Cleco Power this week expects to price a US$425m bond offering intended to recoup costs from damages caused by recent hurricanes and winter storms, adding to a growing list of US utilities that are using this type of debt secured by special charges paid by their customers.

Cleco Securitization I LLC 2022-A features two fixed-rate Triple A tranches: a US$125m A-1 note that carries a weighted-average life 4.87 years and a US$300m A-2 class with a 15.07-year WAL. JP Morgan and Crédit Agricole are the joint bookrunners.

The Louisiana power provider (Baa3/BBB-/BBB-) and other utilities have seen a surge in clean-up costs from severe storms and devastating wildfires and they have sought approval from state regulators to recoup their expenses by tapping the bond market. These securities are often referred to as rate reduction bonds because the financing costs are lower than traditional utility borrowing, thus requiring less payments from ratepayers in the long run.

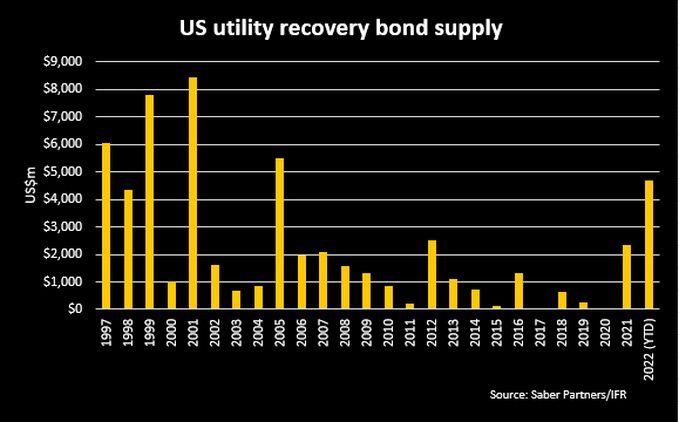

Recovery bond issuance has already reached US$7.8bn this year, propelled by two jumbo offerings tied to Pacific Gas & Electric and Entergy Louisiana. This compared with the US$2.3bn for all of 2021, according to IFR data. JP Morgan analysts last week estimated another US$18bn of recovery paper may reach the market through the first half of 2024.

"Issuance activity from various state utilities looking to recover costs from recent storms/wild-fires is expected to remain high over the next couple of years," they wrote in a research note on Friday.

Cleco intends to use some of the proceeds to finance the costs of storm damage from Hurricane Laura, Hurricane Delta, and Hurricane Zeta and the costs of Winter Storm Uri and Winter Storm Viola. It will also use a portion of the proceeds to set up a funded storm reserve for the costs of Hurricane Ida and a separate funded reserve for future storm costs. The Louisiana Public Service Commission approved the Cleco recovery bond on April 19.

Recovery allure

Investors have been drawn to recovery bonds because of their top-notch ratings. They also see them as an attractive alternative to corporate and muni securities.

Because of the long-dated nature of recovery bonds, banks have been marketing them to corporate bond fund managers in addition to asset-backed investors. They also began showing them to municipal bond investors this year, market participants said.

"These bonds are attractive to our long-dated strategies," a senior portfolio manager said. "They are a good alternative to munis and do not have the same corporate volatility profile."

JP Morgan and Credit Agricole declined to comment on the issue. Cleco Power could not immediately be reached for a comment.

Another large offering getting ready to hit the market this year is a US$2.1bn bond from the Electric Reliability Council Texas to recover the surge in costs for its member utilities that bought power during Winter Storm Uri in February 2021.