This year’s steep rise in inflation has drawn more income-seeking money managers towards quantitative investment strategies in markets tracking interest rate moves, a still developing – and, some say, controversial – space where banks are jostling for position.

Banks and investors have looked to grow QIS in fixed income in recent years, as increased electronification has made it easier to create strategies that aim to harvest returns on a systematic basis in these markets. This year’s unpredictable inflation outlook, and central bank response, has helped recruit more investors to rates-focused QIS as generating income from traditional bond and equity portfolios has become more challenging.

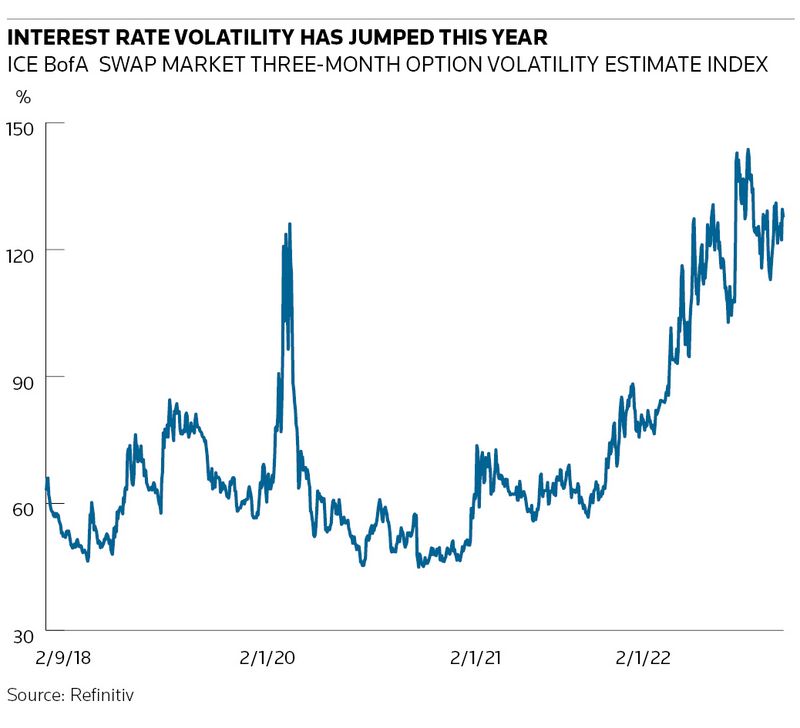

As well as trend-following strategies that aim to ride momentum shifts in bonds and swaps, banks have tapped into burgeoning demand for products based on derivatives that measure the volatility in rates markets as prices have whipsawed this year. Bankers say some of these strategies have delivered impressive performance, while cautioning of the potential risks involved given the complexities of these markets.

“QIS development has historically been very much focused on equities. One of our priorities in recent years has been to develop fixed-income strategies,” said Guillaume Arnaud, head of QIS at Societe Generale. “It is more complex for banks to develop rates QIS. You need liquid instruments, because you’re committing to making bids and offers for years ahead, and you need a way to get objective, external prices.”

Fixed-income investors have been slower to adopt quant investing compared with the prominent role these strategies now play in equities, where hedge funds have been deploying technology to exploit market inefficiencies for decades. But electronification has brought increased certainty of execution, price transparency and more data for firms to pore over to identify money-making opportunities.

Valery Bloud, head of QIS client solutions at BNP Paribas said fixed income has been the fastest growing area in QIS in recent years, increasing from about a quarter of total industry-wide assets a decade ago to more like a third today. That has come even as the broader QIS business has expanded substantially, multiplying by around four times across the industry, he estimates.

Easy pitch

This year’s market backdrop of sinking stock and bond prices has certainly done no harm to the pitch for quant strategies that aim to generate returns with a low correlation to traditional assets.

QIS products overall have performed very well this year, said Pete Clarke, global head of derivatives strategy at UBS, whether it’s in rates, equities, volatility or commodities. That has led to a "huge amount" of business in what he called “alternative carry” as well as defensive strategies and portfolios.

“We’ve seen a lot of product development in rates QIS as the demand for alternative exposure to duration picked up, with a broader range of clients across different geographies that we’ve added to the platform,” said Tom Payne, EMEA head of structuring at UBS.

Government bond yields have seesawed this year as traders have struggled to gauge the inflationary outlook. That has increased the appeal of momentum strategies that can ride the swings in bond and derivatives prices rather than having to place bets on where yields will settle. Volatility-based strategies where investors buy and sell interest rate options have proven popular for similar reasons.

“Everyone is jumping on the bandwagon in rates QIS, particularly with what’s happening in inflation. There’s a big focus on swaptions indices and how banks are pitching rates volatility,” said Steve Loeys, head of index structuring at Nomura.

Swaption strategies

There are notable advantages of building quant strategies in swaptions markets, where traders buy or sell the right to enter an interest rate swap at a given point in the future. These derivatives are much longer-dated than listed derivatives and have far more reference points, providing financial engineers with a wealth of raw material to craft products. There are also some favourable dynamics in these markets to explore.

In dollar swaptions, for instance, callable debt sold to Taiwanese insurers (Formosa bonds) depresses long-dated volatility, creating a downwards sloping swaptions curve. That dynamic, known as backwardation, makes it easier to create strategies that aim to produce steady returns for the investor, while also keeping some defensive qualities that look to protect against a sudden jump in volatility.

“Defensive carry has been popular in these markets given the lack of conviction of where bond yields are heading,” said BNPP’s Bloud. “The shape of the forward curve in interest rate options can give the investor positive carry, while having some long volatility exposure helps them if markets get shaky.”

But these strategies can be problematic, some bankers say. Swaptions markets are nowhere near as liquid or transparent as listed shares or futures, making it hard to provide accurate (and objective) valuation of positions, particularly after the first day of the trade when the options are no longer at-the-money. Some are also critical of how strategies are sometimes developed in this space.

“A lot of strategies are highly parametrised to produce good backtests,” said Kirt Bains, head of index marketing and origination at Nomura. “We don’t believe in that: there’s no free lunch.”

Vol exposure

Tony Morris, who heads QIS at the Japanese bank, said it’s important to understand where returns come from in products such as so-called swaptions triangles – a popular, three-legged structure giving investors exposure to different parts of the volatility surface.

“It’s usually because they contain a boatload of short gamma [exposure to short-dated volatility],” said Morris. “The downwards sloping nature of the vol surface is a great story, but it doesn’t hold up to scrutiny. There’s performance attrition from transaction costs and the declining level of volatility.”

SG’s Arnaud said the short gamma exposure was akin to a financing leg of the trade. “It can cost you money in specific scenarios, but it can provide value over time,” he said.

Ensuring that the client is always long “vega” (longer-dated volatility) is important so that they have a positive exposure to rates volatility, he said, while the negative impact of the gamma leg can be reduced if the client accepts a lower return profile. A short-term trend following component can also be added to provide a hedge.

“We’re seeing clients do that more and more in the last few months, becoming more explicitly defensive,” Arnaud said.