Fixed income trading was supposed to settle down to "normal" levels this year, but volatility and central banks' policy changes are driving markets and stoking client activity, and traders are once again saving the day for investment banks willing to meet the moment.

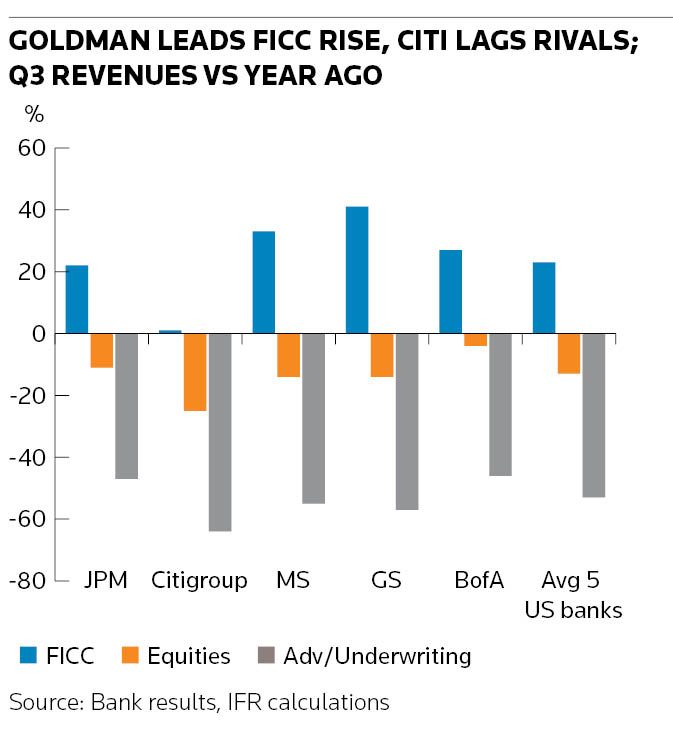

Revenue from fixed income, currency and commodities trading in the third quarter rose 23% from a year earlier to US$15.8bn across the top five US banks, including JP Morgan, Goldman Sachs, Bank of America, Morgan Stanley and Citigroup.

That's a significant contrast with investment banking, where Q3 revenue slumped 53%, dragged down by a steep decline in debt and equity underwriting (see story below).

Total trading revenue in the quarter was up 6% to US$25.8bn across the five banks in the quarter, including a 13% dip in equities trading revenues in aggregate across the five banks.

Goldman turned in a stellar quarter and enjoyed the the biggest surge in FICC, with revenue up 41% to US$3.5bn. That easily offset a 14% decline in equity trading to US$2.7bn, which edged out rival Morgan Stanley, which pulled in US$2.5bn from equity trading, also down 14% from a year ago. Goldman is on track to unseat Morgan Stanley as the top bank for equity trading in 2022, which would be its second year on top in a row.

In FICC, Goldman said it saw strength across rates, currencies and commodities, driven by elevated levels of client engagement during a period of increased central bank activity and volatility. And despite the decline in equity trading revenue, Goldman said it generated near-record revenues of US$1.1bn in equities financing.

It was a good quarter in FICC for all five banks.

BofA's FICC revenues in Q3 rose 27% from a year ago as it shed its cautious approach to trading. The performance – BofA's best third quarter since 2010 – was driven by growth in macro products, and benefited from investments made over the past year to strengthen the trading group, according to BofA CFO Alastair Borthwick.

“We've been investing heavily over the past year in several macro businesses that we identified as opportunities for us, and we were rewarded this quarter,” Borthwick told analysts on an earnings call.

BofA also had the smallest decline in equity trading in the quarter, with revenues down 4% from a year ago.

Morgan Stanley's FICC revenues for Q3 rose 33% from a year ago, and JP Morgan reported a 22% rise. Citi underperformed rivals with a 1% rise in FICC, as strength in rates and FX was largely offset by headwinds in spread products, the bank said.