ listing in March is a notable example. Press reports suggested CVC was seeking a valuation of as much as €7bn last year when it started exploring an IPO, having bought the cosmetics retailer from PE rival Advent International in 2015 for nearly €3bn.

In the end, the IPO priced in March at the bottom of the range to give a €2.8bn post-money market capitalisation. The margin loan will inject more capital into the company and help lower its leverage – a common strategy for private equity firms using these facilities.

The five main underwriters on the IPO – Citigroup, Deutsche Bank, Goldman Sachs, UBS and UniCredit –provided the margin loan, secured against “the vast majority” of CVC’s remaining stake in the company. That implies the loan is collateralised several times over, a requirement that lending banks typically demand. CVC holds a 54% stake in Douglas following the listing, which was worth about €1.5bn at the time of the IPO.

“Loans are always smaller than the IPO because we lend on an overcollateralisation basis of two to four times. Depending on who the sponsor is and the technical and fundamental characteristics of the underlying shares, banks can get more comfortable with lending larger percentages of the IPO size,” said Gaut. “If the seller is a very reputable, a very strong counterparty and the underlying company technical[s] justify it, then you're going to get more comfortable.”

The IPO prospectus said CVC may have to pledge more shares if Douglas’ stock falls. It was trading around €19 a share on Friday, 28% below the IPO price.

Some bankers question whether these loans can weigh on companies' shares. Lottomatica also traded lower after Apollo Global Management’s €600m IPO of the Italian gambling company in 2023, which was accompanied by a €400m margin loan facility, although the stock has since rebounded.

“It does tend to spook the market as everyone is worried about the levels taken [on the loan],” one ECM banker said. “The terms are usually not disclosed so people start speculating.”

Additional reporting by Tom Hill and Robert Venes