Foreign exchange traders are using record volumes of futures contracts this year as stricter regulations are increasing the appeal of trading FX derivatives on exchanges.

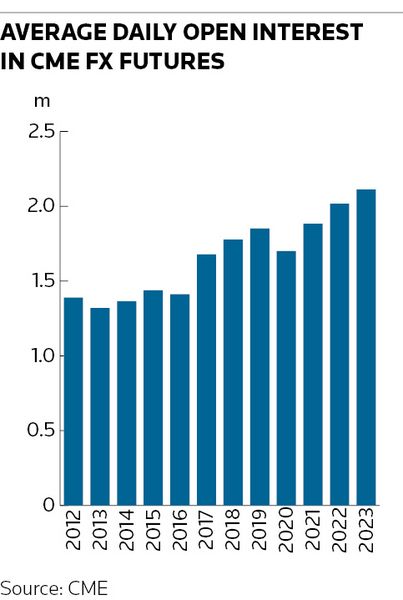

CME Group, the world's largest marketplace for these contracts, said average daily open interest for FX futures reached more than 2.1m contracts on its exchange in the first nine months of this year, roughly 5% higher than the previous record over the same period in 2022.

Despite this growth, futures remain a small fraction of the US$7.5trn-a-day FX market, and some traders are sceptical of a widespread shift to listed derivatives amid various challenges for these markets.

But exchange executives say powerful tailwinds are encouraging more institutional investors to trade these contracts, including bank regulations that have made it far more expensive to trade over-the-counter derivatives like FX forwards.

"As more derivatives users are affected by these rules in the coming years, and the cost of OTC derivatives trades increase, they'll be an even greater motivation to trade futures," said Paul Houston, global head of FX at CME.

Futures trading has not taken off in the FX market the way it has done in other markets, like interest rates, where listed derivatives have become a common way to manage risk. Average daily volumes in FX futures reached US$148bn in June, according to the Bank for International Settlements, compared with US$9.1trn for interest rate futures.

Most of the FX market is still transacted over the counter, where trading counterparties directly face one another. But exchange executives are confident more activity will shift their way in the coming years due to regulations that have materially increased the costs of trading OTC derivatives.

Most derivatives users must now post initial margin – the collateral stumped up at the start of a trade to protect counterparties from the risk of default – after regulations came into force in September that exempt only those with uncleared derivatives exposures of less than US$50m or €50m. Banks have also had to adjust to new rules that have increased the amount of capital they must hold against uncleared or unmargined derivatives exposures, prompting many to raise their prices for products like FX forwards.

"There is a growing demand for listed FX products to coexist alongside OTC in a kind of hybrid set-up," said Lee Bartholomew, head of fixed-income and currencies exchange-traded derivatives product design at Eurex. While Eurex has a much smaller presence in FX futures than CME, it is also projecting an increase in volumes this year – a 125% rise compared with 2021, growing to the equivalent of around 1.7m contracts.

Flexible futures

However, some FX traders say there are good reasons to believe futures will struggle to gain traction more widely. Chief among them is the fact that trading conventions in these markets lack flexibility for investors that need to hedge their currency risk at irregular times.

Most activity on exchanges takes place through an anonymous central limit order book, with futures only trading on standardised dates. This set-up doesn't suit many real-money investors, like asset managers, who often need to roll their FX trades alongside cash management requirements – which can sometimes arise on "broken" dates, like public holidays.

"There's a myriad reasons why the real-money community need FX transactions to trade to so-called broken dates, which is why FX futures aren't really a structure that works for them," said Jay Moore, CEO of the peer-to-peer platform FX HedgePool.

CME and Eurex are currently in discussions with liquidity providers and end-users about potentially offering "FlexFutures" that would trade on non-standard dates. They are also taking steps to make futures contracts more like OTC derivatives.

That includes, for example, making it easier to do block trades and "exchange for related positions" – types of privately negotiated transactions that typically allow for larger transfers of risk. Both block and EFRP futures can be traded to broken dates if agreed by both parties, increasing their appeal for institutional investors.

"Building liquidity in non-standard dates is one of the bigger hurdles here as liquidity tends to coalesce around standardised dates, but we do already have the foundations in place for flexible execution given our 25 liquidity providers and the fact that we're now at a critical mass of people trading blocks and EFRPs," said CME's Houston.

Exchange executives say these initiatives are already spurring growth in futures markets. There has been a total of 274,000 FX futures and options contracts traded via blocks and EFRPs this year at CME – 23% higher than the record set last year. Meanwhile, Eurex said block trades account for about 70% of its FX futures volumes.

But the head of FX trading at a European bank said only five or six banks are "actively" trading blocks and EFRPs. This means that many investors are still sticking to more familiar OTC derivatives, like FX forwards and swaps, he said.

"While it's encouraging that futures use is on the rise, they won't ever get to the same level of activity as OTC FX derivatives," the trading head said.