The European Commission’s latest proposals on derivatives clearing omit crucial details that will ultimately determine how damaging the reforms could be for European banks and other swaps users, industry experts say.

The Commission announced a series of measures on Wednesday aimed at bringing more clearing of interest rate and credit derivatives within its borders – one of the main financial initiatives European policymakers have pursued since the UK’s Brexit vote. These will require EU-based firms to funnel an unspecified portion of certain euro derivatives (and some denominated in Polish zloty) through so-called active accounts at EU-based central counterparties.

But the Commission has delegated the details of exactly how much activity needs to move to within the EU to the European Securities and Markets Authority, leaving a number of important questions up in the air. That includes whether EU authorities will grant carve-outs that local banks are lobbying for to ensure their derivatives operations aren’t cut off from some parts of financial markets following the reforms.

Bill Stenning, head of public affairs UK at Societe Generale, said the proposals had been “reasonably well-received”, but noted there were concerns too.

“The concerns lie around ... the lack of detail, particularly whether market-making and client clearing will be in or out of scope. A lot of euro swap trading is with offshore clients. To be competitive onshore, you need access to the whole market. If you are limited in your activities it can be difficult to compete against other firms that aren’t,” he said.

“We’re engaging to make sure that these criteria are suitably calibrated,” he said.

Battleground

Derivatives clearing – where trades are pushed through CCPs to reduce systemic risk in these markets – has become a major battleground in the tug of war between the EU and the UK over the location of certain financial services following the 2016 Brexit vote. The UK's LCH handles over 90% of the cleared interest rate derivatives market, including the vast majority of euro swaps clearing – a fact that has long irritated EU policymakers (IFR is part of LSEG, which also owns LCH).

Swap users have tended to concentrate their activity in a particular product in one CCP after the push towards central clearing that followed the 2007–08 crisis, as increased liquidity and economies of scale have helped to lower costs. That dynamic has complicated the EU's bid to force more clearing into the bloc. The Commission has extended regulatory relief until mid-2025 for EU firms to clear in the UK, while maintaining it expects EU firms to shift more euro swap activity onshore.

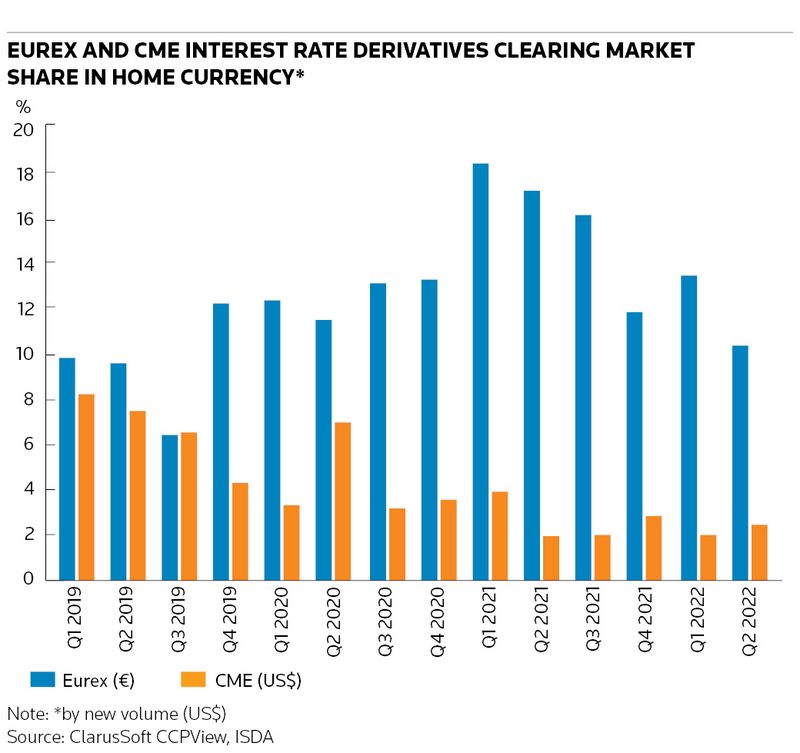

“Some euro interest rate derivatives clearing has moved into the EU since Brexit, but it's been at a fairly leisurely pace and seems to have plateaued lately. Ultimately, making the EU a more attractive and efficient place to clear derivatives would help move that process along,” said Kirston Winters, chief risk officer at post-trade firm Osttra.

Tall order

Intercontinental Exchange's decision to shutter its London CCP for credit default swaps may help the EU's cause. LCH runs a Paris-based clearinghouse for CDS, which may attract business that doesn't migrate to ICE's US-based clearing offering. Industry insiders have also been cheered by Commission proposals to increase the competitiveness of clearing in the EU.

But the EU still faces several challenges in prising more activity away from London in interest rate derivatives. Chief among them is that a large amount of euro interest rate derivatives clearing doesn't involve EU firms (as much as three quarters of the market, LCH has said).

Many global firms will clear euro swaps alongside US dollars, sterling and other currencies, allowing them to gain efficiencies when trading in one place. Frankfurt-based Eurex Clearing, the main EU rates clearinghouse, offers far fewer currencies than LCH and the vast majority of its business is concentrated in euros. EU banks are concerned that a blunt ban on them accessing LCH could cut them off from a large part of the market that still wants to clear there.

SG's Stenning said excluding client clearing from any mandate would be an obvious step to take. "It is the client that chooses the CCP. If we have to constrain our non-EU clients then we will simply lose them," he said.

Splitting risk

More broadly, industry insiders say the EU must be mindful of the risks of splitting the euro swap market in a way that hurts EU-based banks – something that occurred after it banned EU firms from transacting certain derivatives on UK-based trading venues last year. The EU's share of on-venue euro swaps trading increased significantly following the move, according to Osttra, but US venues were even bigger beneficiaries as of the end of the first quarter. Moreover, 15% of this activity still stayed in the UK – out of the reach of EU banks.

Stenning warned against policies that could lead to the market for euro swaps bifurcating between a European-only onshore market and a non-European offshore market.

"Is it really a step forward to have significant liquidity pools in euros in which EU firms aren’t active? I’m not sure that’s a desirable outcome," he said.

As a result, how momentous this will be for EU banks looks set to hinge on how EU authorities design the reforms.

"The key thing will be what counts as a material amount and what activity is exempt," said Winters. "Depending on how it’s calibrated, it could be a big problem [for EU banks] or no problem whatsoever. As usual, the devil will be in the details."