Natixis' corporate and investment bank has long specialised in designing and selling complex investment products. Now, the French lender is looking to broaden the scope of its global markets division through a concerted effort to expand in trading of “flow” instruments such as currencies, government bonds and swaps.

Senior executives believe a beefed-up presence across financial markets will lend greater balance to Natixis’ trading unit, which has suffered two high-profile losses in the past five years totalling nearly €500m in some of its mainstay structured derivatives activities.

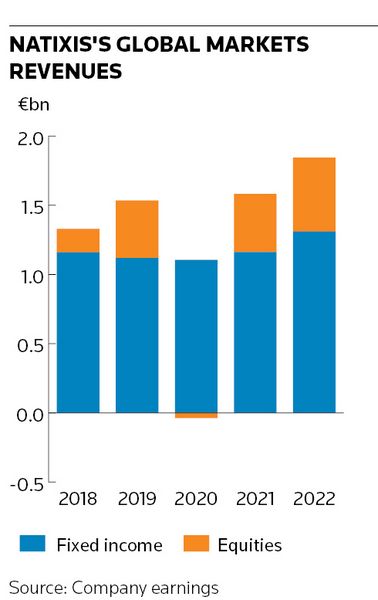

In one measure of its intentions, the bank has brought 1,500 new clients on board over the past three years – with over half of those coming in 2022. Natixis said it increased its flow trading revenues 40% last year, including sharp gains in currencies and commodities, helping its overall markets revenues rise 17% to €1.8bn.

“We are moving towards doing more flow,” Michael Haize, Natixis CIB's global head of markets, told IFR. “We decided in 2020 that, instead of retrenching, we wanted to extend our presence in all asset classes and grow in a robust and sustainable way.”

Natixis’ flow push has come amid the most favourable environment for trading desks in years, with a steep rise in interest rates triggering a surge in client activity. That contrasts with the period running up to the onset of the pandemic in 2020, when flow trading revenues slumped as low interest rates depressed volatility.

Like other large French banks, Natixis has historically been known for its presence in more structured activities, such as selling notes with embedded derivatives to European and Asian retail investors. But that business has also proved costly for the bank in recent years.

In 2018, Natixis booked a €259m loss from structured equity derivative products it had sold in Asia, prompting it to scale back in that market. Natixis was subsequently one of several banks to suffer large equity structured products losses when stocks plunged and companies cancelled dividends at the start of the pandemic, reporting a hit of €208m in the first half of 2020.

The bank responded by revamping those activities and focusing on less risky products. Natixis’ senior management also concluded they needed a more balanced markets business after watching larger competitors with well-staffed flow trading desks rack up bumper trading profits in 2020 as clients shuffled positions.

“We want to have a portfolio of business that provides risk diversification,” said Haize. “Some asset classes are countercyclical. Last year was more difficult for the credit business, but FX and commodities benefited from the volatility of the market.”

Organic growth

Natixis isn’t alone in looking to expand in flow. BNP Paribas, its larger local rival, has invested heavily to turbocharge an expansion in equities trading with the acquisitions of Deutsche Bank’s prime brokerage unit and the remaining stake in cash equities specialist Exane.

There are no such large-scale acquisitions on the cards for Natixis. Haize said the bank was looking to grow its market revenues “organically” and continue its "sustainable" expansion rate of the past two years. That may involve hiring more salespeople, he said, though much of the investment so far has been in upgrading technology systems to be able to process a higher volume of trades.

Expanding its client reach has been a pivotal part of the strategy too – and not just because of the opportunity to generate more revenues. “More clients mean more business, but it also increases our capacity to recycle our risks,” Haize said.

Natixis is expanding the range of products it trades to help drum up more business. After starting with areas where it has had a larger presence traditionally, such as trading in currencies and government bonds, the lender is now moving onto longer-dated interest rate swaps.

“Clients want you to be a liquidity provider across the full range of products,” Haize said. "Before, maybe we focused a bit too much on some niche clients. But today, because we can offer the full product spectrum, we have access to the bigger clients.”

The bank has also broadened its client base within its structured business. Asia has been a major target area of growth as the firm aims to regain ground after stepping back in the wake of the 2018 losses. Natixis CIB is applying for securities licences in South Korea, while also focusing on countries such as Japan and Taiwan in a drive to do more business in the region.

“We try to diversify our client base and our products, even within the structured product world, to be much more resilient if another adverse event happened,” said Arie Boleslawski, head of equities and deputy head of global markets.

“People trade a lot of structured products in Asia, but the risk profile is totally different to what we see in Europe, with much shorter tenors and using US underlyings, rather than European underlyings."

Staying the course

Natixis’ decision to stick with its structured products business – and its efforts to rebuild in Asia – may raise eyebrows given its track record in recent years, even if the bank says it has improved its approach to risk management.

Boleslawksi suggests Natixis may handle situations like 2018 differently in the future, noting that a significant part of those losses came from costs associated with exiting positions.

"We’ve made a lot of progress since then on our risk framework," he said. "If an adverse event happens again, we’d be much more careful about managing and solving the situation ourselves.”

Haize emphasised that, while the bank doesn't like to lose money, the losses were "very manageable" compared to the size of the group's overall income and also didn't affect its creditworthiness.

Natixis CIB is part of the cooperative Groupe BPCE, which runs the second-largest retail banking network in France and reported €25.7bn of net banking income in 2022. Executives believe that heft provides the firm with a solid base for its markets expansion.

“We are a very stable, sound bank: systemically important with diversified operations across retail, insurance, asset and wealth management and investment banking. We have a strong credit rating, good liquidity access and good capital, which gives us a lot of attributes we can monetise and leverage,” Haize said.

Some analysts still express scepticism around whether Natixis will stay the course in flow trading, particularly if markets settle down again. Haize acknowledged the expansion will take time, but said the bank is committed to the business.

“It is certainly a shift, hence we need to convince our clients,” he said. “Our aim is to grow steadily, taking it step by step.”