Reaching the top

The 2022 US corporate bond market tested issuers unlike any year since the credit crisis, as rates rose and volatility prevailed. For providing a diversity of clients the right advice for these trying times – and helping them raise a lot of money – Citigroup is IFR’s US Bond House and Yankee Bond House of the Year.

![]()

In 2022 banks and bond issuers were forced to confront a hawkish US Federal Reserve that pushed up borrowing costs to levels not seen since the global financial crisis. The period of ultra-low rates, relatively low volatility and reasonable inflation was over.

Few financial sectors felt this more acutely than fixed income in the US. Overall investment-grade corporate bond issuance in the country fell 17% to US$1.21trn in 2022, according to Refinitiv data. The US high-yield market for new issues – essentially shut for much of the year – recorded an incredible 78% drop in volume to a mere US$101bn.

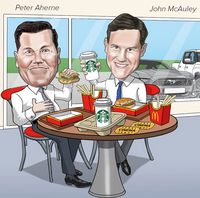

No bank navigated this tough terrain better than Citigroup. For evidence of its ability in difficult markets, Peter Aherne, co-head of North America debt capital markets alongside John McAuley, pointed to the sheer number of regular big-ticket issuers that chose Citigroup as a bookrunner.

The roster includes McDonald’s, IBM, Starbucks, BP, Toyota and P&G.

“These are some of the best run companies in the world,” Aherne said. “If you think about the importance of managing the issuance of debt, managing the liabilities of an organisation like that: this is what drives equity returns. Your liability portfolio creates leverage that drives equity valuations.”

It is that mindset that helped Citigroup gain market share in US investment-grade bonds, with the bank sitting in third position in Refinitiv’s league tables. It also allowed the underwriter to climb the US high-yield bond league table one spot to third and also increase its share, despite the severe dislocation in leveraged finance.

“This is critically important to everyone at these companies,” Aherne said. “And we've assembled a capital markets and syndicate team that's acutely aware of the value that gets created each and every day in managing the issuance, and in some cases, the repurchases and retirement of liabilities.”

Citigroup was particularly adept at bringing foreign issuers to the US dollar market and led many of the bigger corporate deals for non-US issuers. In fact, the bank took the top slot on IFR’s Yankee league table, capturing market share of 10.2% with US$36.2bn issued by 143 borrowers.

One of its crowning achievements in the Yankee market was working as a bookrunner on the US leg of the bond financing that backed Haleon’s spinoff from UK drugmaker GlaxoSmithKline. Haleon’s inaugural US$8.75bn bond in March attracted nearly US$34bn in demand, one of the biggest Yankee corporate order books of the year.

Citigroup, like most banks, did not emerge from 2022 unscathed by the disruption in leveraged finance. The bank was among the underwriters that took losses on bonds backing leveraged buyouts, like the deal for Citrix Systems, as market rates exceeded rate caps in debt commitments.

Nevertheless, in addition to rising up the junk bond league table, Citigroup proved its mettle when it was called on to work on several crucial high-yield offerings. When Caa2/CCC+ rated AMC Entertainment, still reeling from Covid-19’s effects on the cinema industry, needed to find fast liquidity to refinance debt at UK subsidiary Odeon Cinemas, it chose Citigroup as lead-left.

Originally intended for the sterling bond market, the fundraising had to be shifted to the US market after a massive sell-off in London soured demand. No problem. Citigroup was eventually able to raise US$400m for the company via a five-year non-call two senior secured note. The bonds priced at an exceedingly high yield of 15.066%, but AMC got the capital it needed.

“We worked with them to try to think how we can get access to capital that’s cost effective – or possible, frankly, given the credit,” said Bill Hughes, head of North America leveraged syndicate.

At the other end of the high-yield ratings spectrum is Ford Motor, a Double B credit that selected Citigroup as one of six active bookrunners on a US$1.75bn offering of 10-year senior unsecured green bonds in August.

The success of the ESG-labelled transaction illustrates the breadth of capabilities on offer at Citigroup in 2022. “When you think about Ford, capital access is really not the question, right?” Hughes said. “The question for Ford is, ‘What is the best advice you could give them to maximise their opportunity to get into the market and raise capital?’”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com