Vedanta Resources has outlined a proposal to push out maturities on around US$3.15bn of offshore bonds, as S&P warned of rising risks of a payment default if the transaction is not approved.

The Indian metals-to-mining conglomerate on Wednesday announced it had agreed a new credit facility of US$1.25bn maturing in April 2026 with "reputable financial institutions", while simultaneously beginning a liability management exercise for its bonds maturing in 2024 and 2025. The company said this would create a "long-term sustainable capital structure".

Standard Chartered is the arranger of the loan, and Varde Partners, Cerberus, Davidson Kempner, Ares SSG and Farallon Capital are heard to be among the private credit funds involved. The loan is heard to have an interest rate of 18%, according to sources.

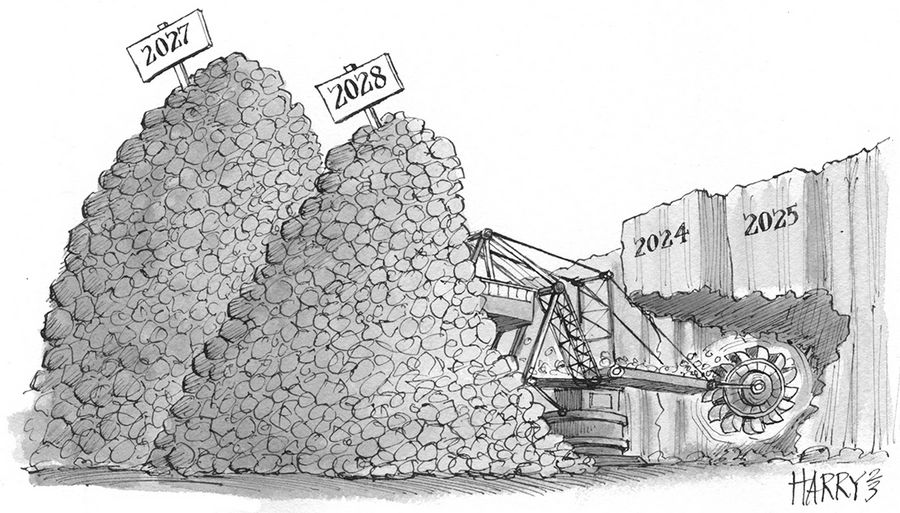

Vedanta Resources and its subsidiaries – Vedanta Resources Finance II, Twin Star Holdings and Welter Trading – have also begun a consent solicitation for US$1bn 13.875% bonds due January 21 2024, US$1bn 6.125% notes due August 9 2024, and US$1.2bn 8.95% notes due March 11 2025. It is proposing to extend the maturities, increase the coupons, improve the security package, seek waivers to allow the new credit facility, and allow the group to proceed with a demerger of Indian unit Vedanta Limited into six "pure play" companies.

The liability management exercise was necessary given the conglomerate has US$4.5bn of debt due through March 2025, according to S&P estimates. There was a "high likelihood of conventional default in the absence of the transaction" because of reduced access to cash at the subsidiary level, while external financing remains challenging, said Neel Gopalakrishnan, director of corporate ratings at S&P, in a webinar on December 15.

The company is proposing to repay 53% of the principal of the US$1bn 13.875% bond due January 21 2024, 6% of the principal of its US$1bn 6.125% notes due August 9 2024 and 16% of the principal of the US$1.2bn 8.95% notes due March 11 2025. The company will use US$779m in cash from the loan facility to make the upfront principal repayments at face value.

The outstanding US$470m January 2024 note will be extended to January 21 2027, US$894m of the August 2024 notes will be exchanged for the December 9 2028 notes and US$1.08bn of the March 2025s will be exchanged for the December 9 2028 notes. The new coupon for all the exchanged bonds will be 13.875%. The January 2027 bonds have a bullet maturity, while the two December 2028 bonds will amortise in three equal parts in August 2027, August 2028 and December 2028.

The August 2024 bonds do not carry a guarantee, but after the exchange will be guaranteed by Twin Star.

The US$600m 9.25% April 2026 bonds will be unchanged, but are also covered by the consent solicitation exercise. The holders have been asked to agree to the covenant changes.

The company will pay US$20 per US$1,000 in principal to holders of the 2024 and 2025 bonds and US$7.50 to holders of the 2026 bonds who agree to the proposals by the early-bird deadline of December 27. This drops to US$2.50 for all bonds if holders give consent after the early deadline but by the deadline of January 2. JP Morgan and Standard Chartered are consent solicitation agents.

Vedanta said that it had delevered its balance sheet by US$3.4bn between March 2022 and June 2023 through dividends from subsidiaries Hindustan Zinc and Vedanta Limited, and selling around a 6% stake in Vedanta Limited for US$700m, but that it also plans to sell more assets.

Extraordinary dividends from events like asset sales will be used solely to repay the new loan until US$750m has been paid off the facility. After that, half of extraordinary dividends will be used to repay the loan and half to repay the restructured bonds.

The private credit facility has a negative pledge of 13.26% shares held by VHML II (Mauritius) in Vedanta Limited and will also have access to the royalty payments Vedanta Limited makes to Vedanta Resources for use of its brand name and other services. The amended January 2024 and March 2025 bonds will be secured against the royalty payments once the credit facility has been repaid.

Following the announcement, S&P downgraded Vedanta Resources and the long-term issue ratings on its bonds due in January 2024, August 2024, and March 2025 to CC from CCC, saying that it considers the proposed liability management exercise to be a distressed exchange as the compensation to bondholders is not adequate to offset the lengthened maturities.

S&P said that the higher coupons of the new bonds, together with the consent fees, gave an internal rate of return of about 15%–16% for the three bonds, largely in line with other CCC credits.

Higher interest

"The higher coupon costs offered on the August 2024 and March 2025 bonds could lead to an additional US$133m interest outgo for the company; while it currently looks manageable, VRL certainly faces a higher interest cost burden in the long-term," said CreditSights' Lakshmanan R, head of South and South-East Asia corporates, and Jonathan Tan Jun Jie, analyst, South and South-East Asia corporates, in a note on December 14.

S&P is also concerned about the private credit facility having priority access to the royalty payments.

"While the group has securitised the brand fee payments to other lending facilities since late 2021, we believe the quantum of the brand fee and its proportion to the total cash flow available to Vedanta Resources to service debt will represent 40%–50% of the total cash flow at Vedanta Resources, excluding extraordinary dividends. This is up from less than 20% previously," S&P said.

S&P warned that it could lower the company's rating to selective default and its 2024 and 2025 bonds to D if the transaction is completed. It placed the CCC rating of the 2026 bond on credit watch with developing implications, and said the rating could move in either direction depending on the outcome of the transaction in the other bonds.

While the liability management exercise would make Vedanta Resources' debt maturities more manageable, as the weighted average maturity of its debt is estimated to increase to three years from 1.5 years, the estimated funding deficit will still be US$500m–$700m for the fiscal year ending March 2025, said Gopalakrishnan at S&P. Asset sales and dividends from subsidiary Hindustan Zinc will therefore be key to meeting large debt payments from FY25 onwards, he said.

Separately, in the rupee market, Vedanta Limited is planning to issue a second tranche of unlisted and unrated rupee bonds, according to market sources. A company committee is meeting on December 19 to consider a private placement of bonds, according to a release on December 14.

On September 27, Vedanta Ltd raised Rs25bn from 18-month unrated bonds at 12% which were heard to be directly placed with funds backed by Oaktree Capital.

Vedanta Resources reported a net loss of US$143m for the April to September period because of a lower operating profit, higher net interest costs and a one-time tax charge, according to its interim results announcement on December 14.