Bank of the Year: Morgan Stanley

The king is dead, long live the king

Investment banking is not just about deals, deals and more deals. It’s about people. And nothing makes that clearer than when one of the most successful bankers of his generation leaves the top job. Mess up the resulting handover and things can go wrong very quickly. Morgan Stanley looks to have handled its succession process extremely well while remaining on top of its game. It is IFR’s Bank of the Year.

It’s not hard to identify precisely the most important moment for Morgan Stanley in 2023. It wasn’t one of the many sparkling deals, clever pieces of advice or intricate trades. It was the exact moment on October 25 when Ted Pick was appointed CEO, taking over from James Gorman.

What to outsiders might seem a functional, even prosaic, process – old bloke leaves the job, someone else takes over – was for watchers of Wall Street banks, with their history of internecine succession struggles, an almost miraculous event. The inspirational figure who had returned Morgan Stanley to the top echelon of global investment banking was now passing on the role.

But it wasn’t a miracle. It was the culmination of a two-year process involving the whole Morgan Stanley board (led by lead independent director Tom Glocer) and a set of outside advisers – but with Gorman as the fundamental driving force.

Indeed, the key decision came from Gorman himself. “The most important thing is that the incumbent CEO has to decide they want to leave, which I did. I gave it everything for 14 years. So it was a long run. I loved it. I loved it all. But I didn't want to be CEO anymore. And that decision gets everybody's attention. I think if you've decided to go it makes it much easier to embrace the process and celebrate the success of the individuals behind you,” Gorman said.

Is it overstating the case to say that it was not only one of the most important decisions of 2023, but of the past decade? Not according to Gorman.

“It’s crucial because you’re setting up the leadership team for the next many years, and if not handled thoughtfully and intentionally, obviously it can lead to some pretty bad outcomes that are not only distracting but might take the company down the wrong path.

“Other companies have gone through this and it’s not worked out well. But I was determined that we would do everything we could to make it work.”

And you don’t need to take Gorman’s word for it. His predecessor, John Mack, whose own ascent to the top was marred by squabbling but who handed on the baton smoothly to Gorman, wrote in his memoirs, published in 2022, that: “Choosing a successor is a lot like drawing up a last will and testament. It is an existential acknowledgment that you will not always be present. Selecting the person to replace you is one of the most monumental decisions a leader can make. If you choose poorly, your legacy will be tarnished and your company damaged.”

Take your Pick

Of course, the real work of making the change had begun years before in identifying and preparing potential contenders for the CEO role and making sure they had the requisite experience across a swathe of Morgan Stanley’s operations – and, crucially, the right personality.

Not surprisingly, Gorman puts great emphasis on competence (“I want everyone at the table to be in the top three in the industry at what they do”), but also (less obviously, given the history of investment banking) collegiality.

“So I've said to this group, I expect you to respect each other. You have to be able to express yourself strongly with respect to the audience. And the audience has to be able to listen to you with a critical mind, but with respect. And if everybody brings that into the room, and lets somebody finish their sentences, doesn't denigrate somebody for getting some facts wrong or do a ‘gotcha’, that's what I mean by collegiality.”

The importance of a harmonious but demanding environment is made clear by Morgan Stanley’s history. In 2005, Mack won a long power struggle to run the bank after he had been pushed out in 2001 by CEO Philip Purcell. It was a grim episode that damaged Morgan Stanley’s reputation, its business and saw a number of its best people leave.

“There have been times in Morgan Stanley’s history when it has not been a particularly collegial environment, and I was determined that we would not have that happen again,” Gorman said.

This time, the contenders for the top job came down to three people: Pick, who ran investment banking and trading; wealth management head Andy Saperstein; and asset management boss Dan Simkowitz.

The effectiveness of the succession process – and that spirit of collegiality – is shown by the fact that the latter two have agreed to stay on and work under Pick (no doubt helped by the US$20m special stock bonuses they received). Saperstein will add the asset management division to his responsibilities, while Simkowitz will take on Pick’s role overseeing investment banking and trading. They will also be Pick’s co-presidents.

“We were fortunate to have three very talented people. Any financial services institution would be happy to have any of them in senior roles. So, by definition, we wanted to keep them,” Gorman said. “But that depends on the chemistry at the top. They worked for me, how would they do working for Ted? Would he want them; would they want him? Obviously, I'd talked through that well ahead of time and I felt that their relationships are extremely strong and cordial. And that wasn't by accident.

“Smooth transitions on Wall Street are rare. Smooth transitions that involve all the senior players staying and prospering are extremely unusual. So I think it's a measure of our culture and the stability and strong position that the firm finds itself in. I think it is a reward for 14 years of really hard work to get to the place we are. Pulling off strong succession is hard to do,” Gorman said.

It's a point that Pick echoes. "We were aware of our own history, and the history of Wall Street successions. But the three of us – Andy, Dan and I – are very close. And if you were to walk on this floor during those months [leading up to Pick's appointment], the doors were always open. We did client meetings together. We did internal panels together. We were determined to work hard together towards the next chapter."

The lack of drama was clearly welcomed by the market: on the day of the announcement, Morgan Stanley’s stock barely moved – quite a vote of confidence, considering that one of the two most successful bankers of his generation was calling it a day (the other being Jamie Dimon, who is still very much clinging on).

Talk to other Morgan Stanley bankers and the sense of relief is palpable that the succession was smooth. Of course, they would say that, wouldn’t they? But even rivals were impressed.

“James did a phenomenal job in developing the succession. It was a bloodless coup, which is rare on Wall Street,” UBS chairman (and ex-Morgan Stanley man) Colm Kelleher told an FT banking summit in November. “I would love to get to that stage in the future when UBS can do a similar succession.”

So what now for Gorman? He is staying on as chairman but only for a year or so, with Pick slated to take over that role too.

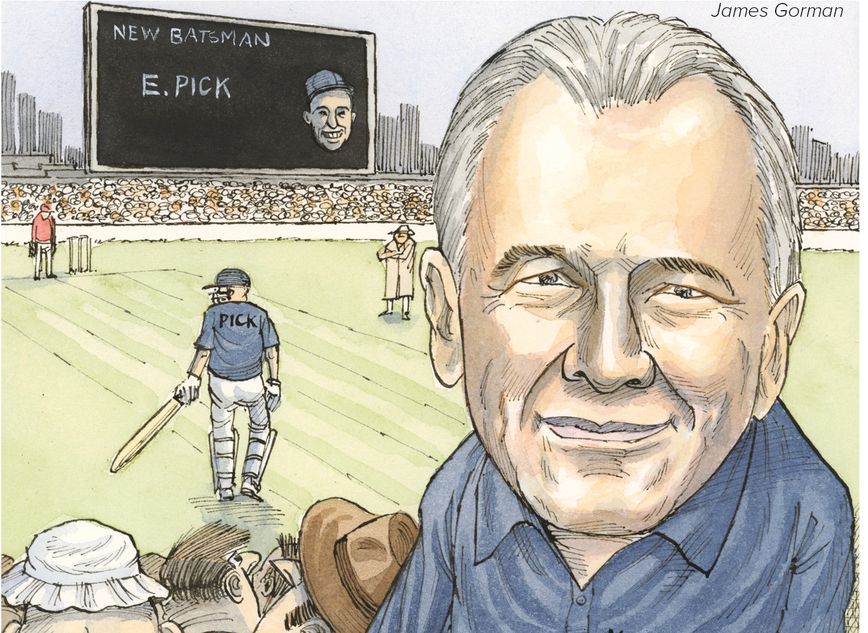

Gorman is a huge cricket fan (a “cricket tragic” in Australian) and reaches for a cricketing metaphor – admittedly at IFR’s prompting – to explain his new role. “I’m now in the grandstand. I've just watched a freshly kitted-up team with their heads properly adjusted marching to the crease.

“I’m like a guy who has led the team through multiple test matches in multiple countries and multiple weather conditions on multiple creases. And now I'm sitting there cheering them on and every now and then, after the match, the new captain will wander across and say, ‘hey, James, did you see what they did with that field placement? What do you think about that?’ And that's my job now.”

Day job

Of course, Morgan Stanley’s 2023 was about much more than succession. There was still the day job to do – and an extraordinarily difficult environment in which to do it.

There isn’t the space here to go into all the deals, the initiatives, the growth of assets under management, etc. So we’ll have to whizz through some highlights and themes.

In ECM, US highpoints included Acelyrin’s twice upsized US$540m IPO and the much-sought after and priced-above-range listing of Klaviyo. In Europe, Morgan Stanley led a successful IPO (a rare thing in 2023) for Romanian energy producer Hidroelectrica, which raised L9.33bn (US$2.1bn). And in Asia it was behind the largest deal in a subdued year in Hong Kong: a HK$4.06bn (US$520m) offering from Chinese contract medical researcher WuXi XDC, a transaction that attracted global demand and performed well in the aftermarket.

In DCM, standouts included RenaissanceRe’s US$750m Tier 3 note; Capital One’s US$2.5bn two-part deal; Intuit’s US$4bn four-trancher; an US$11bn trade for Intel that was split into seven tranches and was the largest US corporate offering in about 10 months; Boston Properties’ US$750m 10-year green bond; and Intesa Sanpaolo’s US$3bn two-part senior preferred bond.

In acquisition finance, a US$9.4bn financing to enable Enbridge to buy three US-based utilities to create the largest natural gas utility franchise in North America was notable, as were two multi-tranche deals for Tapestry in the same week (US$4.5bn and €1.5bn).

Mo Assomull, head of global capital markets, was perhaps most proud of a US$4.9bn whole-business securitisation that Morgan Stanley helped arrange to fund private equity firm Roark Capital’s US$9.6bn buyout of sandwich maker Subway.

“Subway could have been a traditional leveraged finance execution, but given the market uncertainty, we showed up with a very bespoke solution and differentiated ourselves,” he said.

“And that's the way I think about our business. In good markets, financing is super easy. But in trickier times we have to come up with other solutions. There are many different alternatives and we've got the whole package.”

Talk of acquisition finance brings us to the M&A business. Highlights here include Morgan Stanley’s role advising UBS on its dramatic takeover of Credit Suisse (about which Kelleher was fulsome in his praise: see IFR’s M&A Deal of the Year) and the bank’s efforts to arrange the rescue of UK challenger bank Metro Bank. For the latter, Morgan Stanley was lead financial adviser on a complex package of capital, refinancing and potential asset sales.

As the bank’s global co-head of investment banking Simon Smith explains, the Credit Suisse rescue was a vital deal – and not just for those directly involved.

“In terms of the importance of it to the global financial system ... to corporate Europe and corporate Switzerland, it was a once-in-a-lifetime transaction.

“It was a deal that brought together not just our advisory business, but also our sales and trading guys, our GCM guys, our Swiss franchise and our FIG franchise. And it shows that complexity is something we're good at.”

Morgan Stanley’s decade-long push into advising the energy industry – where it was once something of an also-ran – was especially significant since it was otherwise a quiet year for everyone in the M&A business, given the precarious market conditions. Deals that the bank worked on in this space included ExxonMobil’s US$60bn all-stock merger with Pioneer, Chevron’s acquisitions of PDC Energy for US$6.3bn and its US$53bn takeover of Hess, and Oneok’s acquisition of Magellan Midstream Partners to create one of the largest US pipeline companies.

Eli Gross, the bank’s other global co-head of IB, said: “We had made investments in bankers in this space at a time when the space was quiet. It was an investment we made when not knowing the exact timing of the payoff. But we were confident in the athletes that we were hiring, and the opportunity in the business.”

When summing up Morgan Stanley’s year in the capital markets, it’s worth pausing to mention another aspect that speaks well of its culture – especially when praise comes from outsiders: its contribution to the development of diversity and inclusion firms in the US. Loop Capital, winner of IFR’s US D&I House Award, picked out Morgan Stanley for assisting D&I firms and helping them take bigger roles on bigger deals, such as when Morgan Stanley was diversity equity inclusion coordinator on a US$750m tender offer for Verizon.

The Japan plan

Morgan Stanley’s efforts in Japan are also noteworthy – in particular the increasingly effective partnership with Mitsubishi UFJ Financial Group. The pair announced “Alliance 2.0” to push further collaboration.

Mitsubishi UFJ Morgan Stanley Securities was joint global coordinator for Japan Post Holdings’ ¥1.2trn (US$8.13bn) selldown in Japan Post Bank, the largest follow-on globally in 2023, and Morgan Stanley was joint global coordinator on Rakuten Bank's ¥83.3bn IPO.

Notably, both deals were in the market at the height of the US banking crisis and yet proceeded successfully with minimal drops in demand.

Rakuten Group also provided another chunky deal, as Morgan Stanley helped bring the e-commerce giant’s ¥230.4bn primary follow-on. And it helped lead Kokusai Electric’s ¥124.6bn IPO, the biggest float in Japan for almost five years.

MUMSS and Morgan Stanley were just as busy in the international yen bond market, bringing deals from issuers like Electricite de France, Poland, French auto parts supplier Forvia and Indonesia, which accessed the Samurai market to sell Asia’s first sovereign blue bond.

Trading places

That partnership in Japan also helped the trading side of the shop, giving it a unique position of strength in that market as client activity picked up in response to the Bank of Japan starting to adjust monetary policy.

“We have been and remain committed to Japan. In 2023, Japan has been an important market for us,” said Jakob Horder, global co-head of fixed income. “We see room for growth across products there because corporate activity is going to increase.”

The overall markets business in 2023 saw Morgan Stanley consolidate the ground it has won over the past decade – largely when Pick was in charge.

Over that period, the bank grew its equities trading unit into a number one franchise and then achieved a remarkable rebound in fixed income following a dramatic overhaul of the bank’s bond and currency trading operations.

That hard work meant Morgan Stanley was primed to take advantage of the volatile markets that emerged following the outbreak of Covid-19 in 2020, growing its trading revenues by 46% between 2019 and 2022. In the process it overtook Citigroup as the third-largest bank in global markets with almost US$20bn of revenues after cashing in during 2022’s bumper trading environment.

Its trading revenues for 2023 were US$17.7bn, still 30% above their 2019 levels, suggesting the business has shifted onto a consistently higher plane.

“Equity revenues have levelled off in 2023 but at a point notably higher than pre-Covid,” said Alan Thomas, global co-head of institutional equities. “Revenues across the industry were flat for a good decade post the [2008] financial crisis. Now we’re back into a more normalised world where interest rates are no longer zero – and that’s helpful for growing our business.”

Final word

As Gorman heads to the stands, perhaps with a well-earned beer in hand, it’s worth a quick look at how Morgan Stanley has been transformed under his stewardship. When he took over as CEO, capital markets, trading and advisory were responsible for by far the largest share of revenues. But transformational deals – buying the likes of Smith Barney, Eaton Vance and E*Trade – changed that (although it's worth acknowledging that those transactions built on the foundations of the merger of Morgan Stanley with Dean Witter Discover in 1997 – the deal that in other respects led to the succession crisis of 2005). In 2023, the wealth and investment management units – with US$6.5trn under management – brought in 58% of the firm’s revenues and 62% of profits. It’s no longer all about old-fashioned investment banking.

More to the point, since 2010 when Gorman became CEO, the stock price has more than tripled and market capitalisation has increased from US$40bn to US$153bn.

The plan now, according to Pick, is to build on that – extending the push to have a fully integrated investment banking operation to having a fully integrated firm, with all the various parts properly coordinated to take advantage of their individual strengths. "We've had a change in leadership, but it's not a change in strategy. The strategy remains the same. Because James put something together that is differentiated. It’s got staying power, it’s durable. And the barriers to entry are quite high."

The bank is aiming for US$10trn of assets under management, 30% margins in the wealth business, a 70% efficiency ratio across the bank (in other words, 30% net margins) and 20% returns on tangible equity. "That would put us in a position where we stand alone," said Pick.

But when asked to reflect on his reign as CEO and chairman, Gorman sees his contribution as about something more fundamental than an altered business mix and a higher stock price.

“I wanted to return Morgan Stanley to where it was,” he said. “It was revered for most of its history, before we got lost within our own culture wars and internal struggles and then through the financial crisis and our own capital and liquidity issues. [I wanted] to get us back to our core DNA and build on that.

“And I think we've done that. So the business performance, the stock price and the market cap and the competitive positioning … that’s great, right? But what matters for large institutions is their ability to endure through multiple cycles. And for that you need a culture.

“I've always said you start with strategy, then culture, and culture is what then drives future strategy. And we rebuilt the culture and I'm very proud of that. People feel good about working here. They feel proud. And that makes you feel good.”

(Additional reporting by Steve Slater, Christopher Whittall and Daniel Stanton)

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email shahid.hamid@lseg.com in Asia Pacific & Middle East and leonie.welss@lseg.com for Europe & Americas.