Regional shift and rising automation shake up banks' structured products desks

A seismic shift is under way in equity structured product markets as a major geographical realignment and shrinking profit margins are shaking up one of the most important businesses underpinning banks' stock trading divisions.

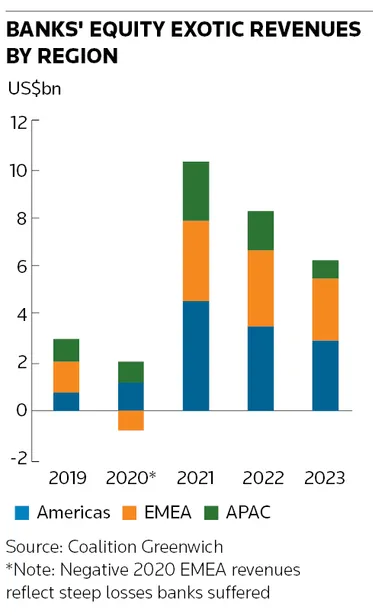

Data provider Coalition Greenwich said the Americas accounted for nearly half the revenues banks generated globally in 2023 in equity structured products, up from about a quarter in 2019, in the latest sign of how the centre of gravity in these markets has moved closer towards the US. That contrasts with a steep decline in the once-vast Asian markets where intense regulatory scrutiny has stifled activity in countries like South Korea and Japan.

This switch in regional power – in terms of buyer base and assets underlying transactions – comes as equity structured products desks are facing pressures that are eroding profitability, including increased competition among banks and rising automation.

A boom this year in US structured product markets illustrates how these forces are coming together. Banks sold US$42bn of US structured notes in the first quarter, according to data provider SRP, a 53% rise from a year earlier. But banks haven’t seen a corresponding rise in earnings, with Coalition Greenwich projecting a roughly 10% revenue increase for banks in structured products globally over the same period.

“The equity structured products landscape has changed massively. Before, it was more driven out of Europe and Asia. Now, much of that activity has shifted and America is in the driving seat,” said Youssef Intabli, head of equities and wealth management at Coalition Greenwich. “The margins in the business are also compressing as more banks invest in this space and automation increases. Issuance volumes are high, but we’re not seeing the same rise in bank revenues.”

Cornerstone

Structured products have long formed a cornerstone of banks’ equities trading divisions. In a typical transaction, banks sell notes to investors that return them their money along with a chunky interest payment provided an equity index reaches a certain level in a year’s time. This saddles the banks with exotic risks that can pose serious problems if markets plunge – as they did in 2020 at the outbreak of the pandemic, leaving several firms nursing heavy losses.

In more benign markets, issuing structured products provides banks with a handy way to fund themselves while also generating bumper profits for trading desks. Banks made a record of more than US$10bn in equity exotics revenues in 2021, according to Coalition Greenwich, as the combination of low bond yields and rising stock markets encouraged retail investors to buy structured products in unprecedented quantities. Revenues declined to about US$6bn last year as higher bond yields drew money away from equity-linked products, although that was still roughly double the amount banks made in 2019.

Under the surface, however, the market has changed dramatically as the extraordinary performance of US stocks has turbocharged volumes in this once sleepier corner of the market – and drawn interest from investors across the globe. Activity in Asia, by contrast, has cratered amid regulatory crackdowns in Japan and South Korea that has crushed demand in two of the region’s biggest markets.

"There has been huge growth in the US business, with products like autocallables becoming more popular, and a big drop in the Asian business because of some structural headwinds in Korea and Japan,” said Julien Lascar, global head of equity derivatives sales at BNP Paribas.

“More trades than ever are linked to the US market, not just in terms of the number of issuances but also because of the extremely strong performance of the assets. Asian and European investors are looking at these markets and saying, 'how can I not participate?'.”

Automate to innovate

Several banks have been investing to expand their reach in structured products. Bank of America has climbed the league tables in US structured products after more than doubling its sales in the first quarter from a year earlier to US$4.3bn, according to SRP, while Goldman Sachs has also increased its market share.

Morgan Stanley has been devoting more resources to its equity structured products business in recent years, building the systems and infrastructure to process large volumes of much smaller tickets.

“We were sub-scale in some parts of derivatives and that’s been a big investment for us over the last few years,” said Alan Thomas, global co-head of institutional equities at Morgan Stanley. “Our risk management capabilities have always been world class. But we needed to build the technology and operations so that we could distribute lots of small tickets in large volumes.”

Some bankers admit privately that those competitive pressures are denting margins in what has historically been one of banks’ more lucrative trading businesses. A technological arms race is helping banks price trades automatically in ever smaller sizes and individual tickets that banks sell to third-party distributors (which these distributors often then divvy up further to end-clients) has dipped below US$100,000 from several times that amount a few years ago.

Bankers are quick to point out that this allows them to print more volume but these innovations have also made the business more commoditised. The result is bite-size transactions that are not covering as much of the high infrastructure costs of running this business as before, some bankers say.

“Automation has been a blessing and a curse," said a senior equity salesperson at a major bank. "It has benefited us because we were early movers but it has also added to the revenue squeeze because you're paying far more in costs than you were in the past."

Margin squeeze

There are other factors weighing on profitability – some of which should fade in time. Analysts say the structured products business has been more heavily weighted towards institutional clients recently, where margins are thinner than the kind of retail-driven activity that helped drive record revenues in 2021.

Higher bond yields also means clients will settle for simpler and cheaper products to hit their return targets. The prevailing low level of stock market volatility, meanwhile, has mechanically encouraged banks to sharpen their prices. Even so, many believe there is only so low banks will go because of the risks the business involves.

“Structured notes are relatively complex derivatives transactions to hedge, which is why some banks have lost money over the years. That means there is a minimum amount of margin banks need to keep to risk-manage the product over its lifetime,” said Guillaume Flamarion, head of structuring for the Americas at Citigroup.

“We believe banks will be very careful not to go too low in margin in order to account for the cost of dynamically risk-managing the positions.”

Others strike a positive tone when discussing the broader outlook for the business. The first-quarter sales boom may have mainly been down to rising stock markets triggering a wave of redemptions in autocallable products, which in turn prompted a surge in new issuance. Still, Lascar said BNPP issued 20% more equity autocallables than were redeemed in the first quarter.

Traders are particularly enthusiastic about the growth of the US business. The stocks underlying these products are the most widely traded in the world, making it easier for banks to hedge risks. Further afield, many are confident that structured product demand in Japan and Korea will rebound in the next 18 months once these markets have worked through their regulatory growing pains.

“I don’t think there is a massive contraction in revenues in the business,” said Lascar, noting that automation leads to more turnover and issuance. “There are new entrants, but there are also a lot of barriers to entry in this business. The markets keep growing so I’m not worried.”