Deutsche Bank’s next big trading push: the Americas

Deutsche Bank is ploughing resources into its fixed-income trading operations across the Americas, marking a dramatic reversal of the sweeping cuts it made to those businesses several years ago.

US agency mortgages, interest rate swaps, commercial paper and Latin America are among the areas where Deutsche is beefing up its presence as it looks to grow its trading revenues in the coming years.

The investments are the clearest sign yet of Deutsche’s renewed ambitions in sales and trading following a remarkable turnaround in fortunes for a set of activities that was slashed back after Christian Sewing took over as chief executive in 2018.

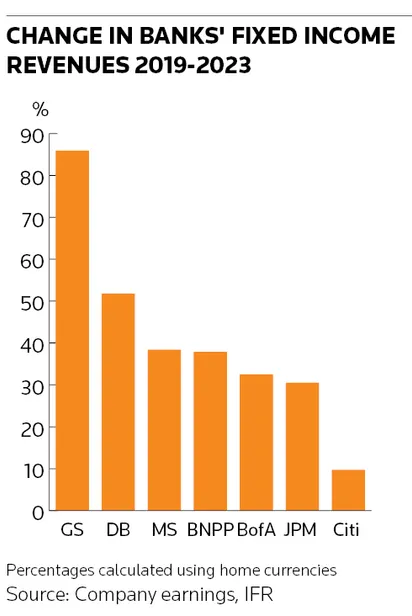

Deutsche made about €8bn in fixed-income and currencies revenues in 2023, a 52% rise from four years earlier, making it one of the fastest-growing banks during that period. Its latest strategy for growth involves nearly a dozen “bitesize” initiatives that investment bank-co head Ram Nayak believes should combine to provide a material revenue boost, with over half coming from the Americas.

“Our journey from 2019 onwards has really been about fixing parts of the business that had been somewhat neglected in the past. We now have a strong, diverse core portfolio of high-performing businesses that have shown their ability to deliver through a range of market conditions,” Nayak told IFR.

“Now, we’ve identified a bunch of initiatives that we think will take us to the next level. Most of those happen to have the biggest bang for your buck in the Americas, partly because we’re already so strong in Europe and Asia,” he said.

Deutsche’s Americas push represents the latest leg in what has been a methodical reconstruction of the bank’s “flow” trading capabilities over the past several years. Sewing had made stripping back the markets division a cornerstone of his turnaround strategy in 2019 following a sustained period of lacklustre returns.

Pulling the plug on equities trading was the most eye-catching move back then. But a series of brutal cuts also landed on flow fixed income, with the bank opting to shift its focus to its more profitable currency trading and structured credit operations. The US rates business was another high-profile casualty.

Taken as a whole, the broad-based retreat capped an extraordinary fall from grace for an investment bank that had ranked behind only JP Morgan in terms of heft in 2011, according to analytics provider Coalition Greenwich, on the back of what Deutsche once dubbed its “flow monster” fixed-income business.

Flow rebuild

Deutsche’s trading division has steadily regained its footing since then. A choppier market environment has provided a useful tailwind, juicing the profitability of flow activities like trading products linked to interest rates. But Deutsche's market share gains in fixed income also come in the wake of Nayak’s rigorous overhaul of the division, including a sharp reduction in front-office headcount in 2019 and 2020 and a revamp of creaking technology systems.

After reinforcing its traditional stronghold of European rates and emerging markets trading, Deutsche has been plugging other gaps in its armoury such as flow credit in Europe and Asia (See box story). The progress the bank has made has given senior management the confidence to endorse an ambitious expansion strategy across the Americas.

“It was exactly right to focus on … where we are strong from a regional point of view, starting with Europe then obviously going into our emerging markets franchise,” Sewing said on an October earnings call. “Ram has a clear plan how to grow also our FIC business in the US over the next 12 to 18 months and he put the right investments into that.”

Nayak outlined three pillars underpinning the next phase of Deutsche’s fixed-income strategy: building businesses where the bank believes it has a natural edge or “adjacency”; strengthening areas where it sees room to grow; and intensifying its client sales coverage.

Trading agency mortgages are one example of a so-called adjacency given these securities have almost identical investor bases and underlying risks as US Treasuries. Similarly, adding base metals isn’t much of a leap when Deutsche already trades precious metals, meaning they can share the same technology and risk systems. Bolstering its presence in emerging market FX options is another natural move given the bank’s strength trading other EM products and developed market options.

“In each [adjacency], we have three parts of the puzzle already in place and this is just the last piece that we need,” Nayak said. “That means it’s cheap [to implement] and it’s somewhere where we already have an advantage.”

LatAm expansion

The Latin America push falls into the same category. LatAm was an important market for Deutsche before John Cryan shut the business down during his time as CEO between 2015 and 2018.

The bank has been rebuilding its presence lately and last year hired a team of bankers with cross-product expertise from Credit Suisse, where Nayak used to head EM trading. Having re-entered Brazil in 2021, Deutsche is now growing in Mexico too – again two markets with overlapping investor bases.

“I can see our edge in Latin America. We have always had a strong financing business, and that has been the backbone of our rebuild so far. The focus now is on the flow business,” said Nayak.

Targeting existing businesses where Deutsche believes it has room to grow should provide a further lift. Deutsche has roughly doubled its US rates trading revenues since 2019. The bank now sees opportunities to expand in the vast market for US interest rate swaps on the back of Deutsche’s credit rating upgrades, which make it a more appealing counterparty for some clients.

Finally, a measured expansion of the bank’s global sales force – which analysts say is smaller than most of its competitors – aims to drum up more business with clients with whom Deutsche is under-represented.

“We have very strong client franchises in Europe and Asia built on outstanding product expertise across a wide range of products. We see an opportunity to leverage our product capabilities to increase our business with clients in the Americas,” Nayak said, noting that many institutions in the region don’t want all their top counterparties to come from the US.

Trading limits

Deutsche already runs a comparatively lean operation, giving it some leeway on staffing at a time when rivals have been cutting. The German bank had the third best revenue to front-office employee ratio in fixed-income trading among major investment banks in the first half of 2023, according to analytics firm Tricumen, behind only Goldman Sachs and JP Morgan.

Nayak said he has given his teams the target of being better than at least one of the big five US banks in each of their core businesses. Still, there are limits to Deutsche’s ambitions. Nayak is clear that there are no plans for the bank to switch equities trading back on. Similarly, there’s no appetite to move back to a “full product suite commodities business”, which the firm largely shuttered a decade ago.

Even US flow credit trading looks to be more of a challenge given the dominant position US banks hold in their home market, although Deutsche already has a long-established financing business in the region.

Still, looking from a higher level, Nayak presents the picture of a fixed-income business that is growing stronger over time. “The trajectory in revenues is there, the momentum is there, and we know what we want to do,” he said.

Deutsche makes headway in European credit trading

Deutsche Bank has reported a marked revenue uptick in European “flow” credit following an expansion effort that has materially increased its corporate bond trading volumes in the region.

Deutsche said “significantly” higher credit trading revenues in the second half of 2023 were in part a result of ongoing improvements in flow trading, where it buys and sells corporate debt and other related instruments on behalf of clients.

The bank has increased its high-yield bond trading volumes tenfold in recent months, according to sources familiar with the matter. Deutsche has also significantly improved its ranking on bond trading platform MarketAxess to the top three by volume across all euro and sterling investment-grade and high-yield credit as of the fourth quarter of 2023.

The improvements come in the wake of a revamp of the bank’s flow operations that has seen it hire more than 20 salespeople and traders over the past 18 months since the arrival of Jonathan Moore, Credit Suisse’s former co-head of credit trading, in September 2022.

“Deutsche Bank is committed to developing a top-ranked flow credit franchise,” said Moore, who now heads European flow credit sales and trading at Deutsche, in an interview with IFR.

“We’re executing against a multi-year strategic plan targeting consistently strong franchise rankings, volume share and revenues. We’re making investments in our human capital, our technology and our processes. The commitment and investments have already started to resonate with our clients and we’re on a good trajectory.”

Deutsche has long retained a strong presence in financing and trading the least liquid, and most complex, parts of credit markets and decided to shield these activities from sweeping cuts that executives levied on its markets division in 2019. Now, the bank has thrown resources behind reviving the more mainstream, and lower returning, business of flow credit – a notoriously competitive market in Europe where the bank had previously struggled to make money.

Deutsche has prioritised growing high-yield bond trading – a logical move, according to Moore, given the bank’s strength in underwriting leveraged finance deals and trading distressed credit.

“We have all the ingredients to be very good in high-yield,” said Moore. “It was a clear opportunity to invest in secondary trading and we’re already seeing good results.”

Some of the more recent hires have focused on credit derivatives, another area Deutsche is looking to grow after retrenching around a decade ago. “It’s important that we have a strong platform in flow credit,” said Moore. “It’s important for the longevity, the sustainability and the consistency of our revenues, and it fits with the broader franchise strengths in European fixed income.”