Traders betting on the direction of US Federal Reserve monetary policy have triggered a surge in activity in derivatives linked to the effective federal funds rate, significantly increasing the prominence of the interest rate benchmark in these multi-trillion dollar markets.

EFFR-linked derivatives accounted for about 32% of the DV01 in US interest rate derivatives in September, trade body ISDA and analytics firm ClarusFT said, citing a common measure of fixed-income market risk. That was up from 24% in August.

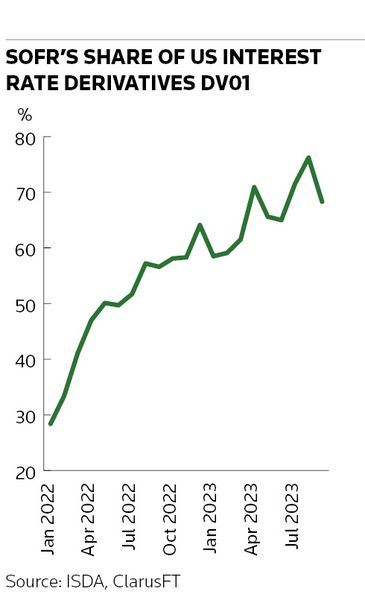

The flurry of EFFR trading comes at a time of upheaval for US rates markets. Hundreds of trillions of dollars of financial contracts have had to move away from US dollar Libor, the controversial lending rate that ceased to exist in June. Most of those products have adopted SOFR, regulators’ preferred Libor replacement.

But turbulence in bond markets has also encouraged growing use of derivatives referencing EFFR, a benchmark tracking the Fed's main policy rate that regulators permit alongside SOFR. That has come as traders have shifted their views on monetary policy in recent weeks and wagered the Fed will be forced to hold interest rates at higher levels for longer in an effort to quell inflation.

“It’s not that there’s been less interest in SOFR. It’s more a reflection that there’s been more use of the effective federal funds rate,” said Olga Roman, head of research at ISDA. “Historically, people use fed funds to express their views on the direction of monetary policy. Changes in expectations around rates, and that they will stay higher for longer, resulted in more activity in fed funds.”

The complexion of US interest rate markets has altered materially over the past year or so as the Libor era has drawn to a close. The troubled benchmark had become deeply embedded in the financial system over the past few decades, acting as a reference in about US$220trn of financial products.

Regulators’ mission to erase Libor changed that, as trillions of dollar derivatives, bonds, mortgages and loans were forced to find another interest rate. Most shifted to SOFR, a lending rate based on the roughly US$1.4trn of US Treasury repo trades that occur each day.

That transition has coincided with the most volatile period for interest rates in years as the Fed and other central banks have tightened monetary policy aggressively to bring inflation down from multi-decade highs.

The Fed held its main policy rate at a 22-year peak after its two-day meeting concluded on Wednesday and chair Jerome Powell said the central bank is “proceeding carefully” – an apparent confirmation that it is nearing the end of its hiking cycle. That follows a sharp rise in long-dated Treasury yields in recent weeks, which some Fed officials have suggested could reduce the need for further rate rises to cool inflation.

“The [Fed] is happy to remain on hold, and watch and see how the economy evolves early next year in light of the recent tightening in financial conditions and higher term premiums,” said Tiffany Wilding, managing director and economist at Pimco.

Tracking rates

The New York Fed publishes the EFFR daily. Its history of closely tracking the Fed's main policy rate has long made it the preferred benchmark for traders using futures and swaps to bet on where interest rates will settle over the near term. That has brought it to the fore again lately amid the shift in market expectations for the Fed.

“In the very front end of the curve, the fed funds swaps are popular because it isolates just the fed funds rate and people can hedge the [Fed] meetings,” said Jason Williams, a rates strategist at Citigroup.

There has been an average of US$108bn in daily money-market transactions this year underpinning EFFR, Fed data show, about 8% of the volume of Treasury repo trades that are used to calculate SOFR. Regulators have said both rates meet global benchmark standards and have been happy for EFFR-linked derivatives trading to continue.

That contrasts with regulators’ views on some “credit-sensitive” Libor replacements, which they have criticised for sharing some of the same flaws as Libor by relying on too few underlying transactions.

“Prior to this transition, US dollar Libor and fed funds both traded in the US dollar market,” said Ann Battle, senior counsel, market transitions, at ISDA. “SOFR was identified as the alternative to US dollar Libor, not as an alternative to fed funds.”

Rates specialists say there are technical reasons that may be inflating the significance of EFFR derivatives volumes because of the extremely short-dated nature of these trades. That dynamic forces traders to transact in larger size to generate enough exposure to interest rate moves.

About 99% of EFFR derivatives notional traded in the second quarter had maturities of a year or less, according to ISDA. The average trade was US$1.6bn during that time, compared with US$85m for SOFR transactions. However, there were far more trades each day linked to SOFR – more than 2,400 on average – compared with just 106 fed funds transactions.

“[EFFR] swaps will be short-dated with large notionals to generate enough DV01, so it does sometimes skew the numbers,” said Williams. “If you go further out in the curve, though, SOFR is the preferred vehicle for hedging anything beyond one year.