Aramco kicks off up to US$13bn follow-on

Books open on Sunday for Saudi Aramco’s long-awaited secondary follow-on that could raise as much as SR49.3bn (US$13.1bn) for the Saudi state.

Rumours of the deal have circulated for some time, including outlandish predictions in 2022 of a US$50bn deal, but anticipation has more recently built around a launch in one of the few windows available between Eid al-Fitr in early April and Eid al-Adha that begins on June 16.

Heavy anticipation has resulted in a huge volume of reverse enquiries, according to bankers involved, with that interest solidified by a wall-crossing exercise involving local, regional and international investors that means the deal is comfortably covered at launch.

The base deal comprises just over 1.5bn shares, representing a 0.64% stake in the company, offered at a SR26.70–SR29 (the close on Thursday) for an up to 7.9% discount.

The range gives a base deal of SR41.3bn–SR44.8bn, though a 10% greenshoe could extend that by SR4.1bn–SR4.5bn. Greenshoes are occasionally used in Saudi Arabia and the inclusion is a function of the deal's size.

Even the bottom end of the range would raise US$11bn, dwarfing the country's total ECM issuance last year of US$4.6bn and coming close to 2022's boom of US$12.5bn.

A banker in the region not involved in the deal said it was already causing some dislocation of the market, with a number of listed peers trading down and anecdotal stories of orders being pulled on live deals in the market as investors reposition themselves.

Despite being one of the largest companies in the world with a US$1.9trn market capitalisation, Aramco is relatively illiquid due to a tiny free-float, with an average daily traded volume of just 12.2m shares putting the offer at more than 122 days’ trading.

The majority of the company is owned by the Saudi state, which will see its stake fall to 81.56%.

Of the shares offered, Aramco intends to purchase SR3.75bn for its share plan for executives and employees.

Internationals welcome

The deal is the first major follow-on in the country since Saudi Telecom in December 2021, which saw SR12bn of stock sold following an upsize.

Shares priced at the bottom of the range, however, and traded down throughout the following year with some bankers in the region saying the deal did not go down well in a market with few reference points for secondary offers.

A more positive parallel is perhaps the recent accelerated offer in ADX-listed Adnoc Drilling, which proved a popular chance for international accounts to enter the register, having been severely scaled back at IPO.

“The Adnoc trade showed you can do secondary and is a decent data point,” said a banker on the Aramco deal, adding that they expect more meaningful international demand than on Aramco’s listing.

Infamously, the international tranche of Aramco's US$29.4bn IPO in 2019 was cancelled due to price sensitivity and lack of demand, leaving the many international banks involved essentially as spectators.

"It’s partly the aim [of the issuer] and a function of how the local market has developed," the banker involved said. "There were not a lot of local offerings and it’s now far more developed than when Aramco came to market."

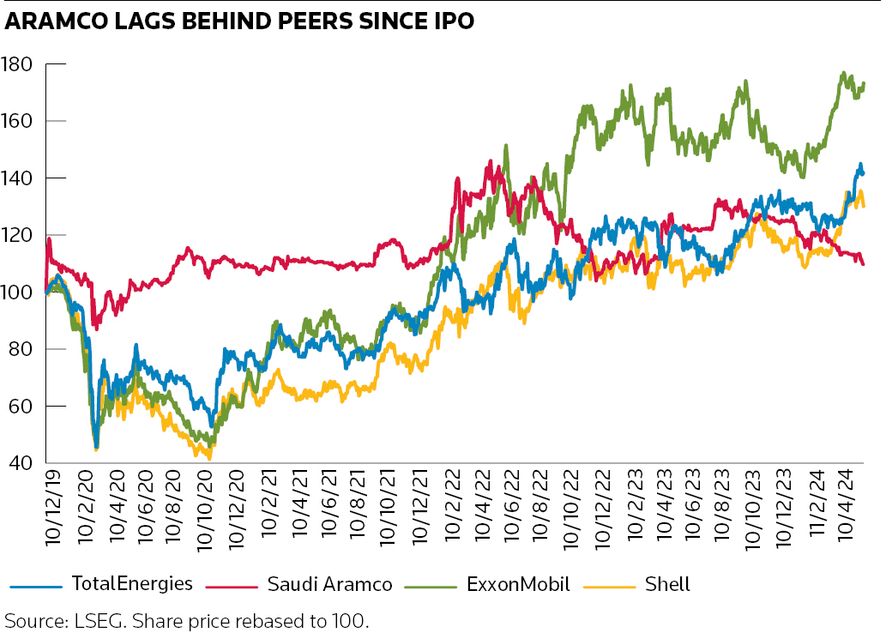

Aramco’s sale comes with shares flat to the close on debut and down more than 12% this year. That translates into a dividend yield of 6.5%.

Bookbuilding closes on Thursday with management travelling for roadshow meetings within the region, in London and New York.

A 10% retail tranche opens for subscription from Monday to Wednesday.

Retail squeeze

Saudi has seen a recent flurry of IPO activity, meaning some retail money is still tied up in those many times subscribed trades awaiting refunds.

While retail investors on Miahona and Fakeeh Care Group should receive refunds in time for the close of subscription on Aramco, refunds for Rasan and Saudi Manpower Solutions are not expected until after Aramco closes, meaning investors in these deals may struggle to participate.

Pricing on Aramco is expected on June 7.

SNB Capital is lead manager, and joint global coordinator with Bank of America, Citigroup, Goldman Sachs, HSBC, JP Morgan and Morgan Stanley. BofA is also stabilisation agent.

Al Rajhi Capital, Riyad Capital and Saudi Fransi Capital are joint bookrunners.