Europe’s hedge fund industry is taking off after lost decade

Europe’s hedge fund industry is showing signs of kicking into gear following a decade of disappointing growth, as improving returns and a more promising investment backdrop are encouraging investors to plough money into the region.

Morgan Stanley is working with more hedge fund launches in Europe this year than it has in the last 10 years, according to Will Smith, head of prime brokerage for EMEA at the US bank, which operates one of the largest units dedicated to servicing hedge fund clients.

Smith highlighted a range of factors attracting investment into European funds, including better performance from long-short equity hedge funds, a recovery in dealmaking, improving economic growth and valuations remaining near record discounts to the US.

“European [hedge fund] AUM hasn’t really grown in line with the whole hedge fund industry over the last 10 years, but it now feels like it is through an inflection point and operating off a good platform,” he said. “Interesting themes are developing in Europe around luxury, defence and healthcare and overall it feels like Europe is entering a more sustained interesting period, which probably helps explain the volume and size of these launches.”

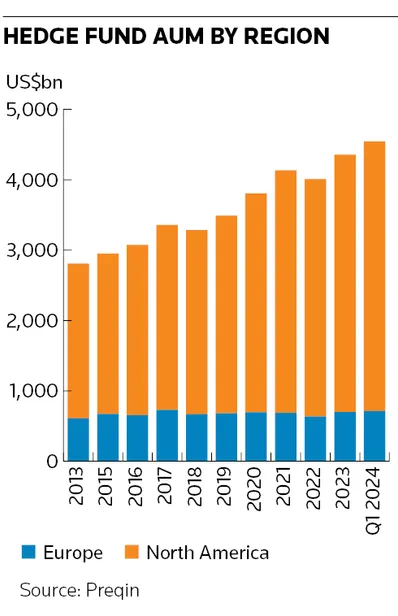

Hedge fund investors neglected Europe for much of the past decade, put off by anaemic economic growth, negative central bank interest rates and underwhelming returns. While US hedge fund assets under management have swelled nearly 75% since 2014 to US$3.8trn at the end of the first quarter, Europe has managed an increase of just 17% to US$714bn, according to data provider Preqin.

There are signs that Europe is starting to cast off its sleepy image in hedge fund circles, however, as a flurry of launches shows more investors are willing to put money to work in the region.

The most prominent debut has been Taula Capital Management, a macro fund established by a former Millennium Management trader, which reportedly launched with US$5bn in assets including significant backing from the US investment giant. That follows long-short equity specialist Katamaran Capital, started by another former Millennium employee earlier this year, and 2023's launch of equity fund Ilex Capital Partners, run by Citadel alumni. All three funds are based in London.

"We’ve seen more fund launches in Europe over the last 12 months than we’ve seen in a number of years,” said Marlin Naidoo, global head of capital introduction at BNP Paribas. “Global managers are looking more at Europe and increasing their European exposures. We’ve also seen more investor foot traffic into London and the continent to meet managers.”

As well as an increase in US investors travelling through Europe, Smith pointed to a "velocity of capital" coming from the Middle East looking for external investment opportunities "that we’ve not seen in a long time".

Improving returns

Improving performance has helped attract more of this money. Long-short equity funds in Europe returned 11% on average in the 12 months to the end of the first quarter, according to Preqin. That still lags US long-short funds but marks a vast improvement from the 4.6% of annualised returns over the past 10 years. Average returns at European fixed-income and credit funds have been more impressive still on a relative basis as they have outstripped their US peers of late.

Naidoo pointed to increased appetite from investors for European credit strategies, while Andrew Sterry, head of UK prime services at financial brokerage StoneX, said the backdrop of higher interest rates is stoking interest in European fixed income more broadly.

There is strong evidence to suggest that the higher interest rate environment is suiting equity hedge funds as well. A recent report from Morgan Stanley Wealth Management highlighted a notable divergence in performance both within and across asset classes in the current interest rate regime – a sign that company-specific developments are driving prices more than macro factors.

That backdrop is benefiting stock pickers. Average annualised equity hedge fund returns come close to 20% when interest rates are greater than 4%, Morgan Stanley said, compared with returns of just above 5% when rates are below 2%.

European stock markets, meanwhile, continue to look cheap on a relative basis after a sustained period of strong returns in the US, with the S&P 500 trading at a price-to-earnings ratio nearly twice that of the Stoxx Europe 600.

"US stock markets have been saturated for a while, and Europe offers more diverse markets," said Sterry. "You're starting to see some of the post-pandemic recovery come through and undervalued stocks starting to realise their growth."