Investors brace for French elections

Investors are bracing for the results of the first round of voting on Sunday in French parliamentary elections, with some betting on a potential rebound in beaten-down French stocks and bonds – and others predicting a further leg lower if extremist parties exceed expectations.

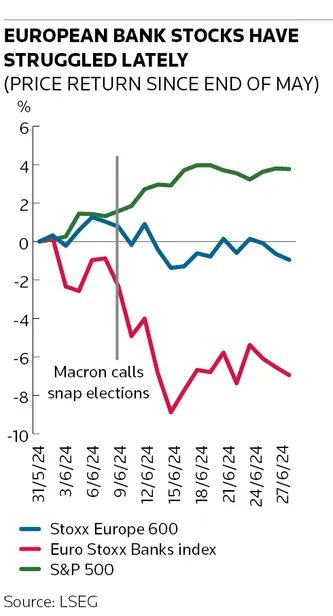

French president Emmanuel Macron’s surprise decision to call a snap vote has rocked the country’s financial markets over the past few weeks, sending bank stocks lower and pummelling government bonds. Opinion polls show parties on the far right and far left of French politics could make significant gains, raising concerns over the direction of the new government and whether it could sharply increase fiscal spending.

A scramble to hedge French exposures has already triggered a marked uptick in trading volumes in equities and bonds. Investors looking to protect their portfolios helped push notional traded volumes in Euro Stoxx 50 index options to their highest level since 2020 in the week ended June 21, according to Kieran Diamond, volatility strategist in UBS's investment bank. Average daily trading volumes in French government bonds have reached €22.4bn this quarter, according to market-wide data from trading platform MarketAxess, the highest level in at least four and a half years.

“There’s definitely been more client activity since June 9 [when Macron called the election],” said the head of equity derivatives at a major European bank. “We see clients taking positions on both sides. At first, positioning was clearly defensive. Things have been stabilising for the past 10 days and some clients are now taking positions on a potential rebound.”

Macron called the surprise vote immediately after Marine Le Pen’s far-right National Rally trounced his Renaissance party in European parliamentary elections earlier in June. Renaissance was the senior partner in a centrist coalition that formed a minority government in France’s National Assembly before it was dissolved ahead of the election.

Macron said France needed a clear majority when he called the snap elections. The first round in the two-round voting system takes place on Sunday, narrowing the field of candidates for each of the French parliament’s 577 seats that are up for grabs, before a final ballot on July 7.

Sell France

Investors sold government bonds following the election announcement, sending the spread between 10-year French yields and ultrasafe German Bunds up to 80bp on Friday, from about 50bp beforehand.

Strategists at Citigroup said French spreads could narrow to as low as 55bp in a “benign” scenario of another centrist coalition or a “constrained” right-wing government where fiscal policy doesn’t become a major flashpoint. A more extreme outcome – where right-wing or left-wing parties gain a majority and fiscal risks become more severe – could see spreads rise beyond 100bp to their widest levels since the early 1990s, outside of the euro crisis. Some investors are already taking a gloomy view.

“We think French government bonds will increasingly behave more like 'peripheral' rather than 'core' assets,” said Felix Feather, an economist at asset manager abrdn, meaning they are likely to trade with greater volatility and at persistently wider levels to Germany.

“This is a result of the strained fiscal position France found itself in even before a snap election was called, and the likelihood of a prolonged period of political instability and unpredictability following the upcoming vote.”

French stocks have also struggled since the vote was called. The Euro Stoxx Banks index, which many investors use as a trading proxy for France because of its heavy weighting of French banks, fell as much as 8% in the days after the announcement, before recovering somewhat. The broader Stoxx Europe 600 index is down nearly 2% since June 9, compared with a 2.5% increase for the S&P 500.

Diamond said implied volatility for European equities has risen sharply ahead of the vote, sending Europe’s equivalent of the VIX index to nearly 20 points from about 12 points in mid-May. That is “reflecting an expectation for some large moves over the next few weeks", he said.

More recently, Diamond said there has been some appetite among investors to position for a rebound, including on some laggard French bank stocks, but only through limited downside structures such as call spreads.

Some are concerned French equities could take a further dive following the election results. Equity strategists at Citigroup said stock valuations could decline as much as 20% from current levels in its "extreme" scenario of a majority right-wing or left-wing government.

"Equity markets may be overly optimistic about the election, as higher-probability outcomes imply some French equity market derating," the strategists said.