China-focused DCM bankers are excited about the possible return of central state-owned corporates to the offshore bond market, although they are careful to keep their expectations in check as nominal US dollar funding costs remain high.

Avic International Leasing was the only central SOE to print offshore this year. Low domestic interest rates, coupled with high US interest rates and lower capital expenditure needs due to slow economic growth in China, encouraged other SOEs to stay onshore.

That absence cost China-focused bankers dear. Unlike deals from local government financial vehicles, which tend to be clubbed, central SOE transactions are generally larger and properly marketed.

But hopes are rising for next year, with a handful of bankers saying they have one or two deals in the pipeline for January.

A DCM banker from an international bank said he heard that a central SOE was planning a US dollar deal at the end of last month, but decided to wait for better market conditions early next year.

A successful deal would reopen the market and more issuers may then follow, he said.

“The tone has definitely changed compared to three or four months ago. More companies are monitoring the market closer than six months ago,” said the banker.

Offshore refinancing needs are expected to drive a pick-up in activity. At least 18 central SOEs have US$17.6bn of bonds maturing or becoming callable next year.

China Petrochemical Corp, known as Sinopec Group, has a US$1.4bn note due in April and another US$1.5bn of bonds callable later next year. State Grid Corp of China’s offshore subsidiaries have US$1.85bn of bonds due next year. Other names including Sinochem Group, CNOOC and China National Aviation Corp all have sizable bonds maturing in 2024.

Most of the central SOEs have ample cash and used internal resources to pay off debt this year, but bankers are expecting them to sell bonds to refinance at least part of the maturities in order to maintain a healthy capital structure, although deal sizes will be smaller than the legacy bonds.

Shift in expectations

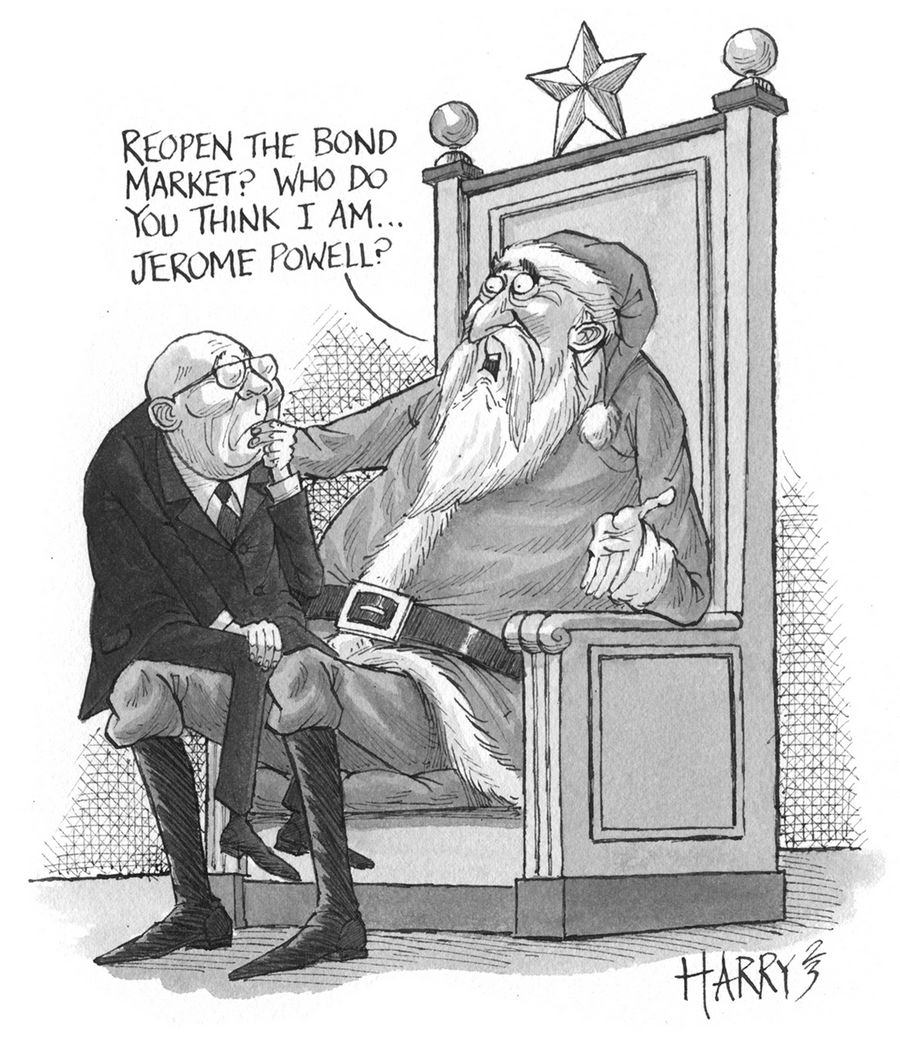

The cost differential between onshore and offshore funding is expected to narrow next year. At its final policy meeting of the year on Wednesday, the US Federal Reserve left rates unchanged and struck an unexpectedly dovish note, with its median dot plot projection for next year hinting at potentially 75bp of easing. The market now sees the first cut coming as early as March, with the yield on 10-year Treasuries falling to 4.03% on Wednesday from its peak of 4.98% this year. Meanwhile, the three-year onshore yield of China Development Bank, which domestic issuers use as a benchmark, has risen 20bp since July.

“The rates expectation has been shifted,” said a syndicate banker from a Chinese bank. “Some SOEs are thinking about coming out.”

Some believe that the government may tighten the restrictions on using onshore proceeds for offshore refinancing for fear that those transactions will put additional pressure on the depreciating renminbi. However, no direct order or window guidance has been given so far, IFR Asia understands.

While optimistic, bankers anticipate that deal volumes will fall short of previous levels.

A banker with two deals in the pipeline said that both are Dim Sum bonds of modest size. A second banker from a Chinese lender said his SOE clients are considering both US dollar and Dim Sum bonds, but that progress is slow and companies are only aiming for US$300m to US$500m prints.

“There are SOEs trying to understand the current situation of the offshore market. We got a lot of enquiries, but most of them do not have a concrete plan,” said a syndicate banker from a Chinese lender.

A DCM banker from a Chinese lender is not optimistic that the expected January deals will be followed by more supply as high absolute yields are still making companies hesitant.

“Although the US may cut rates next year, they are still expensive. I’m currently working with some local corporates and they still want to issue onshore for offshore refinancing,” he said.