South Korean household name LG Electronics made its return to the US dollar market on Thursday to print a US$800m dual-tranche deal that was enthusiastically supported by global investors, allowing it to price at a tighter spread than expected.

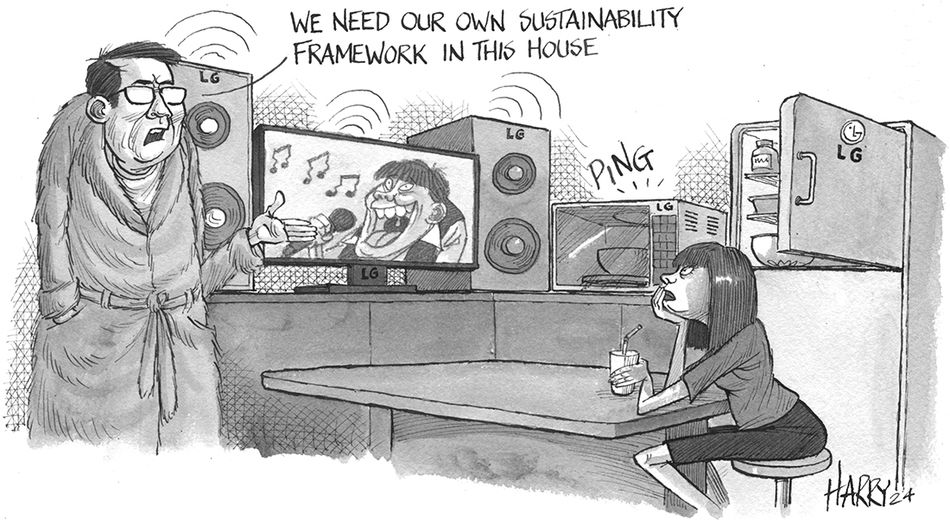

The transaction, made up of a US$500m 5.625% three-year and a US$300m 5.625% five-year sustainability bond, was some time in the making. The borrower first visited global investors on a non-deal roadshow in late February as it had not sold a US dollar bond in more than a decade, meaning the deal was largely treated like a debut.

“One of the reasons they came to the market, besides funding needs … is they want to diversify their funding channels,” said a banker on the deal. “[Then], their goal was … to achieve a competitive pricing, but then also try to really diversify in terms of their investor outreach, both geographically and in terms of different types of investors.”

LG Electronics has around W4.3trn (US$3.1bn) of domestic bonds outstanding, according to LSEG data.

The borrower is also setting itself up to be a more regular issuer offshore. "They are telling us they would like to be more frequent ... maybe once a year going forward," said a second banker.

Having chosen a 144A/Reg S trade, the company looked to the US for support.

“LG itself is a very well known household name in the US,” said the first banker. “During the roadshow we targeted them because we knew they would be interested.”

US investors may find that some South Korean credits trade too tight, and similar borrowers from the country will rely on Asian investors, the first banker said. But LG Electronics attracted US investors who saw the name as a comparable to US appliance maker Whirlpool, which is rated Baa2/BBB/BBB, in line with LG Electronics' Baa2/BBB (Moody's/S&P) ratings.

US investors ended up taking 28% of the three-year notes and 23% of the five-year bonds, but the first banker said the true figures were larger as some US investors participated through their Asia funds. Asia took up 47% and EMEA 25% of the three-year, and Asia 44% and EMEA 33% for the five-year.

US participants mainly focused on the Whirlpool comparable, while Asian investors, and the syndicate, had comparable South Korean names in mind, and in particular other LG credits. As an example, LG Energy Solution, Baa1/BBB+ (Moody's/S&P), sold debut US$400m 5.625% three-year notes and a US$600m 5.75% five-year last year. The bonds were trading at spreads of 99bp and 109bp on Wednesday, according to LSEG data.

"We always knew this is one name that would fly," said the second banker. Indications of interest were strong, at double the deal size, he said.

Finding a price

LG Electronics initially planned to sell its bonds a week earlier, on April 11. But the publication of hotter than expected US consumer price index data overnight shook the market and revived fears that interest rates will stay higher for longer. The South Korean company decided to wait, but on Monday the market was further unsettled by heightened tensions in the Middle East. LG Electronics watched two other South Korean borrowers visit the US dollar market, each paying slight new issue premiums to comfort investors, before it felt confident enough to come out on Thursday.

Some investors had changed their indications of interest to look for an additional 5bp–10bp as the market had changed so much in the prior week, said the second banker. But the issuer was optimistic it could push through that, and hoped for a landing point of 100bp for the three-year tranche, and about 15bp wider for the five-year.

The syndicate cautioned that some premium would likely be needed. "We were thinking on the three-year landing in the context of 105bp, and 120bp on the five year," said the second banker.

But the bookbuild was overwhelming, reaching a combined US$9.3bn at final guidance. The five-year bonds, which carry a sustainability label, were a bit more popular, although the second banker said that was not tied to the label as only three or four ESG funds participated for small amounts.

While LG Electronics had approval to raise US$1bn, and there was speculation that it would hit the maximum amount, it settled for US$800m as that was all it needed, the bankers said.

The US$500m three-year priced at 99.6 to yield 5.772%, and the US$300m five-year at 99.327 to yield 5.782%, or spreads of 95bp and 110bp, inside of estimates. Initial price guidance had been 135bp area and 150bp area.

CreditSights analysts wrote in a pre-pricing note that the deal was attractive down to plus 115bp and plus 135bp. The analysts noted some concern around the company's underperforming subsidiary LG Display, which bankers said investors also discussed during the roadshow.

Analysts at Nomura used sister company LG Chem, a producer of petrochemicals, as a comparable to find fair value for the new deal at around 95bp–100bp and 100bp–115bp, but they noted the new bonds could trade tighter given the strong market for South Korean issuers.

The order book for the three-year reached US$3.2bn, including US$110m from the bookrunners, across 150 accounts at reoffer. Fund and asset managers received 66%, insurers, pension funds and official institutions 15%, bank treasuries 14%, and private banks, corporates and others 5%.

The five-year book stood at US$4bn, including US$170m from the bookrunners, across 170 accounts. Fund and asset managers bought 73%, bank treasuries 16%, insurers and pension funds 8%, and private banks, corporates and others 3%.

The senior unsecured Singapore-listed notes will be rated in line with the issuer. The proceeds from the three-year notes will be used for general operations, including refinancing maturing debt, and the proceeds from the five-year will be used to finance or refinance green and social projects.

BNP Paribas, Citigroup, HSBC, JP Morgan, KDB and Standard Chartered were the joint bookrunners.