Rate uncertainty pushes derivatives volumes to record

Investors betting on the trajectory of central bank rate policies have sent volumes in interest rate derivatives to record highs in the first half of the year.

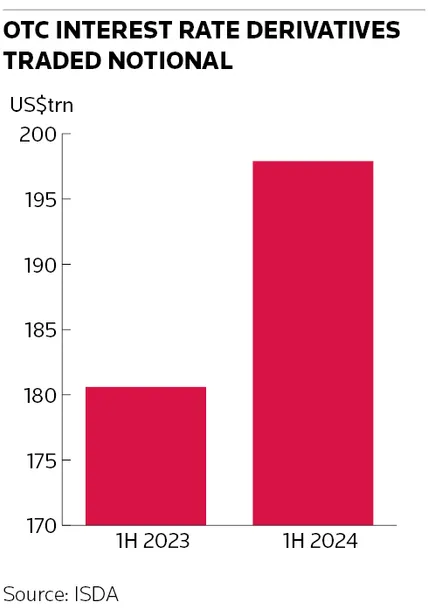

An unprecedented US$198trn of interest rate derivatives contracts changed hands in the first six months of 2024, according to trade repository data collated by the International Swaps and Derivatives Association, a nearly 10% increase from the previous record set in the same period last year.

The surge in volume shows how uncertainty over when central banks will loosen monetary policy has triggered a flurry of client activity for bank trading desks, as investors and large corporates scramble to manage their exposure to interest rates.

"Given increased rates volatility and continued uncertainty, there has been a higher degree of rates hedging among corporate and CFO clients," said a senior rates trader at a major bank.

The trader also highlighted heightened activity among macro hedge funds earlier in 2024 when many investment managers made losing bets on when the US Federal Reserve would start cutting interest rates.

"Macro hedge funds underperformed because they were positioned for rate cuts. Covering that risk ultimately necessitates short-dated rates hedging," the trader said.

Overnight index swaps – short-dated derivatives that are typically used to bet on the direction of interest rates – continued to make up the bulk of overall interest rate derivatives volume, rising 15% to US$124trn in the first half.

However, the biggest trading increase in percentage terms came from fixed-to-floating interest rate swaps, a longer-dated derivative that is popular with corporate treasurers and financial institutions. Volume in these swaps rose more than 30% to US$37trn in the first half, the data show.

CDS volumes decline

Credit derivative markets, by contrast, have experienced a slowdown in activity amid a more benign backdrop for corporate debt markets. Overall traded notional declined by about US$25bn in the first half to US$6.05trn, according to ISDA.

Credit default swap indices – which account for the bulk of activity in these markets – saw volumes decline 3% to US$5.7trn. There was an even larger drop in single-name CDS trading, with volumes sinking 15% to US$349bn in the absence of major market events that had acted as a catalyst a year earlier. Single-name CDS volumes jumped in 2023 following the collapse of Silicon Valley Bank and UBS's emergency rescue of Credit Suisse in March.

“Last year, credit derivatives volumes grew because everyone was hedging around SVB and Credit Suisse," the senior trader said. "This year’s decline in credit derivatives volumes is because of that spike we saw last year.”

ICE Clear Europe last year also shuttered its central clearinghouse for credit default swaps, causing a mass migration of positions to ICE's US clearing unit as well as to LCH's European clearinghouse, CDSClear. This further fuelled elevated CDS volumes in the first half of 2023, leading to a comparable decline in volumes in the first half of this year, said Finbar Cooke, co-head of European credit trading at Barclays.

“Market volumes are significantly lower [but] our market share is higher [and] our business remains very relevant to clients,” he said.