Mid-cap stocks are back; that should be good news for long-suffering private equity investors – and IPO bankers.

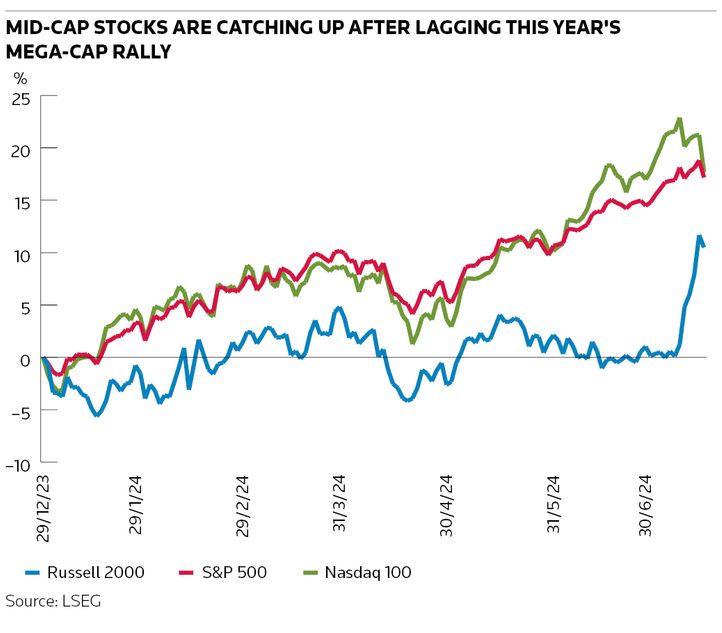

The Russell 2000 rose by more than 11% in five trading days from July 10 – a period when the Nasdaq 100 and S&P 500 were almost flat. PE sponsors, which remain under pressure from their limited partners to exit investments, will be hoping this is the start of a trend.

It’s no secret that mid-cap companies have been unloved lately. While fast-growing mega-cap stocks powered the S&P 500 nearly 90% higher over the past five years, with technology shares helping the Nasdaq 100 surge 150%, the Russell 2000 is up just 43% over the same period.

That mediocre performance has created a serious headache for PE funds looking to clear their backlog of deals and return money to investors, considering the Russell – as well as the lower end of the S&P – is the most relevant reference point for their portfolio companies.

It has also acted as a dampener on new listings from PE shops. PE-backed deals represented 20% of the US$1.8trn of global IPO proceeds raised in the eight years to the end of 2021, LSEG data show, but just 3% of the US$262bn raised in the leaner years of 2022 and 2023. Without PE firing, the IPO engine sputters.

Bankers happily tout the uptick in IPO activity this year, pointing to the 16 PE-backed deals globally in 2024 for US$8bn in proceeds – a roughly eight-fold year-on-year increase – and yet that is from a low base, with both the number of deals and funds raised around 60% below the average for the last decade.That decline has been sharper in the US than Europe, where the numbers are skewed by Swiss skincare company Galderma’s SFr2.3bn (US$2.5bn) offering.

In Europe, where larger free-floats give perhaps the clearest picture of what’s going on in PE land, smaller IPOs with proceeds below US$1bn only raised one-third of the average for the previous 10-year period. This is particularly harmful for specialist brokers like Numis, which Deutsche Bank acquired last year.

This stalemate is damaging for the wider PE industry. The importance of IPOs – as an exit route and a source of competitive tension – shouldn’t be underestimated, even as the traditional hand-off from private to public markets has relied on M&A to strategic buyers. New inventions like private auctions, which allow LPs to take stakes in specific companies, feels like rearranging the deck chairs on the Titanic.

There’s no escaping the fact that investor appetite for these IPOs – which come with significant secondary stock overhangs – is patchy, as is post-IPO share performance. Permira’s high-profile withdrawal of Golden Goose's IPO showed just how nervous sponsors are about bringing deals to market.

Bain estimates that although the value of PE exits is annualising at US$361bn, up 17% from 2023, this year is still shaping up to be the second-worst year since 2016 for exit value. With interest rates staying high and constraining leverage, strategic buyer and sponsor-to-sponsor transactions for PE are up only marginally, putting more pressure on smaller IPOs to provide exits.

Depressed mid-cap valuations have, until recently at least, encouraged PE sponsors to increase the pace of take-private deals, particularly in the UK, with acquisitions such as Hargreaves Lansdown. Annualising volumes from the first half of the year would give US$521bn of new buyout deals, according to Dealogic – around US$160bn greater than exits. This follows a net spend of US$133bn in 2023 and almost US$200bn combined in the prior three years.

Sponsor-to-sponsor deals show up on both sides of this ledger and acquisitions of PE assets by strategic buyers are unlikely to close the gap alone, particularly as corporate boards will look at public market valuations as a sanity check.

All the more reason for PE funds to hope that this mid-cap rally continues and spreads close between public and private market valuations. They would nonetheless do well to recognise that this two-track equity market is unlikely to go away completely. Active stock market investors want to see growth, solid business models and compelling stories before parting with their money.

Goldman Sachs chief executive David Solomon said recently he is looking for increased sponsor activity to spur a recovery in investment banking fees. Sponsor M&A activity and dialogue is starting to perk up, he said, even if it is still “way, way below” the 10-year trend.

The performance of the Russell 2000 index suggests he might be on to something. In the meantime, there’s every reason to believe the IPO renaissance – and PE's ability to take advantage of it – will struggle to get out of second gear.

Rupak Ghose is a former financials research analyst