Berlin Hyp is returning to the ESG space with a euro-denominated three-year green Hypothekenpfandbrief, the first covered issuer out of the starting blocks in a week that is expected to witness an uptick in issuance.

"There were a lot of signs that the covered bond market would be open again this week and I can imagine that a couple of borrowers are on the sidelines. This trade is a good test, and looking at the maturity, there's not much that can go wrong," a banker away from the trade said.

Commerzbank, Credit Agricole, DZ Bank, LBBW, and UBS collected some feedback on Monday with the view to opening books on Tuesday morning.

“Berlin Hyp is one of the pioneers in this [ESG covered] market and it is always good to have them do a new one. This trade ticks several boxes which are important for investors: we have a very defensive tenor, a strong core European name and a very attractive spread versus Bunds – the three-year is currently above 90bp,” one lead manager said, adding that the green label would also help support the trade.

"[ESG labels] help to broaden the investor base, and get a bit more investor stickiness during execution and also in the secondary market," he said.

BHH last tapped the market in May with a tightly priced €750m 10-year social HP debut that almost drew fourfold demand.

It has €2bn of green covered debt outstanding, including a €500m 0.625% October 2025 that was quoted at minus 6bp on Tradeweb.

Market participants said fair value for the new green HP was within a range of 5bp–6bp through mid-swaps.

"We should need minor new issue concession on that defensive tenor, the highest liquidity is still in the three-year part of the curve," the lead said.

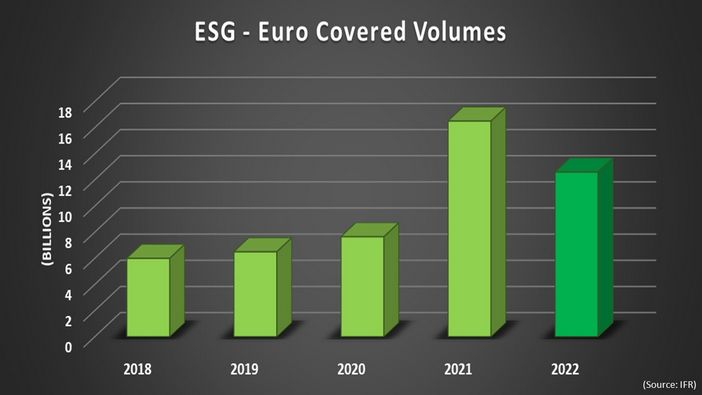

Year-to-date ESG euro covered volumes stand at €12.6bn, versus €16.5bn for the whole of 2021.