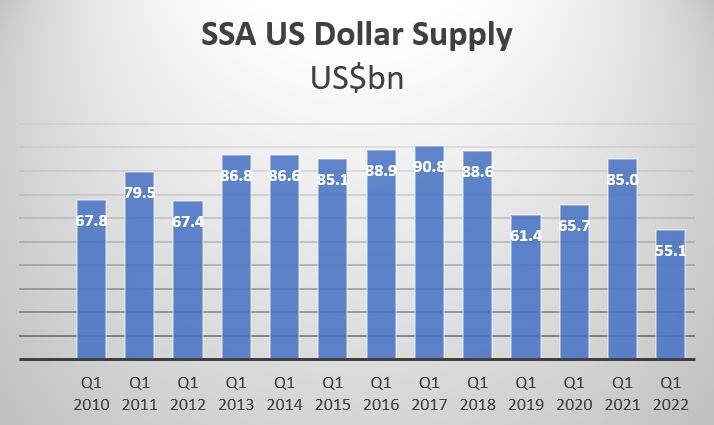

First quarter dollar supply from SSAs collapsed this year to its lowest level in over a decade, with European borrowers largely shunning the market in favour of the euro primary, where pricing has been more appealing.

US dollar issuance came in at just above US$55bn, according to Refinitiv data, the lowest level since at least 2010 and is a fall of more than 35% on the US$85bn issued during the first three months of 2021.

One of the most prominent drivers behind this trend has been the pricing that SSAs have been able to achieve in the euro market, although that is not solely to blame and other factors have played a part in taking issuers away from issuing in the currency.

In Europe, swap spreads widened notably during the quarter, meaning that issuers priced deals at healthy spreads versus Bunds and other European government bonds. As a result, a large part of the investor base was happy to take down deals that were coming at deeply negative concessions versus a borrower’s secondary curve and through swaps.

Over in dollars, swaps spreads have moved little and therefore the relative value versus Treasuries has been limited. Subsequently, deals have not looked as appealing to investors. For example, when KfW priced a €5bn June 2025 in February, the deal came at 35.2bp over Germany. A US$5bn January 2025 priced a few weeks before came at a measly 8.2bp over Treasuries.

“SSAs didn’t want to crystallise the levels available [in dollars] when they could issue in euros through fair value and reprice their secondaries,” said a syndicate banker.

For euro-based funders, the arbitrage also has not worked in favour of dollars.

“Ultimately, it is a function of funding levels being more attractive in euros for European issuers and also the basis swap hasn’t quite worked,” said another syndicate banker. “On top of that, you also have the fact that this year SSA funding programmes have been reduced from their pandemic levels.”

The latter point is reflected in the fact that issuance in other currencies is also down, although not to the same extent as dollars. There has been almost €202bn of euro supply this year, a fall of almost 20% on the first quarter of 2021, but broadly in line with previous years.

One potential catalyst for an increase in dollar issuance in the near or mid-term is the impact that the war in Ukraine will have on the funding needs of the European SSA community. Any major increase in issuance would likely require them to increase the amount that they utilise currencies outside of their home market.

“One thing to consider is what the terrible news out of Ukraine means for the funding programmes of the Europeans,” said the second syndicate banker. “A lot of them will have some kind of change to their funding to help both displaced Ukrainians and helping to rebuild the country.”

Size and uncertainty

There have been other factors putting issuers off the dollar primary, aside from the spread to government bonds and lack of arbitrage opportunities. Uncertainty over the pace of Federal Reserve’s interest rate hikes has kept some buyers on the sidelines. Wild swings in yields has also made issuance difficult especially given that deals tend to be executed over a 24-hour period, leaving them more vulnerable to overnight volatility.

“Earlier this quarter you had some uncertainty around the Fed and rate hikes, so investors were a bit on the back foot,” said the first banker.

And the thinner liquidity, compared to euros, means that bankers suspect those issuers wanting to raise considerable chunks of funding in dollars would need substantial concessions.

"I think US$5bn is do-able in US dollars but you would have to put a proper concession on it," a third syndicate banker said. "That size hasn't been tried and tested for a while."

The last US$5bn trade was priced in January by KfW, only the second this year versus five by the same point in 2021.

For larger trades in the euro market premiums have by and large been restrained although they have crept up in some cases.

When the EU issued just over €10bn across two tranches on March 22 market participants saw the borrower paying only 1bp or 2bp of concession on both legs.

Source: Refinitiv