A Brookfield-backed venture on Thursday issued the largest-ever commercial real estate bond backed by a mall, drawing investors with juicy spreads.

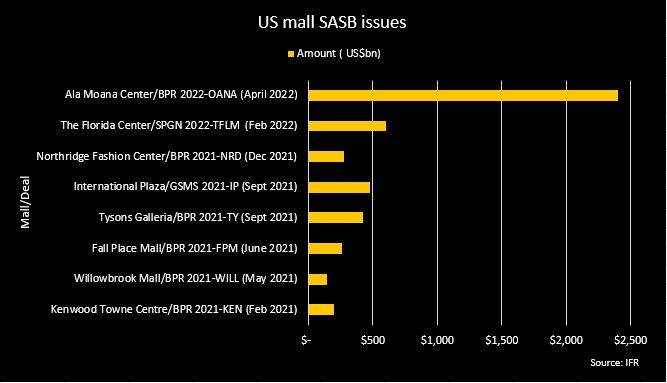

The US$2.4bn BPR Trust 2022-OANA is a cash-out refinancing on the Ala Moana Center near the Waikiki Beach in Hawaii, which is the world's biggest open air shopping complex. Proceeds are intended to refinance a US$1.9bn loan on the 2.72 million square-feet property that also has a 21-story office building and to return US$446m in cash to a venture between Brookfield, Australia's biggest pension fund AustralianSuper, TIAA and IMI-CalPers. Morgan Stanley, Citigroup, JP Morgan, Bank of America, Barclays, Goldman Sachs, Wells Fargo and Deutsche Bank were the co-leads and joint bookrunners.

Partly due to its sheer size, the banks took more than a couple of weeks to market and build the book, market sources familiar with the deal said.

Ala Moana and other "super" regional malls, of which many are operated and jointly owned by Brookfield, have been able to clinch financing because they have been able to recover from the plunge in shoppers in the early stages of the pandemic two years ago.

Revenues of Ala Moana's tenants, which include department store chains like Macy's and Target and high-end fashion shops like Gucci and Louis Vuitton, have returned close to their pre-Covid levels, Fitch said. "As tourism, especially international, recovers, the subject is likely to see additional sales growth," the rating agency said in a pre-sale report.

Still, there are ongoing concerns about the competitive pressure on malls from online shopping, which have made investors wary of retail-backed CMBS. Moreover, market volatility stemming from jitters about the Federal Reserve aggressively raising interest rates and the Russia-Ukraine war added to the challenge of clearing the jumbo transaction, market sources said.

Amid those concerns, leads offered wider spreads to help draw orders and complete the deal, two buyside sources said. The US$1.544bn Triple A rated A note which carried an extended weighted-average life of 4.99 years cleared at one-month term SOFR plus 195bp, wide of initial price thoughts in the 180bp area.

The spread on the senior note compared with 155bp on the US$366.7m Triple A senior note with a similar tenor in a US$600m SASB, SPGN 2022-TFLM Mortgage Trust, backed by a super regional mall in Orlando, Florida, which priced on February 9. The Florida Mall is jointly owned by Simon Property Group and TIAA.

Brookfield declined to comment on the Ala Moana CMBS transaction.

Corrected story: Corrects spelling of Ala Moana Center throughout