SSE PLC achieved size in the hybrid space on Tuesday after conceding a substantial premium on a €1bn perpetual non-call six deal, proceeds of which will go towards refinancing its hybrid dollar and sterling debt.

"I think it was quite ballsy to open books with a hybrid this morning because the market was definitely softer. They've been quite lucky in the sense that the market recovered and the inflation figures helped a bit," one syndicate banker said.

"All-in-all a good trade with some good new issue concession. In this market every deal that actually prices is a good deal. It's a good size for a hybrid and for a name which is probably not investment-grade rated at the hybrid level and does not trade with the widest audience - it's utility and Scottish."

BNP Paribas, BBVA, Bank of America, Morgan Stanley, MUFG and RBC held a global investor call that drew over 75 investors on Monday, a necessary step to reassure potential buyers on the potential impact of risk factors such as upcoming UK electricity price control regulations and investor activism from Elliott Management, which has publicly disavowed SSE's energy transition strategy in past months.

Following investor feedback, the leads opened books for the benchmark trade at 4.125% area on Tuesday, a starting level that looked attractive versus SSE's secondaries.

"I don't think this will come inside a yield of 3.5%, although I see fair value at 3.2%," a second syndicate banker had said on 8 April when the trade was first announced, adding that execution would not be a smooth process in his view.

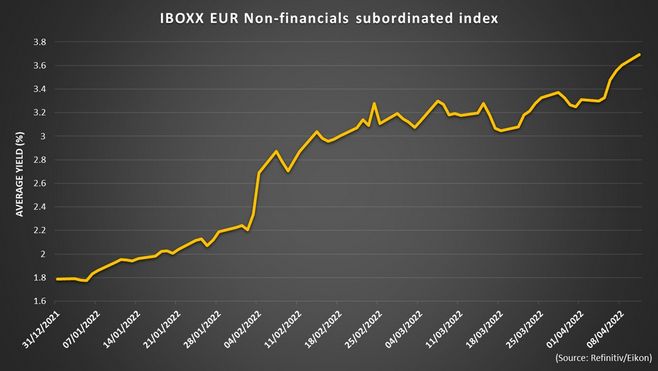

Tuesday saw market participants adjusting their fair value estimates, against a backdrop of heightened market volatility and rising euro hybrid corporate yields.

“Obviously the market is moving around and continues to be fairly volatile in terms of intraday moves but the overall risk tone has been supportive. Fair value is in the context of 3.625%-3.75%,” a third syndicate banker said.

For comparison, Bayer's €500m NC5.5 and Volskwagen's €1bn NC5.75 recent hybrids were quoted around 4.6% and 4.2% respectively on TradeWeb.

“We’ve seen a reasonable bid for hybrids both in primary and secondary trades. Overall demand has been strong and that certainly supports the view to get in, and get this refinancing trade done before the Easter pause. I would expect them to be able to move in from 4.125%," the third banker said.

In the end, the leads were able to print €1bn at 4% on the back of a book over €1.8bn.

"It's a good trade, they needed some size and did €1bn. Price-wise it's quite elevated - it's only one-eighth tighter than IPTs - so there's some price break in this market and there's also the fact that the market is a bit heavier right now - we've seen rates climbing every day for the past few days which is weighting on investor sentiment and their capacity to buy trades," the first banker said.