Bread Financial is preparing to price this week its first credit card-backed bond since 2019, bolstering supply for this type of security, which has not seen much issuance this year amid a weakening in the quality of consumer credit.

The Ohio-based consumer finance company, which changed its name from Alliance Data last year, is returning to the market with a US$250m offering at a time when it is also recording increasing losses and delinquencies on receivables related to credit card programs with L Brands and Signet Jewelers, among other retailers.

Bread's gross charge-off rate on its credit card trust in March was 8.50%, up from 6.21% from a year ago, Fitch said in a pre-sale report published on Friday. The amount of receivables past due 60 days or more in March was 3.69%, up from 2.71% from a year earlier.

The credit card trust, which will support its latest Triple A rated three-year offering, had a total of US$6.1bn at the end of March, Fitch said.

So-called private-label credit card ABS deals, like those from Bread, tend to rack up more losses and delinquencies than general purpose credit card deals issued by banks, market participants said. For that reason, they often offer wider spreads.

Bread on Monday released price guidance on the fixed-rate note at Treasuries plus 135bp area. By comparison, Barclays last month priced a US$500m three-year general-purpose card deal at a spread of 85bp.

RBC, BNP Paribas, CIBC and Truist were appointed as joint lead underwriters for Bread's issue, called World Financial Network Credit Card Master Note Trust 2023-A.

The SEC-registered security, which may price on Tuesday, could be upsized.

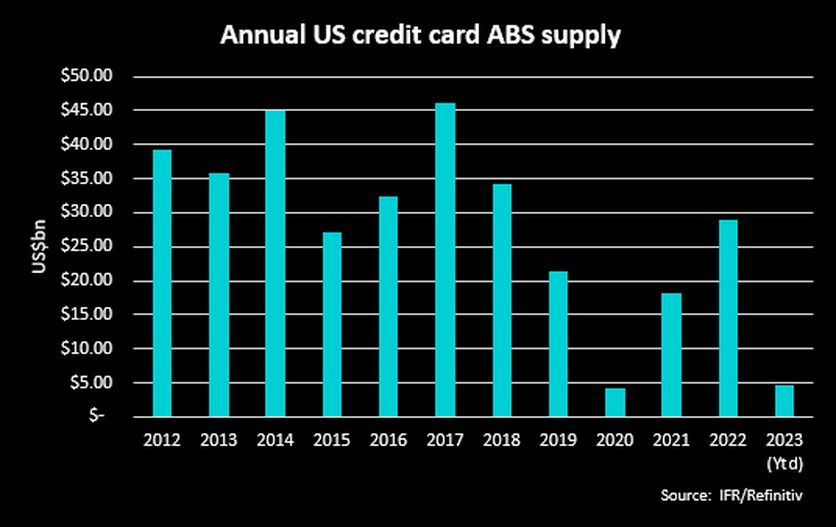

Despite softening consumer credits and worries about a recession, fund managers could be attracted to the Bread deal because credit card ABS issuance has been scarce recently, market participants said.

"We have seen mostly bank card supply this year, so a deal like this could draw orders from people who are looking for additional spreads and some diversification," a portfolio manager said.

Credit card ABS issuance has totaled US$4.6bn this year, which is lower than the US$8.86bn during the same period in 2022, IFR data show.

Refiled story: Adds dropped words