For a market that transacted its first syndicated sustainability-linked loan only two years ago, Taiwan is proving to be fertile ground for the product as its corporate borrowers leave their counterparts elsewhere in Asia Pacific in the dust.

Home to some of the world’s largest chip and electronics manufacturers as well as offshore wind farms, Taiwan has already raised US$13.02bn through 38 SLLs in the first six months of 2023 – the highest for any market in Asia Pacific by volume and number of deals. That tally is even close to Germany's, a far bigger economy, which raised US$14.6bn from SLLs in the first half.

“The prevalence of SLLs in Taiwan is thanks to, firstly, the government encouragement and, secondly, the external pressures the manufacturing industry faces,” said JJ Hsu, head of the corporate finance department at Taipei Fubon Commercial Bank. “As an essential part of the global supply chain, Taiwanese manufacturers are being asked to reduce carbon emissions by their end clients, many of which are international tech giants.”

Manufacturing, which contributes more than a third to Taiwan's GDP, is under pressure from the government to reduce greenhouse gas emissions and from international clients that have pledged to achieve net-zero emissions.

Large multinationals such as Apple, Fujitsu and Siemens have formed a global initiative called RE100, pledging to source all their electricity through renewable energy. Twenty-eight Taiwanese companies have also joined, including Acer, GlobalWafers and TSMC.

Banks operating in Taiwan have jumped onto the bandwagon as arrangers of SLLs since March 2021, when its Financial Supervisory Commission updated its Green Finance Action Plan 2.0 to increase scrutiny on environmental, social and governance disclosures among listed companies and financial institutions.

In July 2021, liquid crystal display manufacturer AUO closed an increased NT$50bn (US$1.78bn) seven-year SLL in what was the largest as well as longest-tenor financing of the type from Asia at the time. It followed days after chemical maker Eternal Materials signed the island’s first such loan.

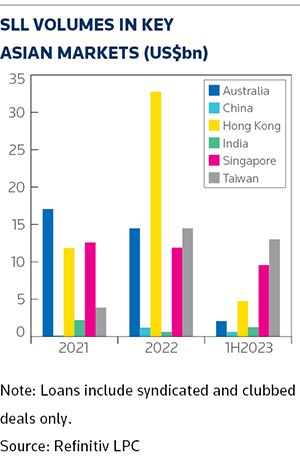

SLL volumes in Taiwan skyrocketed to US$14.48bn in 2022, growing nearly four-fold from the previous year. (See Chart.)

New structures

New structures are also emerging. In July, LCD maker Innolux launched a NT$30bn five-year SLL with a green tranche for purchasing renewable energy and Taiwan renewable energy certificates (T-REC). That loan follows a US$500m-equivalent three-year loan for Wistron that has both ESG metrics and a green use of proceeds. Wistron’s loan, completed in March, includes a NT$1.2bn tranche for purchasing T-REC.

While the growth in SLL volumes in Taiwan is impressive, especially compared with other markets in Asia Pacific, and is expected to continue, there are challenges nonetheless.

Small and medium-sized borrowers that lack a carbon inventory find it hard to formulate key performance indicators and sustainability performance targets for SLLs. Some market participants also consider SPTs in some of the borrowings to be too loose and easy to achieve.

“A lot of SLLs are not that green. They are being done for the sake of doing it,” said a senior syndicated loan banker at a state-owned bank.

Bankers said most syndicated SLLs in Taiwan do not have a second-party opinion on the SPTs beforehand, but have third-party verifications of a borrower’s performance level against each SPT after the deal is signed.

A second-party opinion is recommended under the SLL principles set by the Asia Pacific Loan Market Association, the Loan Market Association and the Loan Syndications and Trading Association to determine the relevance, robustness and reliability of selected KPIs, but it adds to the costs. Taiwanese regulators have yet to follow in the footsteps of their counterparts in Hong Kong and Singapore to subsidise the cost of external review services for borrowers of sustainable financings.

“The Taiwanese market still lacks the awareness of the greenwashing issue,” said a Taipei-based senior corporate banker at a foreign bank. “Banks here focus on providing economic incentives for companies to buy the product. There have not been many SLLs with a margin step-up mechanism if the borrower fails to meet the target.”

However, some local bankers believe the market is making progress.

“The KPIs are becoming more rigorous and diverse than in the early days,” said Hsu. “Large corporations are mostly disciplined in setting SPTs. In the meantime, banks and large corporations are learning to calibrate the SPTs to make them more ambitious.”

Green loans

Meanwhile, the outlook for green loans is mixed as new offshore wind farm and solar power plant projects face increasing hurdles.

Since 2021, solar power green loans have totalled US$4.89bn, while the tally for offshore wind farms is US$1.86bn, according to Refinitiv LPC data.

Developers placing bids in the third phase of Taiwan’s offshore wind development must fulfil more stringent guidelines for wind farm projects from 2026 to 2035, while solar power plants often cause land disputes. The uncertainties around localisation requirements, corporate power purchase agreements and land rights are risks for lenders.

The land available specifically for solar power is not enough, resulting in developers increasingly building plants near fishery and agricultural farms, which in turn has led to protests from nearby residents and environmentalists.

“Banks are now more concerned with the localisation requirements when it comes to offshore wind project financings, and for solar power PFs, the land disputes worry us,” said the second loan banker.

However, the pipeline for offshore wind and solar power PFs is still building. Last month, a consortium led by Taiwanese life insurers launched a NT$6.94bn six-year PF to build solar power plants on top of fish farms in south-western Taiwan.

Copenhagen Infrastructure Partners is sounding the market for a syndicated loan of around NT$86bn to back the 500MW Fengmiao offshore wind farm it won in the third phase of a development auction.

“The pipeline for green project financings will only increase as Taiwan has already pledged to invest in green energy,” Hsu said.