Sabana Industrial REIT has raised S$100m (US$74.1m) from a sustainability-linked bond backed by the Credit Guarantee and Investment Facility, but had to delay pricing and raise the yield after a minority shareholder disrupted the deal.

The issue marks the first Singapore dollar CGIF-guaranteed SLB, and is also Sabana REIT's first non-sukuk bond.

The five-year note priced on Tuesday at a yield of 4.15%, inside initial guidance of 4.2% on the previous Friday but above final guidance of 4% after activist shareholder Quarz Capital Asia raised objections to the bond issue.

While there are few comparables for a company like Sabana REIT, which owns a portfolio of 18 industrial buildings such as warehouses in Singapore, a banker familiar with the deal estimated the issuer would need to pay fair value of at least 6%, or even 7%, for a standalone deal. He said even at that level it would be tough to attract demand from fund managers and insurers.

"Given the company's turbulent history ... your bond investors want stability. Before (CGIF), I'm very sure no one would have bought it on a standalone basis," said the banker.

The bond is guaranteed by CGIF, which was established by the Asian Development Bank and the ASEAN countries plus China, Japan and South Korea, means it will be rated AA by S&P, in line with CGIF. Sabana REIT is not rated.

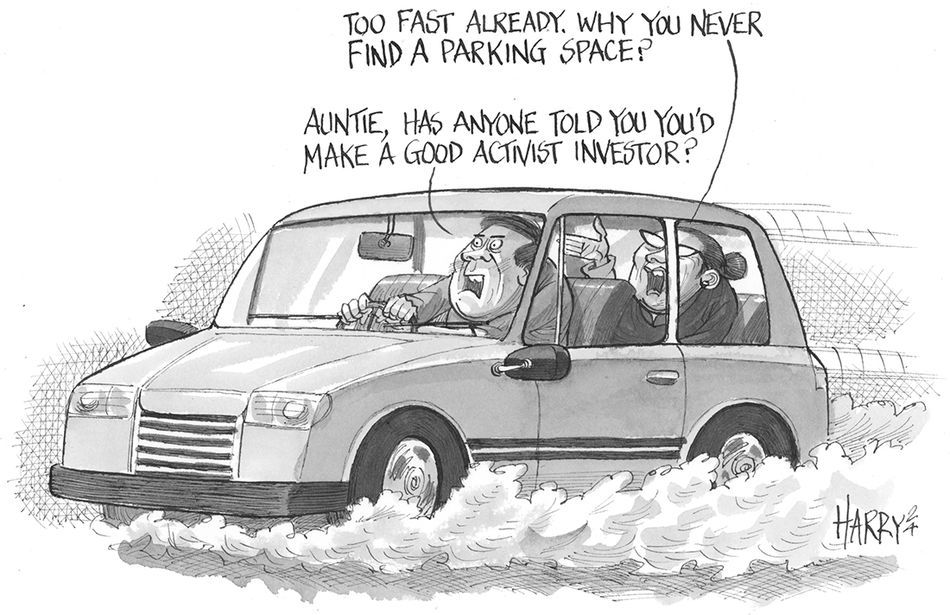

The deal hit a speed bump on June 14 – when it was due to price – when Quarz, an activist investor that held a 13.89% stake in the issuer as of March 8, sent a letter to the REIT's trustee, HSBC Institutional Trust Services, and the Monetary Authority of Singapore, alleging that the deal would "substantially complicate and impede the internalisation process to potentially entrench the current REIT manager and its sponsor from being removed".

Since last year, the REIT has been tied up in a process to internalise its management functions by incorporating a subsidiary, wholly owned by the trustee, and appointing it to act as Sabana REIT’s manager.

At Quarz's prompting, shareholders last August passed two resolutions – to remove Sabana Real Estate Investment Management as the REIT's manager, and to kickstart the internalisation process. Quarz claimed that internalisation of the manager would bring benefits to unitholders by providing cost savings once the external manager is removed. It estimated cost savings of around S$7.3m of fees and net profit which unitholders currently pay to the external manager. SREIM is an indirect wholly owned subsidiary of Cayman Islands-incorporated ESR Group, which held a 19.97% stake in Sabana REIT as of March 8.

Quarz later admitted that its cost saving estimates were wrong, and under the terms of a settlement with ESR removed various open letters, slides and commentaries about its rationale for internalisation.

The target budget set for the internalisation was S$3m–$5m, but the REIT had spent S$5.3m as of March 31. The process started in the third quarter of last year and is estimated to take at least 12 months to complete, with SREIM acting as interim manager in the meantime.

Quarz's June 14 letter criticised the proposed bond deal, saying that with the internalisation process still active, a potential new manager may lack control over the debt because of the proposed terms, and the removal of the manager could result in a forced pre-payment of the bonds.

The investor also claimed that it was "highly abnormal and extraordinary" to refinance now, when the company's next maturity is in October 2025.

In response, the REIT's manager issued two statements to assuage investor concerns, explaining that the bond issue had been in the works since June 2022, before shareholders had asked to internalise the management function.

The refinancing exercise was essential to the REIT's capital management planning, it argued, and delaying it on account of the internalisation exercise would not be in the REIT's interest, "especially in view of the attendant uncertainties and in the current high interest rate environment".

"As part of the manager’s capital management efforts, the bond issuance seeks to stabilise the cost of funding, diversify the sources of funding, and mitigate the refinancing risks for Sabana Industrial REIT," said the manager.

It also said that if the REIT's manager were to be replaced, the bonds would still continue to their scheduled maturity. In the event of a change of control of the REIT manager, in the worst case guarantor CGIF could ask for a higher guarantee fee or additional security. A change of control would only trigger an immediate repayment if no replacement manager was appointed, or if CGIF did not give its consent to the change of control within a specified review period.

"There is no reason to issue the bond now," said Havard Chi, head of research at Quarz, in an email to IFR, adding: "It is already clear that interest rates will come down going forward."

Alongside the bond issue, CIMB and HSBC are also providing a loan facility backed by a standby letter of credit in favour of the guarantor, so that if Sabana REIT were to default on the bond and CGIF had to make the principal payment to investors, the two banks would pay up to S$10m to CGIF.

Quarz criticised the SBLC arrangement too, claiming that it could cause "potential disruptions to the REIT's financing activities", incorrectly stating that a change of control of the REIT manager would trigger an immediate repayment of the facility.

The REIT manager said that the terms of the proposed bond deal were in the interests of the REIT and would not place further restrictions on the internalisation process.

"Unit holders are reminded that it should be expected that the new internal manager will need to engage with all financiers in respect of these restrictions and future financing terms," the manager said.

Final orders for the SLB were over S$200m, and the bonds were allocated entirely to investors in Asia. Fund managers and insurance players were allocated 89%, while private banks and securities houses took 11%.

The Reg S notes were issued by trustee HSBC Institutional Trust Services.

"We had a look at the (REIT's) credit and we found that the assets were performing well and from that point of view, we felt it is a good enough credit for us to support," said Anuj Awasthi, vice president of operations at CGIF.

CGIF aims to support first-time issuers and thematic bonds, like Sabana REIT's maiden SLB, as part of its remit to develop Asia's local bond markets, and discussions between the two began in late 2022.

"Sabana REIT has developed targets which are consistent with its ESG/sustainability targets and its sustainability-linked financing framework," said Awasthi.

Sabana REIT has set a sustainability performance target of achieving at least a 24% reduction in Scope 2 greenhouse gas emissions by the end of 2027, compared with a 2023 baseline. If it misses the target, the interest rate on the bonds will increase by 30bp per annum from June 26 2028.

Donald Han, CEO of the REIT's manager, said in a statement that the REIT will continue to implement solar panel installations across selected portfolio assets and highlighted that most of its multi-tenanted properties will be powered by renewable energy by the fourth quarter of this year.

The REIT aims to become one of Singapore's first carbon-neutral industrial REITs by 2040, and Han said it remains "well on track" to do so. It has a target to convert all financing facilities into sustainability-linked or green loans by 2025.

Proceeds will be used for capital expenditure, including acquiring new properties and/or asset enhancement initiatives for existing properties owned by the group, and to refinance existing term loans, including loans from the leads.

CIMB Bank (Singapore branch) was the sole global coordinator. It was also joint lead manager, bookrunner and sustainability-linked framework adviser with HSBC.

On a pro forma basis, Sabana REIT’s weighted average tenor of borrowings will lengthen to 3.5 years as at March 31 post-bond issue compared to 2.7 years beforehand. The hedge ratio will rise to 80.1% from 51.8%. The REIT has no refinancing requirements until 2026.

Sabana REIT's last deal came in 2014, when it sold a S$100m 4.25% 4.5-year sukuk offering at par. Back then it was called Sabana Shari'ah Compliant Industrial REIT with a remit to follow sharia investment principles, but in 2021 it dropped the requirement and changed its name.

Sabana REIT pointed to its press release and declined to comment further.