![]()

In October 1999, David Bowie appeared on the Late Show with David Letterman to promote his new album Hours, his first new record for two years. The release was something of a milestone for the music industry: the first album from a major artist to be pre-released for download on the internet. Bowie was just about to kick off a worldwide tour and had recently become an unlikely star on cable TV as the host of an erotic horror series that featured vampires, cannibalism and lots of sex.

But Letterman wasn’t interested in any of that stuff. Instead, he wanted to talk about a deal that the singer had done almost three years earlier – the so-called Bowie Bonds. “Welcome to the show,” Letterman greeted him with. “How you doing? Now, I don’t know anything about finance, I don’t know nothing about showbusiness, but I heard I heard it a couple of years ago, something that I thought, ‘oh boy, if this thing works, it sounds like genius to me’.”

A few months later, Jeremy Paxman interviewed Bowie for the BBC's Newsnight and also quizzed him about Bowie Bonds.

The fact that Bowie was still being asked about the Bowie Bonds on primetime TV three years after the deal took place illustrates just how ground-breaking it all was. This kind of thing had never been done before, and there was a real feeling that it would revolutionise the music industry and the way that major artists and labels got paid. The US$55m securitisation of royalties from his back catalogue was seen as the first of many similar deals.

This episode of The Syndicate tells the story of how the deal came together. It starts many years earlier at a meeting in London between Bowie, his wife Angela and the young lawyer Tony Defries. Bowie wanted to break free of his manager and record label, which he felt were only interested in milking Space Oddity, his one big hit. Defries offered to take over management and proposed a plan that would free the singer from his contracts – and secure control of his back catalogue.

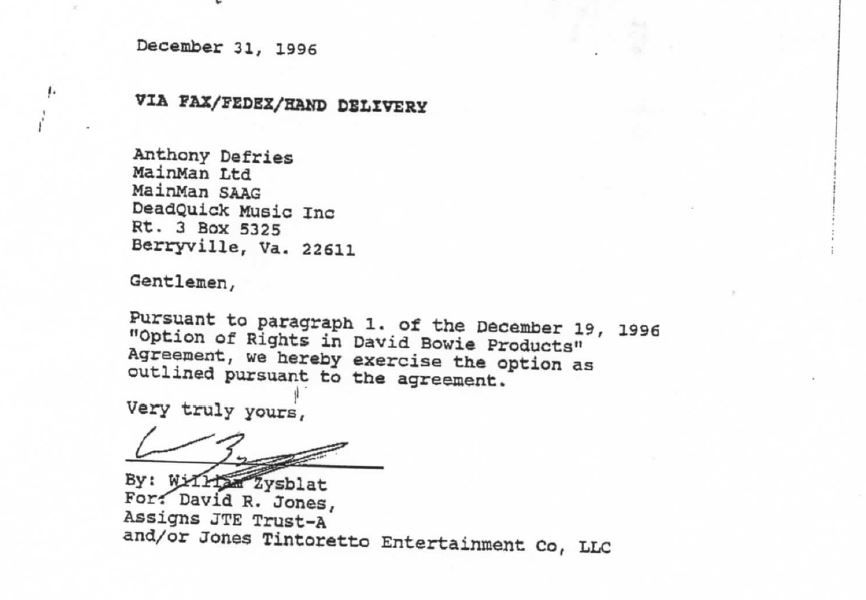

That deal was what would create the Bowie Bonds almost three decades later. It bound Bowie and Defries into business together and gave them joint ownership over all his material. That was all well and good while their relationship worked. But, by 1975, the two of them had stopped speaking and Bowie began to despise the deal he’d signed up to. For two decades they soldiered on – until the stars came into alignment in 1996, and the Bowie Bonds would free the two men from each other.

The deal would also change the lives of others close to it. The pioneers behind the deal thought they were onto a big thing: they had proven that securitising music royalties could work, and the sky was the limit. They openly talked about this being a US$1bn market and, as the architects of that first ever deal, they thought they were ideally placed to be market leaders. The three of them decided to a joint venture and began hunting for the next big deal. The Rolling Stones was top of their list.

But the joint venture ended in disaster and culminated in a multi-billion-dollar court battle that has to this day left many of those involved bitter and resentful. We speak to those involved and examine why, given all the hype around the Bowie Bonds, the asset class never really took off. We talk to Tony Defries about the deal that would later make the bonds possible, to the banker David Pullman that put it together, as well as to others involved in this landmark deal.

To hear this episode – and more like it – for free and in full, click one of the links below or search your podcast provider of choice for "IFR the Syndicate".

![]()