Toshiba LBO tests Japanese lev fin

The five banks leading a whopping ¥1.4trn (US$9.47bn) loan backing the leveraged buyout of Toshiba by private equity fund Japan Industrial Partners are casting their net as wide as possible to bring lenders into the largest such financing in Asia Pacific.

Close to a hundred prospective lenders are on the target list for Sumitomo Mitsui Banking Corp, Mizuho Bank, Sumitomo Mitsui Trust Bank, MUFG and Aozora Bank, which have provided the seven-year financing.

SMBC and Mizuho face a daunting task as the duo has committed ¥441.4bn and ¥394.3bn respectively, accounting for more than two-thirds of the financing’s term loan tranches – a ¥300bn amortising portion and a ¥900bn bullet piece. Sumitomo Mitsui Trust Bank, MUFG and Aozora Bank funded ¥188.6bn, ¥137.1bn and ¥38.6bn, respectively. The five leads are providing a ¥200bn commitment line on a pro rata basis.

Although the three tranches pay interest margins of over 300bp, 350bp and 300bp over Tibor, respectively – attractive compared to the wafer-thin returns on plain-vanilla financings in Japan – Toshiba’s chequered history casts a shadow for some lenders.

“We do not see any issues with the loan terms, but it is difficult to understand a complex company that is in the restructuring stage. The outlook for the memory business is also uncertain,” said a banker at a Japanese bank.

Toshiba's reputation was damaged by an accounting scandal in 2015 and the bankruptcy of subsidiary energy company Westinghouse in 2017. The company had been under pressure from activist shareholders and was forced to sell underperforming businesses.

“It would be difficult to join the deal if our internal rating marks Toshiba as a non investment-grade credit,” said a banker at an international bank.

Toshiba is rated B+ by S&P, which downgraded the company from BB− last December, and BBB− by R&I.

“We are being cautious towards LBOs at the moment, and we would like to carefully evaluate lending to the deal as we do not want to get hurt,” said another banker at a Japanese bank.

Domestic liquidity

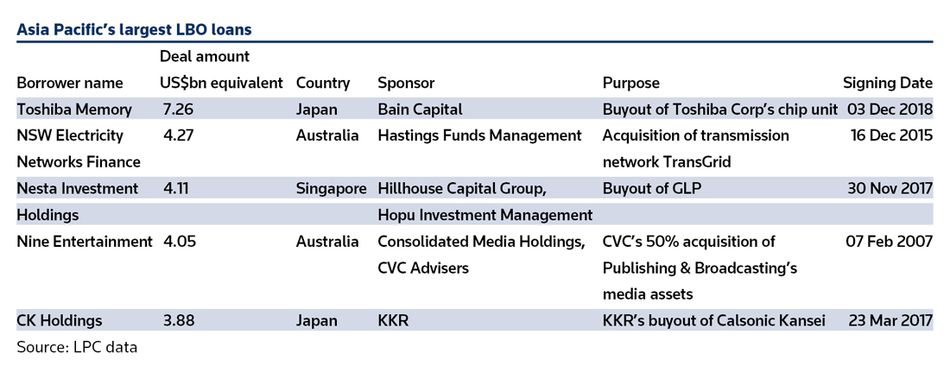

The gargantuan size of the financing – it easily eclipses Japan’s record annual LBO loan volume of US$7.52bn in 2018, according to LPC data – will require every ounce of domestic liquidity available.

As has been the practice in jumbo financings in Japan, top-tier domestic banks are expected to take large commitments, while the smaller Japanese regional banks can lend no more than US$100m-equivalent, or even US$50m.

“Even if all the small lenders join, not much can be expected. It depends on how much they can bring in lenders with big-ticket commitments,” said a banker at another Japanese bank.

For non-Japanese banks, the pricing might not be as attractive as other leveraged financings from other parts of Asia. Non-bank lenders – another source of liquidity that financial sponsors have tapped into for some LBOs and dividend recapitalisations in the region – are also not as active in Japan.

The experience of the previous largest LBO loan from Asia Pacific serves as a good guide. Mizuho and SMBC led a banking group that provided a ¥825bn loan in June 2018 for private equity firm Bain Capital's ¥2trn acquisition of Toshiba Memory, which has since changed its name to Kioxia Holdings. That loan was not syndicated widely, while a ¥1.028trn five-year takeout loan Kioxia completed in December 2019 with the three mega-banks Mizuho, MUFG and SMBC as underwriters also did not elicit a strong response because of the sluggish performance of the semiconductor industry.

In recent years, Japan’s leveraged finance market has also suffered setbacks that have soured sentiment among lenders.

A ¥430bn loan backing the LBO of automotive parts supplier Marelli Holdings by KKR completed in 2017 marked the second-largest as well as one of the most widely syndicated such borrowings in Japan. That loan ranks as the fifth-largest LBO financing in Asia Pacific. (See Table.) However, court-led rehabilitation proceedings in 2022 forced 26 domestic and international lenders with exposure to Marelli to take a haircut of ¥450bn on roughly ¥1.1trn of debt.

As a consequence of those developments, some market participants have explored ways to expand the investor base. For example, the Japanese Bankers Association established a study group last August to address issues of concentration risks and MUFG established the country’s first LBO loan fund in April last year.

Some factors that could play in Toshiba’s favour include the leverage levels of the borrowing and the relationship pull.

The margins will step down if the leverage decreases. The borrowing represents gearing of 6.2 times based on Ebitda of ¥226bn for the fiscal year ended March 2023 – in line with the trends in the Japanese leveraged finance market, although it is relatively higher compared to other LBO deals in the rest of Asia Pacific. The loan is said to also carry tight covenants.

Some 20 Japanese companies have invested equity alongside JIP in the LBO, including chipmaker Rohm, utility Chubu Electric Power and financial services firm Orix. Additionally, domestic financial institutions and corporates are providing ¥235.5bn in mezzanine debt and ¥200bn through preferred stock to back the LBO.

TBJH, a special purpose company owned by the JIP-led consortium, is investing ¥860bn from the funds raised from the above-mentioned investors.

Toshiba ended its 74-year history as a listed company in December after TBJH successfully closed a ¥2trn tender offer for the conglomerate last September.

Responses from prospective lenders to the ¥1.4trn loan are due at the end of February with a targeted closing at the end of the fiscal year in March.